Classique Designs sells a variety of merchandise, including school shoes for girls. The business began the last quarter of 2013 with 30 pairs of the "Aerosoles" brand at a total cost of $54,000. The following transactions, relating to the "Aerosoles" brand were completed during the quarter:

Classique Designs sells a variety of merchandise, including school shoes for girls. The business began the last quarter of 2013 with 30 pairs of the "Aerosoles" brand at a total cost of $54,000. The following transactions, relating to the "Aerosoles" brand were completed during the quarter:

Chapter1: Financial Statements And Business Decisions

Section: Chapter Questions

Problem 1Q

Related questions

Question

What's the answer for these questions

Transcribed Image Text:Question 3

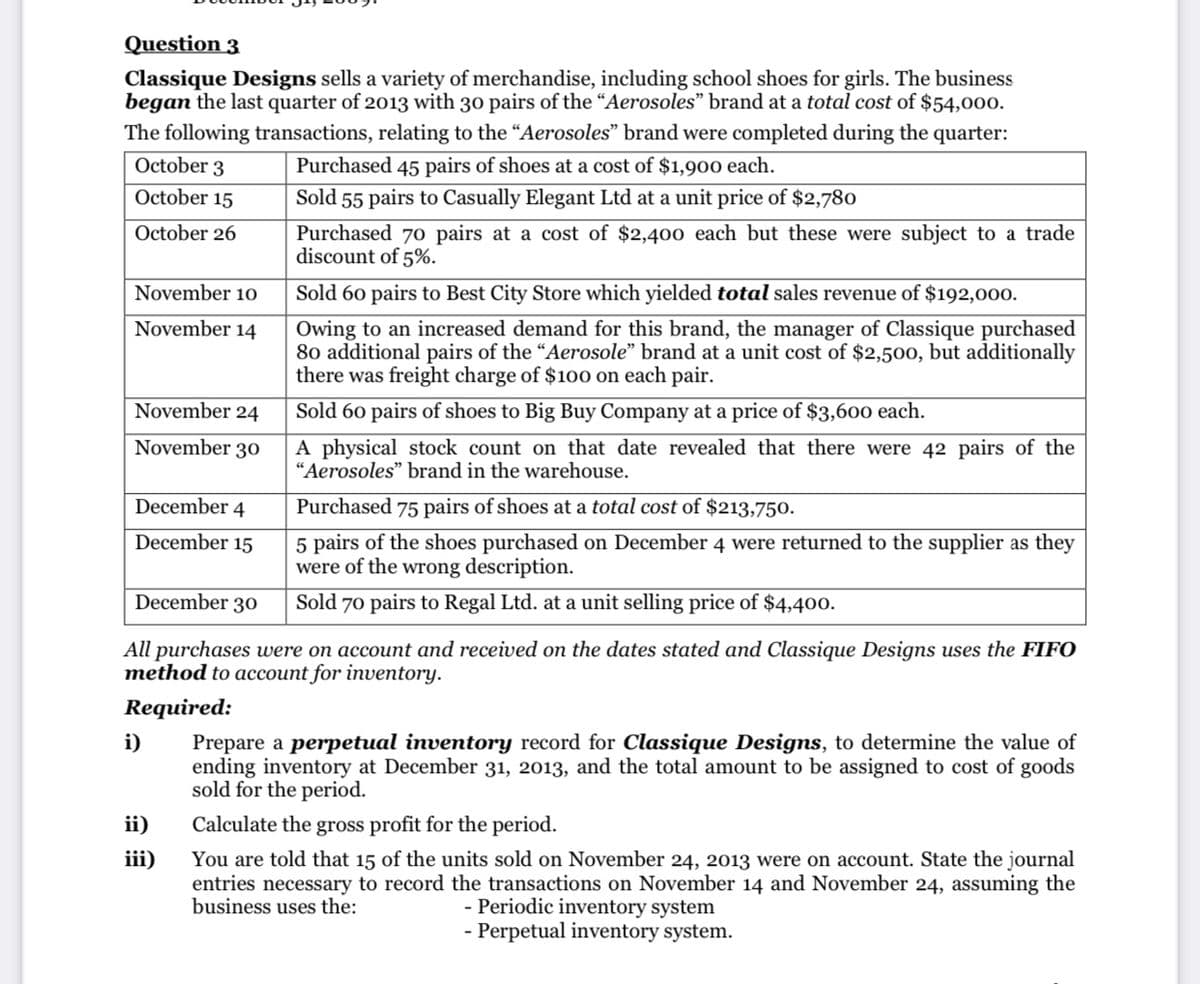

Classique Designs sells a variety of merchandise, including school shoes for girls. The business

began the last quarter of 2013 with 30 pairs of the “Aerosoles" brand at a total cost of $54,000.

The following transactions, relating to the “Aerosoles" brand were completed during the quarter:

October 3

Purchased 45 pairs of shoes at a cost of $1,900 each.

October 15

Sold 55 pairs to Casually Elegant Ltd at a unit price of $2,780

October 26

Purchased 70 pairs at a cost of $2,400 each but these were subject to a trade

discount of 5%.

November 1o

Sold 60 pairs to Best City Store which yielded total sales revenue of $192,000.

November 14

Owing to an increased demand for this brand, the manager of Classique purchased

80 additional pairs of the “Aerosole" brand at a unit cost of $2,500, but additionally

there was freight charge of $100 on each pair.

November 24

Sold 60 pairs of shoes to Big Buy Company at a price of $3,600 each.

November 30

physical stock count on that date revealed that there were 42 pairs of the

"Aerosoles" brand in the warehouse.

December 4

Purchased 75 pairs of shoes at a total cost of $213,750.

5 pairs of the shoes purchased on December 4 were returned to the supplier as they

were of the wrong description.

December 15

December 30

Sold 70 pairs to Regal Ltd. at a unit selling price of $4,400.

All purchases were on account and received on the dates stated and Classique Designs uses the FIFO

method to account for inventory.

Required:

i)

Prepare a perpetual inventory record for Classique Designs, to determine the value of

ending inventory at December 31, 2013, and the total amount to be assigned to cost of goods

sold for the period.

ii)

Calculate the gross profit for the period.

You are told that 15 of the units sold on November 24, 2013 were on account. State the journal

entries necessary to record the transactions on November 14 and November 24, assuming the

- Periodic inventory system

- Perpetual inventory system.

iii)

business uses the:

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 4 steps with 3 images

Recommended textbooks for you

Accounting

Accounting

ISBN:

9781337272094

Author:

WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:

Cengage Learning,

Accounting Information Systems

Accounting

ISBN:

9781337619202

Author:

Hall, James A.

Publisher:

Cengage Learning,

Accounting

Accounting

ISBN:

9781337272094

Author:

WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:

Cengage Learning,

Accounting Information Systems

Accounting

ISBN:

9781337619202

Author:

Hall, James A.

Publisher:

Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis…

Accounting

ISBN:

9780134475585

Author:

Srikant M. Datar, Madhav V. Rajan

Publisher:

PEARSON

Intermediate Accounting

Accounting

ISBN:

9781259722660

Author:

J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:

McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:

9781259726705

Author:

John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:

McGraw-Hill Education