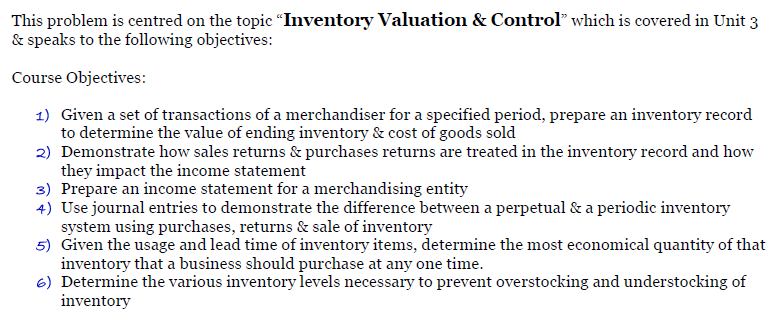

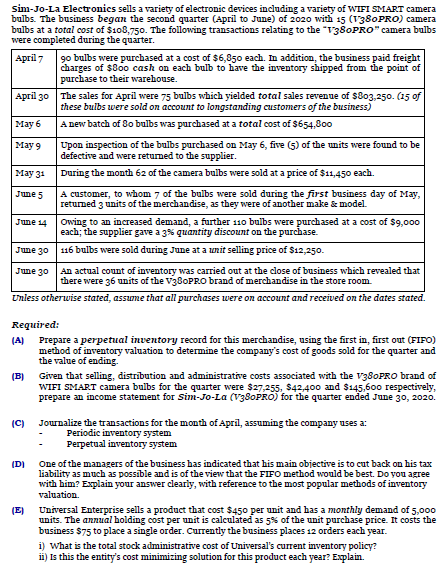

Sim-Jo-La Electronics sells a variety of electronic devices including a variety of WIFI SMART camera bulbs. The business began the second quarter (April to June) of 2020 with 15 (V380PRO) camera bulbs at a total cost of $108,750. The following transactions relating to the "V380PRO" camera bulbs were completed during the quarter. April 7 90 bulbs were purchased at a cost of $6,850 each. In addition, the business paid freight charges of $800 cash on each bulb to have the inventory shipped from the point of purchase to their warehouse. April 30 The sales for April were 75 bulbs which yielded total sales revenue of $803,250. (15 of these bulbs were sold on account to longstanding customers of the business) May 6 A new batch of 8o bulbs was purchased at a total cost of $654,800 May 9 Upon inspection of the bulbs purchased on May 6, five (5) of the units were found to be defective and were returned to the supplier. May 31 During the month 62 of the camera bulbs were sold at a price of $11,450 each. A customer, to whom 7 of the bulbs were sold during the first business day of May, returned 3 units of the merchandise, as they were of another make & model. June 5 June 14 owing to an increased demand, a further 110 bulbs were purchased at a cost of $9,000 each; the supplier gave a 3% quantity discount on the purchase. June 30 116 bulbs were sold during June at a unit selling price of $12,250. June 30 An actual count of inventory was carried out at the close of business which revealed that there were 36 units of the V380PRO brand of merchandise in the store room.

Master Budget

A master budget can be defined as an estimation of the revenue earned or expenses incurred over a specified period of time in the future and it is generally prepared on a periodic basis which can be either monthly, quarterly, half-yearly, or annually. It helps a business, an organization, or even an individual to manage the money effectively. A budget also helps in monitoring the performance of the people in the organization and helps in better decision-making.

Sales Budget and Selling

A budget is a financial plan designed by an undertaking for a definite period in future which acts as a major contributor towards enhancing the financial success of the business undertaking. The budget generally takes into account both current and future income and expenses.

Step by step

Solved in 6 steps with 7 images