Jabulani Jomo, a sole trader, owns Jomo Entreprises. The entity is a general dealer which uses the Perpetual Inventory System and is not a Registered VAT Vendor. (i.e. ignore VAT) Jomo Entreprises marks up all their goods at a constant mark-up of 15% on cost. Ledger Account balances, amongst others, on 1 May 2019: Bank (favourable) R42 655 Debtors Control R312 000 The Debtors List consists of: Nancy Jones R55 000; Katlego Dlamini R127 000 and Brandon van der Merwe R130 000 Credit Losses R23 560 Sales R457 500 Transactions, amongst others, for May 2019: Receipt R76 was issued to Katlego Dlamini who paid R55 000 in full settlement of the amount he owed as at 1 April 2019, R58 000. A prompt settlement discount was granted and JV77 was completed. 3 Cash sales according to the cash register roll amounted to R424 925. The tenant, Susie Snyman, paid her rent directly into the entity's current bank account, R17 000. NEED Bank returned Katlego Dlamini's cheque (see 1 May 2019) marked R/D. 8 Sold goods on credit to Nancy Jones R37 490 (Cost Price R32 600). Credit Invoices C735 was issued. Sold goods on credit to Brandon van der Merwe R25 599 (Cost Price R22 260). Credit 00

Jabulani Jomo, a sole trader, owns Jomo Entreprises. The entity is a general dealer which uses the Perpetual Inventory System and is not a Registered VAT Vendor. (i.e. ignore VAT) Jomo Entreprises marks up all their goods at a constant mark-up of 15% on cost. Ledger Account balances, amongst others, on 1 May 2019: Bank (favourable) R42 655 Debtors Control R312 000 The Debtors List consists of: Nancy Jones R55 000; Katlego Dlamini R127 000 and Brandon van der Merwe R130 000 Credit Losses R23 560 Sales R457 500 Transactions, amongst others, for May 2019: Receipt R76 was issued to Katlego Dlamini who paid R55 000 in full settlement of the amount he owed as at 1 April 2019, R58 000. A prompt settlement discount was granted and JV77 was completed. 3 Cash sales according to the cash register roll amounted to R424 925. The tenant, Susie Snyman, paid her rent directly into the entity's current bank account, R17 000. NEED Bank returned Katlego Dlamini's cheque (see 1 May 2019) marked R/D. 8 Sold goods on credit to Nancy Jones R37 490 (Cost Price R32 600). Credit Invoices C735 was issued. Sold goods on credit to Brandon van der Merwe R25 599 (Cost Price R22 260). Credit 00

Chapter12: Current Liabilities

Section: Chapter Questions

Problem 8PA: Serene Company purchases fountains for its inventory from Kirkland Inc. The following transactions...

Related questions

Question

The Cashbook Receipts for May 2019.

