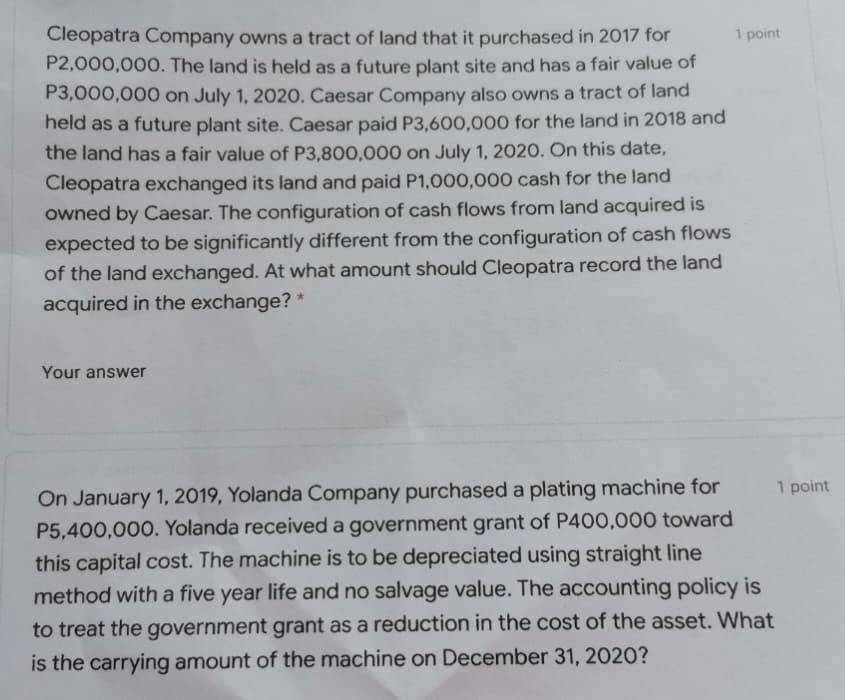

Cleopatra Company owns a tract of land that it purchased in 2017 for P2,000,000. The land is held as a future plant site and has a fair value of P3,000,000 on July 1, 2020. Caesar Company also owns a tract of land held as a future plant site. Caesar paid P3,600,000 for the land in 2018 and the land has a fair value of P3,800,000 on July 1, 2020. On this date, Cleopatra exchanged its land and paid P1,000,000 cash for the land owned by Caesar. The configuration of cash flows from land acquired is expected to be significantly different from the configuration of cash flows of the land exchanged. At what amount should Cleopatra record the land acquired in the exchange? *

Cleopatra Company owns a tract of land that it purchased in 2017 for P2,000,000. The land is held as a future plant site and has a fair value of P3,000,000 on July 1, 2020. Caesar Company also owns a tract of land held as a future plant site. Caesar paid P3,600,000 for the land in 2018 and the land has a fair value of P3,800,000 on July 1, 2020. On this date, Cleopatra exchanged its land and paid P1,000,000 cash for the land owned by Caesar. The configuration of cash flows from land acquired is expected to be significantly different from the configuration of cash flows of the land exchanged. At what amount should Cleopatra record the land acquired in the exchange? *

SWFT Essntl Tax Individ/Bus Entities 2020

23rd Edition

ISBN:9780357391266

Author:Nellen

Publisher:Nellen

Chapter8: Property Transactions: Capital Gains And Losses, Section 1231 And Recapture Provisions

Section: Chapter Questions

Problem 38P

Related questions

Question

Show the solution in good accounting form

Transcribed Image Text:1 point

Cleopatra Company owns a tract of land that it purchased in 2017 for

P2,000,000. The land is held as a future plant site and has a fair value of

P3,000,000 on July 1, 2020. Caesar Company also owns a tract of land

held as a future plant site. Caesar paid P3,600,000 for the land in 2018 and

the land has a fair value of P3,800,000 on July 1, 2020. On this date,

Cleopatra exchanged its land and paid P1,000,000 cash for the land

owned by Caesar. The configuration of cash flows from land acquired is

expected to be significantly different from the configuration of cash flows

of the land exchanged. At what amount should Cleopatra record the land

acquired in the exchange?

Your answer

1 point

On January 1, 2019, Yolanda Company purchased a plating machine for

P5,400,000. Yolanda received a government grant of P400,000 toward

this capital cost. The machine is to be depreciated using straight line

method with a five year life and no salvage value. The accounting policy is

to treat the government grant as a reduction in the cost of the asset. What

is the carrying amount of the machine on December 31, 2020?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning