classification of items in the financial statements E one period to the next unless a PFRS/IFRS requi Statement 1: An entity shall retain the presentation change in presentation. Statement 2: When it is impracticable to reclassify compara amounts, an 'entity shall simply disclose information in the notes. a. Only the first statement is correct. ctatoment is correct 6.

classification of items in the financial statements E one period to the next unless a PFRS/IFRS requi Statement 1: An entity shall retain the presentation change in presentation. Statement 2: When it is impracticable to reclassify compara amounts, an 'entity shall simply disclose information in the notes. a. Only the first statement is correct. ctatoment is correct 6.

SWFT Essntl Tax Individ/Bus Entities 2020

23rd Edition

ISBN:9780357391266

Author:Nellen

Publisher:Nellen

Chapter18: Comparative Forms Of Doing Business

Section: Chapter Questions

Problem 5P

Related questions

Question

Choose the letter that corresponds to the answers.

Transcribed Image Text:relevant to the understanding of the entity's financial

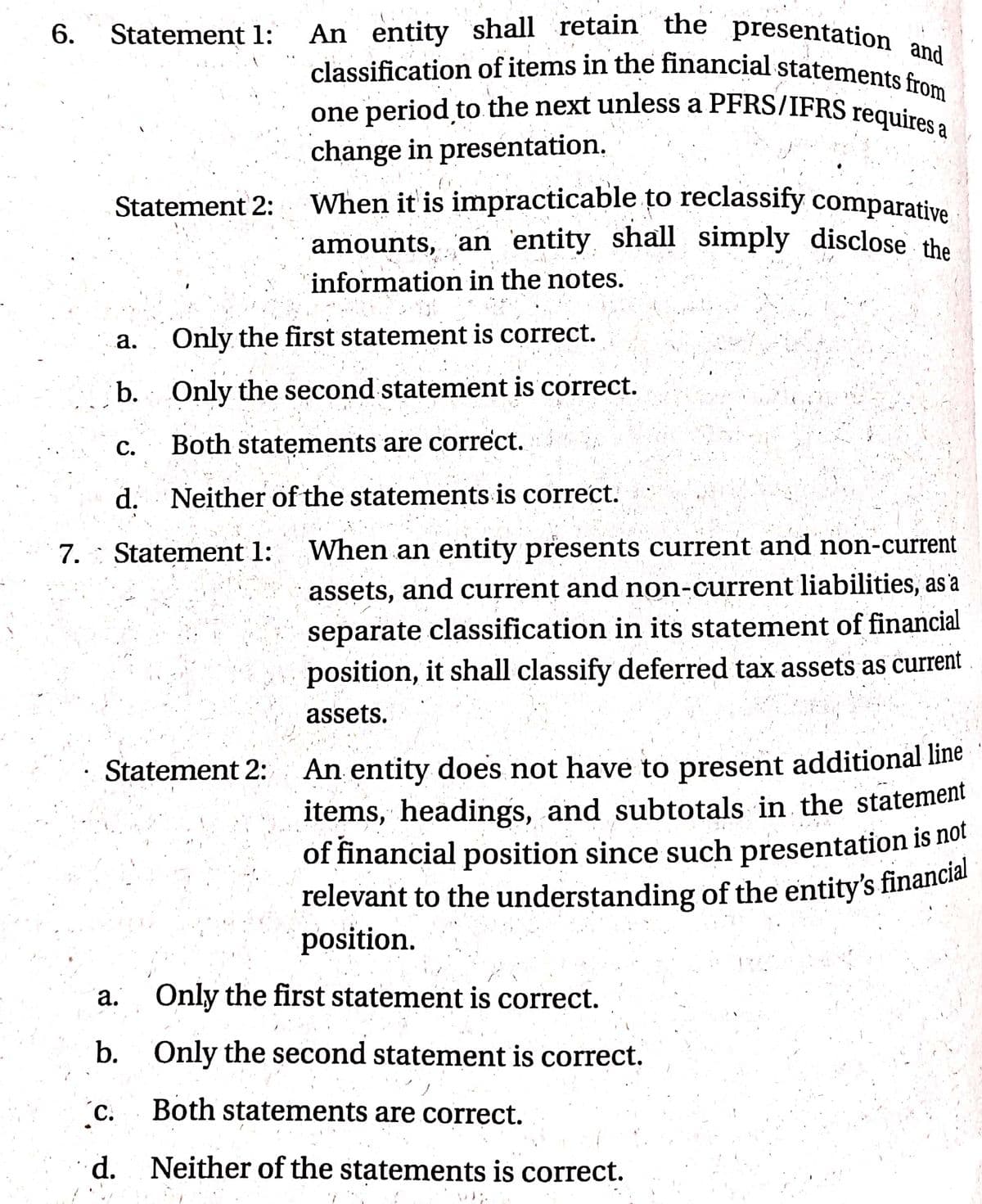

6.

classification of items in the financial statements from

An entity shall retain the presentation and

one period to the next unless a PFRS/IFRS requires a

When it is impracticable to reclassify comparative

Statement 1:

one period to the next unless a PFRS/IFRS requires

change in presentation.

Statement 2:

amounts, an entity shall simply disclose the

information in the notes.

а.

Only the first statement is correct.

b. Only the second statement is correct.

с.

Both statements are correct.

d. Neither of the statements is correct.

7. : Statement 1:

When an entity presents current and non-current

assets, and current and non-current liabilities, as'a

separate classification in its statement of financial

position, it shall classify deferred tax assets as current

assets.

An entity does not have to present additional line

items, headings, and subtotals in the statement

of financial position since such presentation is no!

Statement 2:

position.

а.

Only the first statement is correct.

b.

Only the second statement is correct.

(C.

Both statenments are correct.

d.

Neither of the statements is correct.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Auditing: A Risk Based-Approach (MindTap Course L…

Accounting

ISBN:

9781337619455

Author:

Karla M Johnstone, Audrey A. Gramling, Larry E. Rittenberg

Publisher:

Cengage Learning

Century 21 Accounting Multicolumn Journal

Accounting

ISBN:

9781337679503

Author:

Gilbertson

Publisher:

Cengage

Auditing: A Risk Based-Approach (MindTap Course L…

Accounting

ISBN:

9781337619455

Author:

Karla M Johnstone, Audrey A. Gramling, Larry E. Rittenberg

Publisher:

Cengage Learning

Century 21 Accounting Multicolumn Journal

Accounting

ISBN:

9781337679503

Author:

Gilbertson

Publisher:

Cengage