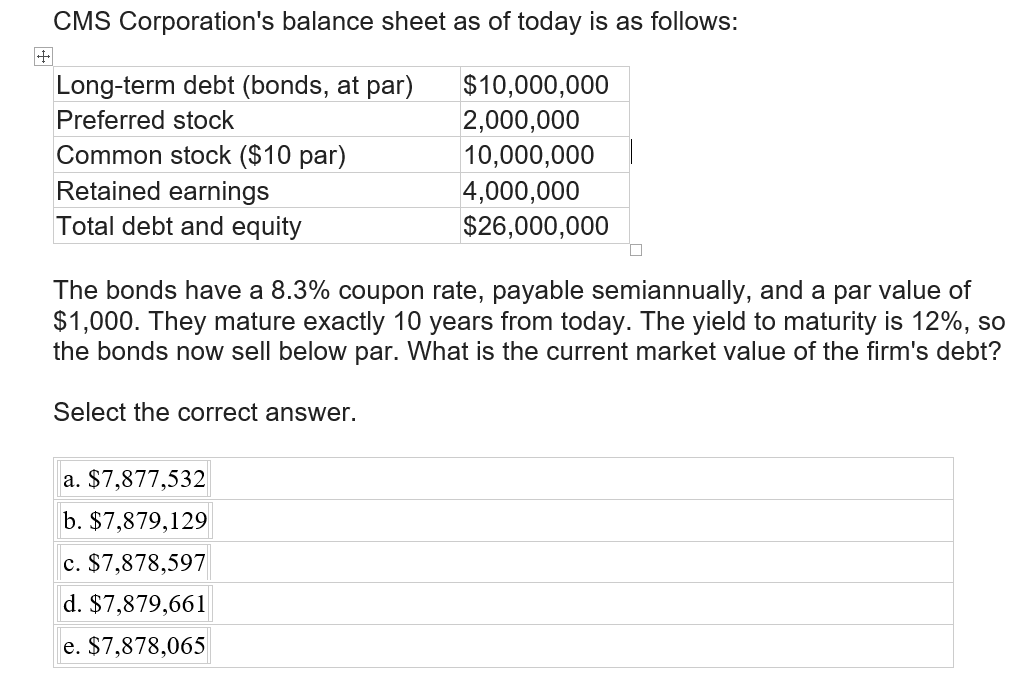

+ CMS Corporation's balance sheet as of today is as follows: Long-term debt (bonds, at par) Preferred stock $10,000,000 Common stock ($10 par) Retained earnings Total debt and equity 2,000,000 10,000,000 4,000,000 $26,000,000 ப The bonds have a 8.3% coupon rate, payable semiannually, and a par value of $1,000. They mature exactly 10 years from today. The yield to maturity is 12%, so the bonds now sell below par. What is the current market value of the firm's debt? Select the correct answer. a. $7,877,532 b. $7,879,129 c. $7,878,597 d. $7,879,661 e. $7,878,065

+ CMS Corporation's balance sheet as of today is as follows: Long-term debt (bonds, at par) Preferred stock $10,000,000 Common stock ($10 par) Retained earnings Total debt and equity 2,000,000 10,000,000 4,000,000 $26,000,000 ப The bonds have a 8.3% coupon rate, payable semiannually, and a par value of $1,000. They mature exactly 10 years from today. The yield to maturity is 12%, so the bonds now sell below par. What is the current market value of the firm's debt? Select the correct answer. a. $7,877,532 b. $7,879,129 c. $7,878,597 d. $7,879,661 e. $7,878,065

Chapter16: Financial Planning And Control

Section: Chapter Questions

Problem 12PROB

Related questions

Question

Transcribed Image Text:+

CMS Corporation's balance sheet as of today is as follows:

Long-term debt (bonds, at par)

Preferred stock

$10,000,000

Common stock ($10 par)

Retained earnings

Total debt and equity

2,000,000

10,000,000

4,000,000

$26,000,000

ப

The bonds have a 8.3% coupon rate, payable semiannually, and a par value of

$1,000. They mature exactly 10 years from today. The yield to maturity is 12%, so

the bonds now sell below par. What is the current market value of the firm's debt?

Select the correct answer.

a. $7,877,532

b. $7,879,129

c. $7,878,597

d. $7,879,661

e. $7,878,065

AI-Generated Solution

Unlock instant AI solutions

Tap the button

to generate a solution

Recommended textbooks for you

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning