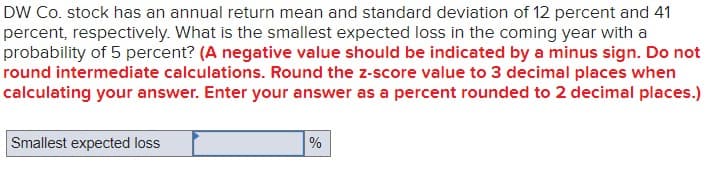

DW Co. stock has an annual return mean and standard deviation of 12 percent and 41 percent, respectively. What is the smallest expected loss in the coming year with a probability of 5 percent? (A negative value should be indicated by a minus sign. Do not round intermediate calculations. Round the z-score value to 3 decimal places when calculating your answer. Enter your answer as a percent rounded to 2 decimal places.) Smallest expected loss %

Q: ces The inverse demand for a homogeneous-product Stackelberg duopoly is P= 10,000 -4Q. The cost…

A:

Q: How does data bias influence the culture of ethics and profitability in the financial services…

A: Data bias in the financial services sector can have profound and far-reaching consequences on both…

Q: Bond J has a coupon of 6.8 percent. Bond K has a coupon of 10.8 percent. Both bonds have 20 years to…

A: Part 2: Explanation:Step 1: Calculate the current price of each bond.The formula to calculate the…

Q: a U.S. firm holds an asset in Great Britain and faces the following scenario: (13 points) State 1…

A: Analyzing the U.S. Firm's British AssetThis scenario provides a U.S. Firm protecting an asset in…

Q: provide correct answer A,B,C,D

A: Step 1: The journal entries for Part A, B and C respectively are passed as follows:-DateGeneral…

Q: Marissa Manufacturing is presented with the following two mutually exclusive projects. The required…

A: The computation for "Parts a and b" is shown in excel table below: The formula used above is shown…

Q: You are evaluating two different silicon wafer milling machines. The Techron | costs $265,000, has a…

A: Calculate Annuity Factor (A/F) for Machine Life at 10% discount rate.A/F = 1 - (1 + R)^-N / R (where…

Q: Q4. You are willing to buy a car which will cost you 20000 euros. A bank is willing to provides you…

A: In this scenario, you are considering two loan options from a bank to purchase a car costing 20,000…

Q: A stock having a beta of 2 means

A: Key Points:Beta is a historical measure and doesn't guarantee future performance.A high beta doesn't…

Q: Baghiben

A: Step 1:Face Value of bond =$100Coupon Rate of bond =9%Annual Coupon (PMT) =Coupon Rate*Face Value…

Q: a. What is the primary difference between financial statementanalysis and operating indicator…

A: Approach to solving the question: Detailed explanation: Examples: Key references:

Q: Raghubhai

A: Calculations:Cost of equity (Ke) using CAPM:Ke = Rf + β * MRPKe = 3.30% + 1.15 * 11.00%Ke =…

Q: Nikulbhai

A: −$130,015 Step 1: Calculate Expected SalesExpected Sales=Current Sales×(1+Growth…

Q: 1. Suppose two factors are identified for the U.S. economy: the growth rate of industrial…

A: Here's how to calculate the best guess for the rate of return on the stock:Expected Contribution…

Q: These spot foreign exchange rate were reported on Dec,24,2008. U.S $ JAPANESE YEN 0.008864 Calculate…

A: The cross rate between two currencies can be found by dividing one currency's rate by another…

Q: Exercise 4. Consider the following information about the U.S. Treasury Securities: Maturity (in…

A:

Q: Practice Question Solved: 7 Highest and Best Use (HBU) Analysis Imagine you are trying to determine…

A: In assessing the highest and best use (HBU) for the subject property, we evaluate three potential…

Q: You are evaluating a closed-end mutual fund and see that its price is different from its net asset…

A: Discount = (Risk-Adjusted Abnormal Return - Expense Ratio) / (Dividend Yield + Expense Ratio -…

Q: Required: A bond has a par value of $1,000, a time to maturity of 20 years, and a coupon rate of…

A: Step 1:1. Annual Coupon Payment Calculation:Par Value (F):$1,000Coupon Rate: 7.30%Annual Coupon…

Q: Two years ago, on March 1, 2020 Mark bought a new tractor. Mark traded his old tractor which had a…

A: Part 2: Approach to solving the questionTo calculate the depreciation for 2021, we need to…

Q: Sky is a single parent of a 1 year old daughter, Becky. She has an annual income of $45,000. Sky…

A: The CESG is a government grant that supplements the contributions made to an RESP. The amount of the…

Q: please answer correctly fast please:

A: To calculate the beta of a portfolio given the expected return on the portfolio (E(rp)), the…

Q: Question 15 of 30 View Policies Current Attempt in Progress -/0.35 ⠀ Carla Vista Corporation is…

A: Step 1: The calculation of the NPV and The IRR AB1Equipment cost $ 1,856,000.00 2Cashflow $…

Q: Baghiben

A: The correct answer is:The stock is worth $17.48. Here are the steps to get the answer:1. Dividends…

Q: None

A: Total enterprise value (TEV) is a valuation measurement used to compare companies with varying…

Q: Financial managers must be able to balance current assets and current liabilities to ensure the…

A: Question 1The operating cycle and cash cycle are two fundamental concepts in financial management…

Q: Consider the following cash flows: Co -$27 C₁ +$ 24 C2 +$ 24 C3 +$ 24 C4 -$46 a. Which two of the…

A: Question AIRR or the Internal Rate of Return is a discount rate that makes the net present value…

Q: Zero-Coupon Bonds (ZCBS) with maturity in 1 and 5 years are available on the market. Their…

A: Reference : Financial Engineering, Financial Economics, Computational Finance, Spot rate, Forward,…

Q: Jasmine's Dresswear Manufacturers is preparing a strategy for the fall season. One alternative is to…

A: To calculate the Net Present Value (NPV) for both options, we'll multiply the cash flows by their…

Q: A $6,000 bond that carries a 4.00% coupon rate payable semi-annually is purchased 7 years before…

A: If the face value of the bond is greater than the purchase price of the bond, there will be a…

Q: 14 ants eBook Print References Triad Corporation has established a joint venture with Tobacco Road…

A: Step 1: Determine the Earnings after tax . Earnings after tax is Earnings before Interest Taxes and…

Q: None

A: Step 1:We have to calculate the price of the stock one year from now.The formula for calculating the…

Q: 13. Alston Trucking has a contract to transport a trailer load of beer from Milwaukee to Houston.…

A: Option D is correct because the trailer interchange agreement between Alston Trucking and Sykes…

Q: Baghiben

A: Smolira Golf DuPont Identity BreakdownWe can construct the DuPont identification for Smolira Golf by…

Q: None

A: Given information: Cost of capital (r) = 5.05% or 0.0505 Initial Investment (CF0) = $39,304Year…

Q: MIRR is usually calculated with the same reinvestment rate as that embedded in the cost of debt NPV…

A: MIRR, or Modified Internal Rate of Return, is usually calculated with the reinvestment rate that is…

Q: Nikul

A: Step 1:a)We have to calculate the firm's market value capital structure weights.Calculations are…

Q: You have just sold your house for $950,000 in cash. Your mortgage was originally a 30-year mortgage…

A: Certainly! Let's break down the calculations step by step.1. **Monthly Discount Rate (\( r \)):**…

Q: Lasky Manufacturing has two divisions: Carolinas and Northeast. Lasky has a cost of capital of 7.5…

A: Step 1: EVA formula is NOPAT- (Cost of Capital * Invested Capital) Step 2: Here, we will assume…

Q: Sand Key Development Company has a capital structure consisting of $20 million of 10% debt and $30…

A: Certainly! The question asks us to find the level of operating income at which Sand Key would be…

Q: Taylor Glass has annual sales of $1,790,000. Although it extends credit for 30 days (n30), the…

A: Approach to solving the question: For better clarity of the solution, I have provided the…

Q: es Suppose the following bond quote for IOU Corporation appears in the financial page of today's…

A: currentyield is calculated as the annual coupon payment divided by the current bond price,…

Q: A project will produce an operating cash flow of $7,500 a year for 8 years. The initial fixed…

A: 1. Define the Cash Flows:The first step is to identify the cash flows associated with the project.…

Q: None

A: Step 1:It need to use a statistical software package that can perform multiple regression analyses…

Q: EV Hyper Chargers is considering a project with the following cash flows: Year O Year 1 Year 2 Year…

A:

Q: F1

A: Step 1: From the question, we have the outstanding balance of June month and the current billing…

Q: If I were to calculate and compare the percentage of net accounts receivable, relative to total…

A: Certainly, calculating and comparing the percentage of net accounts receivable relative to total…

Q: Provide Correct option

A: Cash flow from operating activitiesNet Sales$2,900,000Less: Cost of good sold(1,500,000)Gross…

Q: Portfolio A is a well-diversified portfolio that is equally-weighted among 6,000 different and…

A: Systematic Risk: This type of risk is inherent to the entire market or a market segment. Systematic…

Q: Please Give Step by Step Answer Otherwise i give DISLIKES !!

A: Step 1:iRobot = 0.99 x 3,490/3,490+0 = 0.99Middleby's = 1.94 x 7,610/7,610+777 = 1.760National…

Raghubhai

Step by step

Solved in 2 steps with 1 images

- If the return on stock A in year 1 was 10 %, in year 2 was -6 %, in year 3 was -2 % and in year 4 was 10 %, what was the standard deviation of returns for stock A over this four year period? (Round your answer to 1 decimal place and record without a percent sign. If your final answer is negative, place a minus sign before the number with no space between the sign and the number).The common stock of Manchester & Moore is expected to earn 14.8 percent in a recession, 8 percent in a normal economy, and lose 5.8 percent in a booming economy. The probability of a boom is 12 percent while the probability of a recession is 6 percent. What is the expected rate of return on this stock? (Do not round intermediate calculations and enter your answer as a percent rounded to 2 decimal places, e.g., 32.16.)You find a certain stock that had returns of 16 percent, −23 percent, 24 percent, and 9 percent for four of the last five years. The average return of the stock over this period was 10.2 percent. a. What was the stock’s return for the missing year? (Do not round intermediate calculations and enter your answer as a percent rounded to 1 decimal place, e.g., 32.1.) b. What is the standard deviation of the stock’s returns? (Do not round intermediate calculations and enter your answer as a percent rounded to 2 decimal places, e.g., 32.16.)

