Coefficient of variation of Which project has a lower absoute risk level which project project would you advise the firm to choose? Explain your answers h a lower relative rik level which

Coefficient of variation of Which project has a lower absoute risk level which project project would you advise the firm to choose? Explain your answers h a lower relative rik level which

Chapter11: Capital Budgeting And Risk

Section: Chapter Questions

Problem 4P

Related questions

Question

!

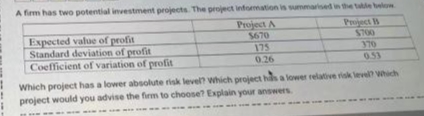

Transcribed Image Text:A firm has two potential investment projects. The project information is summarised in the tale below

Project A

$670

175

0.26

Project B

$700

Expected value of profit

Standard deviation of profit

Coefficient of variation of profit

370

0.53

Which project has a lower absolute risk level? which project has a lower relative risk level? Which

project would you advise the firm to choose? Explain your answers

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub