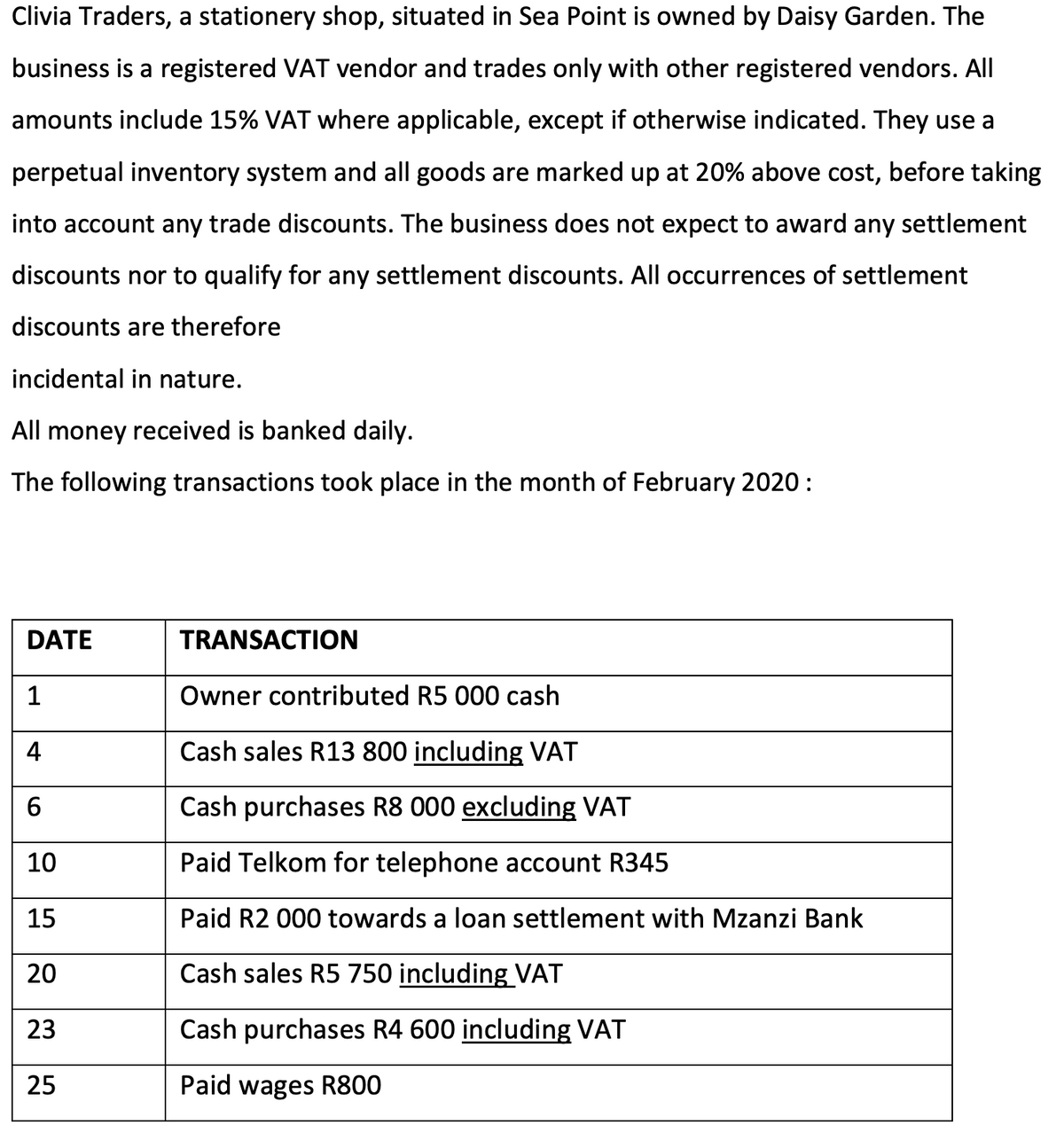

Clivia Traders, a stationery shop, situated in Sea Point is owned by Daisy Garden. The business is a registered VAT vendor and trades only with other registered vendors. All amounts include 15% VAT where applicable, except if otherwise indicated. They use a perpetual inventory system and all goods are marked up at 20% above cost, before taking into account any trade discounts. The business does not expect to award any settlement discounts nor to qualify for any settlement discounts. All occurrences of settlement discounts are therefore incidental in nature. All money received is banked daily. The following transactions took place in the month of February 2020 : DATE TRANSACTION 1 Owner contributed R5 000 cash 4 Cash sales R13 800 including VAT 6 Cash purchases R8 000 excluding VAT 10 Paid Telkom for telephone account R345 15 Paid R2 000 towards a loan settlement with Mzanzi Bank 20 Cash sales R5 750 including VAT 23 Cash purchases R4 600 including VAT 25 Paid wages R800

Bad Debts

At the end of the accounting period, a financial statement is prepared by every company, then at that time while preparing the financial statement, the company determines among its total receivable amount how much portion of receivables is collected by the company during that accounting period.

Accounts Receivable

The word “account receivable” means the payment is yet to be made for the work that is already done. Generally, each and every business sells its goods and services either in cash or in credit. So, when the goods are sold on credit account receivable arise which means the company is going to get the payment from its customer to whom the goods are sold on credit. Usually, the credit period may be for a very short period of time and in some rare cases it takes a year.

Can you kindly assist on attached. Following subsidiary journals for Clivia Traders for February 2020:

-

- Cashbook receipts

Trending now

This is a popular solution!

Step by step

Solved in 3 steps with 4 images