Classificati 1 An entity invests in a pool of assets that is managed by an investment house. In accordance with the entity's business model, the investment will be held until it matures in 10 years' time, at which date the entity will collect the principal amount in the investment together with the interest earned. In accordance with the principles of PFRS 9, the entity will most likely measure the investment at a. Amortized cost. c. FVOCI (Mandatory). d. FVOCI (Election). b. FVPL.

Classificati 1 An entity invests in a pool of assets that is managed by an investment house. In accordance with the entity's business model, the investment will be held until it matures in 10 years' time, at which date the entity will collect the principal amount in the investment together with the interest earned. In accordance with the principles of PFRS 9, the entity will most likely measure the investment at a. Amortized cost. c. FVOCI (Mandatory). d. FVOCI (Election). b. FVPL.

Financial Accounting

15th Edition

ISBN:9781337272124

Author:Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:Carl Warren, James M. Reeve, Jonathan Duchac

Chapter15: Investments And Fair Value Accounting

Section: Chapter Questions

Problem 2PB

Related questions

Question

Transcribed Image Text:Classification

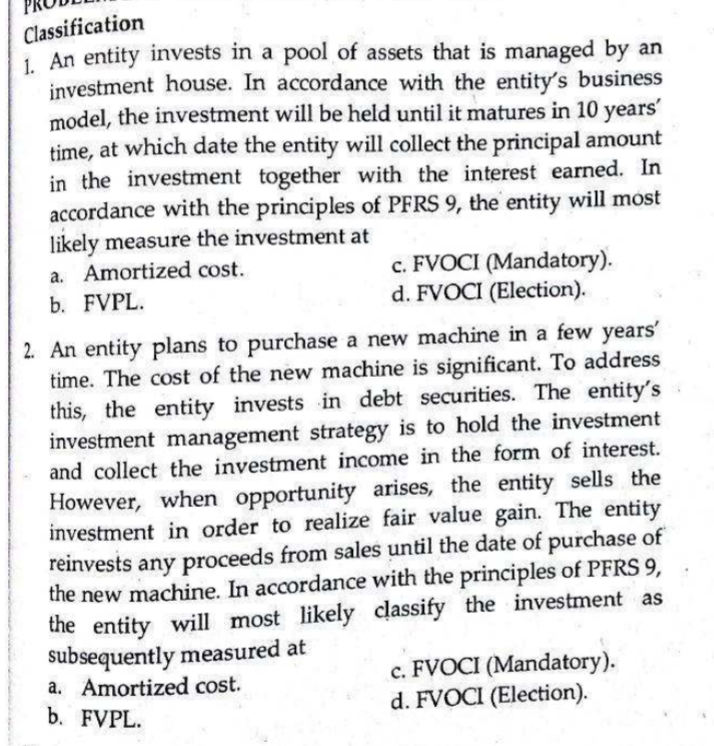

1. An entity invests in a pool of assets that is managed by an

investment house. In accordance with the entity's business

model, the investment will be held until it matures in 10 years'

time, at which date the entity will collect the principal amount

in the investment together with the interest earned. In

accordance with the principles of PFRS 9, the entity will most

likely measure the investment at

c. FVOCI (Mandatory).

d. FVOCI (Election).

a. Amortized cost.

b. FVPL.

2. An entity plans to purchase a new machine in a few years'

time. The cost of the new machine is significant. To address

this, the entity invests in debt securities. The entity's

investment management strategy is to hold the investment

and collect the investment income in the form of interest.

However, when opportunity arises, the entity sells the

investment in order to realize fair value gain. The entity

reinvests any proceeds from sales until the date of purchase of

the new machine. In accordance with the principles of PFRS 9,

the entity will most likely classify the investment as

subsequently measured at

a. Amortized cost.

b. FVPL.

c. FVOCI (Mandatory).

d. FVOCI (Election).

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Financial Accounting

Accounting

ISBN:

9781337272124

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Financial Accounting

Accounting

ISBN:

9781337272124

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Auditing: A Risk Based-Approach (MindTap Course L…

Accounting

ISBN:

9781337619455

Author:

Karla M Johnstone, Audrey A. Gramling, Larry E. Rittenberg

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Financial Reporting, Financial Statement Analysis…

Finance

ISBN:

9781285190907

Author:

James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

Publisher:

Cengage Learning