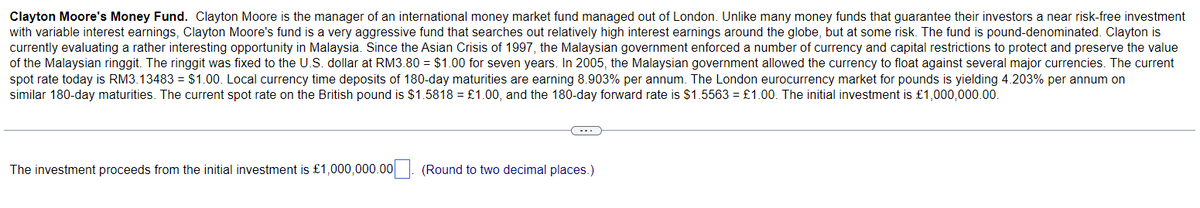

Clayton Moore's Money Fund. Clayton Moore is the manager of an international money market fund managed out of London. Unlike many money funds that guarantee their investors a near risk-free investment with variable interest earnings, Clayton Moore's fund is a very aggressive fund that searches out relatively high interest earnings around the globe, but at some risk. The fund is pound-denominated. Clayton is currently evaluating a rather interesting opportunity in Malaysia. Since the Asian Crisis of 1997, the Malaysian government enforced a number of currency and capital restrictions to protect and preserve the value of the Malaysian ringgit. The ringgit was fixed to the U.S. dollar at RM3.80 = $1.00 for seven years. In 2005, the Malaysian government allowed the currency to float against several major currencies. The current spot rate today is RM3.13483 = $1.00. Local currency time deposits of 180-day maturities are earning 8.903% per annum. The London eurocurrency market for pounds is yielding 4.203% per annum on similar 180-day maturities. The current spot rate on the British pound is $1.5818 = £1.00, and the 180-day forward rate is $1.5563 = £1.00. The initial investment is £1,000,000.00. The investment proceeds from the initial investment is £1,000,000.00 (Round to two decimal places.)

Clayton Moore's Money Fund. Clayton Moore is the manager of an international money market fund managed out of London. Unlike many money funds that guarantee their investors a near risk-free investment with variable interest earnings, Clayton Moore's fund is a very aggressive fund that searches out relatively high interest earnings around the globe, but at some risk. The fund is pound-denominated. Clayton is currently evaluating a rather interesting opportunity in Malaysia. Since the Asian Crisis of 1997, the Malaysian government enforced a number of currency and capital restrictions to protect and preserve the value of the Malaysian ringgit. The ringgit was fixed to the U.S. dollar at RM3.80 = $1.00 for seven years. In 2005, the Malaysian government allowed the currency to float against several major currencies. The current spot rate today is RM3.13483 = $1.00. Local currency time deposits of 180-day maturities are earning 8.903% per annum. The London eurocurrency market for pounds is yielding 4.203% per annum on similar 180-day maturities. The current spot rate on the British pound is $1.5818 = £1.00, and the 180-day forward rate is $1.5563 = £1.00. The initial investment is £1,000,000.00. The investment proceeds from the initial investment is £1,000,000.00 (Round to two decimal places.)

Chapter21: International Cash Management

Section: Chapter Questions

Problem 16QA

Related questions

Question

Transcribed Image Text:Clayton Moore's Money Fund. Clayton Moore is the manager of an international money market fund managed out of London. Unlike many money funds that guarantee their investors a near risk-free investment

with variable interest earnings, Clayton Moore's fund is a very aggressive fund that searches out relatively high interest earnings around the globe, but at some risk. The fund is pound-denominated. Clayton is

currently evaluating a rather interesting opportunity in Malaysia. Since the Asian Crisis of 1997, the Malaysian government enforced a number of currency and capital restrictions to protect and preserve the value

of the Malaysian ringgit. The ringgit was fixed to the U.S. dollar at RM3.80 = $1.00 for seven years. In 2005, the Malaysian government allowed the currency to float against several major currencies. The current

spot rate today is RM3.13483 = $1.00. Local currency time deposits of 180-day maturities are earning 8.903% per annum. The London eurocurrency market for pounds is yielding 4.203% per annum on

similar 180-day maturities. The current spot rate on the British pound is $1.5818 = £1.00, and the 180-day forward rate is $1.5563 = £1.00. The initial investment is £1,000,000.00.

The investment proceeds from the initial investment is £1,000,000.00

(Round to two decimal places.)

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Recommended textbooks for you