- You’ve observed the following returns on Pine Computer’s stock over the past five years: −26.4 percent, 14.6 percent, 32.2 percent, 2.8 percent, and 21.8 percent. What was the arithmetic average return on the stock over this five-year period? Note: Do not round intermediate calculations and enter your answer as a percent rounded to 2 decimal places, e.g., 32.16. What was the variance of the returns over this period? Note: Do not round intermediate calculations and round your answer to 6 decimal places, e.g., .161616. What was the standard deviation of the returns over this period? Note: Do not round intermediate calculations and enter your answer as a percent rounded to 2 decimal places, e.g., 32.16.You’ve observed the following returns on Yamauchi Corporation’s stock over the past five years: –28.2 percent, 15.8 percent, 34.6 percent, 3.4 percent, and 22.4 percent. a. What was the arithmetic average return on the stock over this five-year period? (Do not round intermediate calculations and enter your answer as a percent rounded to 2 decimal places, e.g., 32.16.) b. What was the variance of the returns over this period? (Do not round intermediate calculations and round your answer to 6 decimal places, e.g., 32.161616.) c. What was the standard deviation of the returns over this period? (Do not round intermediate calculations and enter your answer as a percent rounded to 2 decimal places, e.g., 32.16.)The rate of return on General Electric common stock over the coming year is normally distributed with an expected value of 15 percent and a standard deviation of 12 percent. Determine the probability of earning a negative rate of return.

- The common stock of Air United, Inc., had annual returns of 15.6 percent, 2.4 percent, -11.8 percent, and 32.9 percent over the last four years, respectively. What is the standard deviation of these returns? Group of answer choices 13.29 percent 14.14 percent 16.50 percent 17.78 percent 19.05 percent show your work please and let me know if we can solve it by financial calculatorYou’ve observed the following returns on Pine Computer’s stock over the past five years: 13 percent, −13 percent, 20 percent, 25 percent, and 10 percent. a. What was the arithmetic average return on the company’s stock over this five-year period? (Do not round intermediate calculations and enter your answer as a percent rounded to 1 decimal place, e.g., 32.1.) b-1. What was the variance of the company’s returns over this period? (Do not round intermediate calculations and round your answer to 5 decimal places, e.g., .16161.) b-2. What was the standard deviation of the company’s returns over this period? (Do not round intermediate calculations and enter your answer as a percent rounded to 2 decimal places, e.g., 32.16.) a. Average return % b-1. Variance b-2. Standard deviation %You’ve observed the following returns on SkyNet Data Corporation’s stock over the past five years: 11 percent, –10 percent, 19 percent, 18 percent, and 10 percent. a. What was the arithmetic average return on the company's stock over this five-year period? (Do not round intermediate calculations and enter your answer as a percent rounded to 1 decimal place, e.g., 32.1.) b-1. What was the variance of the company's returns over this period? (Do not round intermediate calculations and round your answer to 5 decimal places, e.g., .16161.) b-2. What was the standard deviation of the company’s returns over this period? (Do not round intermediate calculations and enter your answer as a percent rounded to 2 decimal places, e.g., 32.16.)

- An index model regression applied to past monthly returns in Ford’s stock price produces the following estimates, which are believed to be stable over time: rF = 0.1% + 1.1rM If the market index subsequently rises by 7.3% and Ford’s stock price rises by 7%, what is the abnormal change in Ford’s stock price? (Negative value should be indicated by a minus sign. Do not round intermediate calculations. Round your answer to 2 decimal places.).You’ve observed the following returns on Yasmin Corporation’s stock over the past five years: 15 percent, –6 percent, 18 percent, 14 percent, and 10 percent. a. What was the arithmetic average return on the company's stock over this five-year period? (Do not round intermediate calculations. Enter your answer as a percent rounded to 1 decimal place, e.g., 32.1.) Average return % b-1 What was the variance of the company's stock returns over this period? (Do not round intermediate calculations and round your answer to 5 decimal places, e.g., 32.16161.) Variance b-2 What was the standard deviation of the company's stock returns over this period? (Do not round intermediate calculations. Enter your answer as a percent rounded to 2 decimal places, e.g., 32.16.) Standard deviation %A company has a beta of 1.4, the T-bill rate is 2.09%, and the expected return on the market is 9.02%. What is its required rate of return? Do not round your intermediate calculations. Express as a percent rounded to two decimal places.