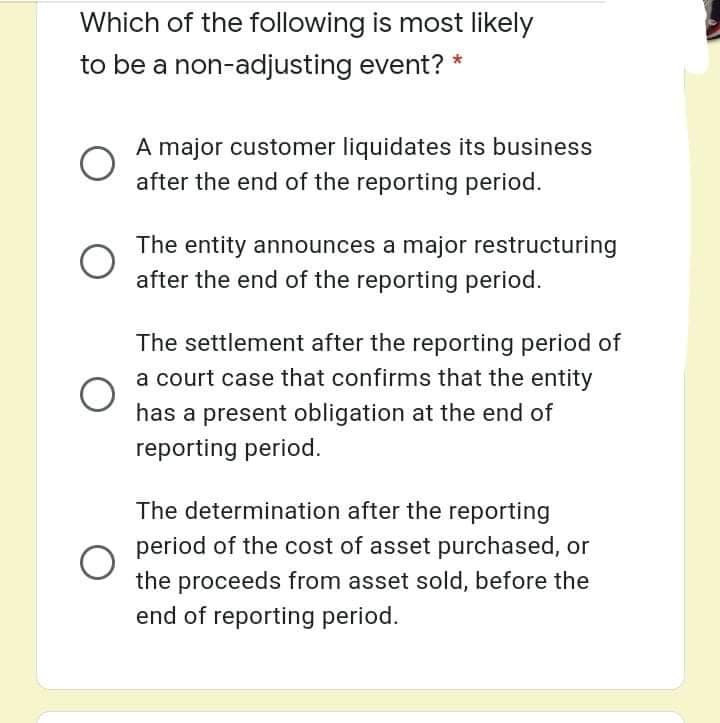

Which of the following is most likely to be a non-adjusting event? * A major customer liquidates its business after the end of the reporting period. The entity announces a major restructuring after the end of the reporting period. The settlement after the reporting period of a court case that confirms that the entity has a present obligation at the end of reporting period. The determination after the reporting period of the cost of asset purchased, or the proceeds from asset sold, before the end of reporting period.

Which of the following is most likely to be a non-adjusting event? * A major customer liquidates its business after the end of the reporting period. The entity announces a major restructuring after the end of the reporting period. The settlement after the reporting period of a court case that confirms that the entity has a present obligation at the end of reporting period. The determination after the reporting period of the cost of asset purchased, or the proceeds from asset sold, before the end of reporting period.

Auditing: A Risk Based-Approach (MindTap Course List)

11th Edition

ISBN:9781337619455

Author:Karla M Johnstone, Audrey A. Gramling, Larry E. Rittenberg

Publisher:Karla M Johnstone, Audrey A. Gramling, Larry E. Rittenberg

Chapter14: Completing A Quality Audit

Section: Chapter Questions

Problem 27CYBK

Related questions

Question

Transcribed Image Text:Which of the following is most likely

to be a non-adjusting event? *

A major customer liquidates its business

after the end of the reporting period.

The entity announces a major restructuring

after the end of the reporting period.

The settlement after the reporting period of

a court case that confirms that the entity

has a present obligation at the end of

reporting period.

The determination after the reporting

period of the cost of asset purchased, or

the proceeds from asset sold, before the

end of reporting period.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Auditing: A Risk Based-Approach (MindTap Course L…

Accounting

ISBN:

9781337619455

Author:

Karla M Johnstone, Audrey A. Gramling, Larry E. Rittenberg

Publisher:

Cengage Learning

Auditing: A Risk Based-Approach to Conducting a Q…

Accounting

ISBN:

9781305080577

Author:

Karla M Johnstone, Audrey A. Gramling, Larry E. Rittenberg

Publisher:

South-Western College Pub

Auditing: A Risk Based-Approach (MindTap Course L…

Accounting

ISBN:

9781337619455

Author:

Karla M Johnstone, Audrey A. Gramling, Larry E. Rittenberg

Publisher:

Cengage Learning

Auditing: A Risk Based-Approach to Conducting a Q…

Accounting

ISBN:

9781305080577

Author:

Karla M Johnstone, Audrey A. Gramling, Larry E. Rittenberg

Publisher:

South-Western College Pub