please ass

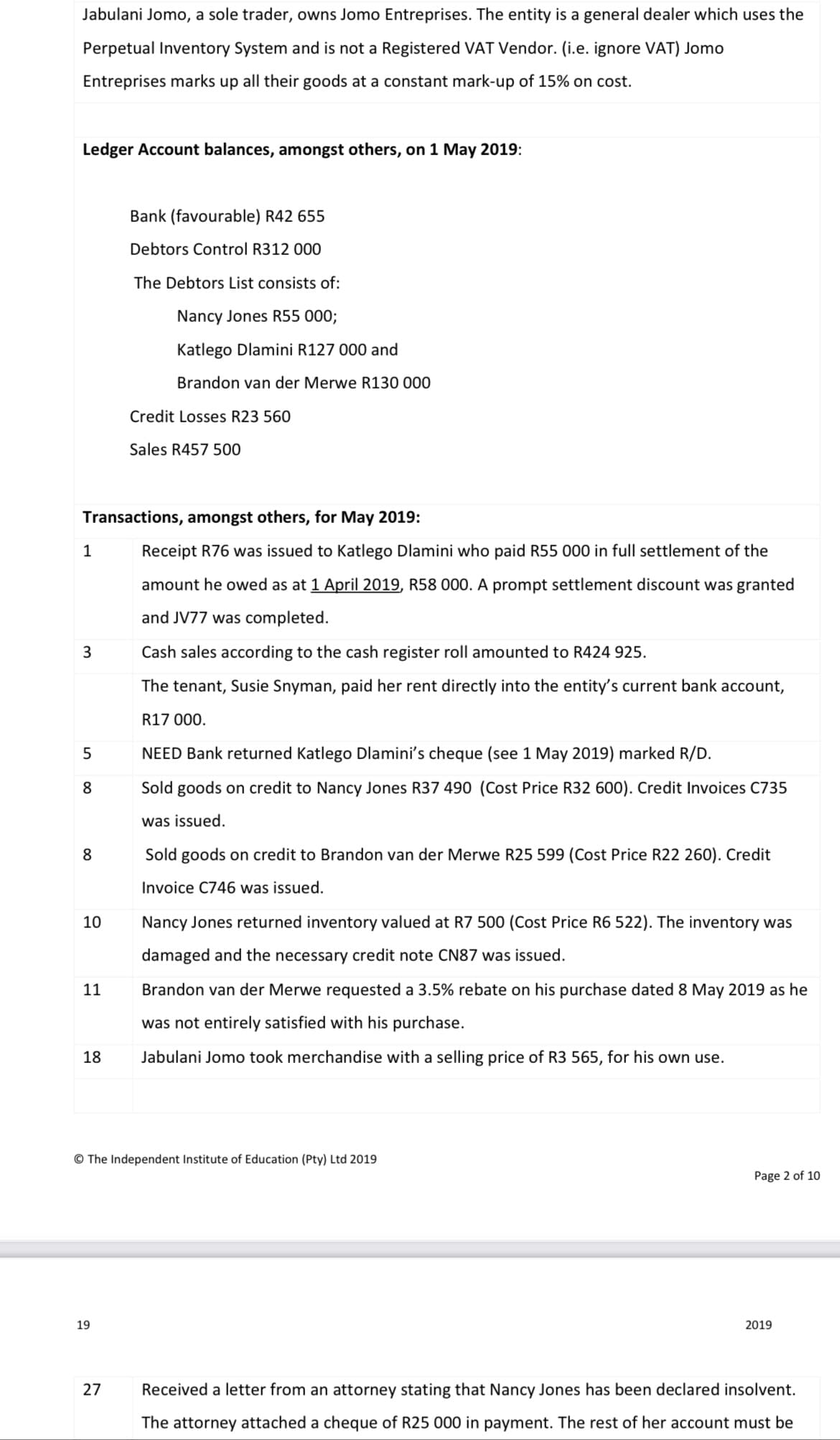

Transcribed Image Text:Jabulani Jomo, a sole trader, owns Jomo Entreprises. The entity is a general dealer which uses the

Perpetual Inventory System and is not a Registered VAT Vendor. (i.e. ignore VAT) Jomo

Entreprises marks up all their goods at a constant mark-up of 15% on cost.

Ledger Account balances, amongst others, on 1 May 2019:

Bank (favourable) R42 655

Debtors Control R312 000

The Debtors List consists of:

Nancy Jones R55 000;

Katlego Dlamini R127 000 and

Brandon van der Merwe R130 000

Credit Losses R23 560

Sales R457 500

Transactions, amongst others, for May 2019:

Receipt R76 was issued to Katlego Dlamini who paid R55 000 in full settlement of the

amount he owed as at 1 April 2019, R58 000. A prompt settlement discount was granted

and JV77 was completed.

3

Cash sales according to the cash register roll amounted to R424 925.

The tenant, Susie Snyman, paid her rent directly into the entity's current bank account,

R17 000.

NEED Bank returned Katlego Dlamini's cheque (see 1 May 2019) marked R/D.

8

Sold goods on credit to Nancy Jones R37 490 (Cost Price R32 600). Credit Invoices C735

was issued.

8

Sold goods on credit to Brandon van der Merwe R25 599 (Cost Price R22 260). Credit

Invoice C746 was issued.

10

Nancy Jones returned inventory valued at R7 500 (Cost Price R6 522). The inventory was

damaged and the necessary credit note CN87 was issued.

11

Brandon van der Merwe requested a 3.5% rebate on his purchase dated 8 May 2019 as he

was not entirely satisfied with his purchase.

18

Jabulani Jomo took merchandise with a selling price of R3 565, for his own use.

© The Independent Institute of Education (Pty) Ltd 2019

Page 2 of 10

19

2019

27

Received a letter from an attorney stating that Nancy Jones has been declared insolvent.

The attorney attached a cheque of R25 000 in payment. The rest of her account must be

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning