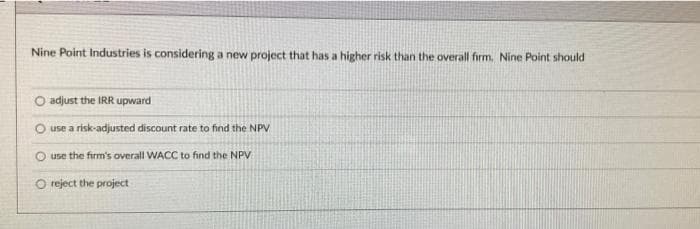

Nine Point Industries is considering a new project that has a higher risk than the overall firm. Nine Point should O adjust the IRR upward use a risk-adjusted discount rate to find the NPV use the firm's overall WACC to find the NPV O reject the project

Q: According to the M&M propositions, in a perfect market which of the following statements is true?

A: The Modigliani and miller approach can be used for the dividend decision. This approach is an…

Q: The general decision rule in Internal Rate of Return (IRR) is; Group of answer choices Accept…

A: solution concept If the IRR is greater than the cost of capital the project shall be accepted If the…

Q: Your firm is considering what has been estimated to be a positive NPV project (NPV > 0). What can…

A: Net present value is the different between present value of the cash outflows and present value of…

Q: ND Inc. is considering Projects S and L, whose cash flows are shown below. These projects are…

A: There are various techniques that are used by the management in order to select the most beneficial…

Q: What is the expected value of the outcomes?

A: Expected income is also called the expected return. It is the profit or loss expected to be…

Q: Expected value of profit Standard deviation of profit Coefficient of variation of profit Project A…

A: Standard deviation is absolute measure of risk. Higher the standard deviation, higher the risk.…

Q: If a firm uses its weighted average cost of capital (WACC) as the discount rate for all of the…

A: I. Because in case WACC calculation we only consider cost of debt, tax benefit , cost of equity and…

Q: Consider the following two statements concerning risk analysis: 1. Sensitivity analysis provides…

A: CAPM: CAPM model is tool of calculating risk adjusting discount rate. In this model, risk free rate…

Q: Manipulating CAPM Use the basic equation for the capital asset pricing model (CAPM) to work each of…

A: Hi! Thank you for the question, As per the honor code, we are allowed to answer three sub-parts at…

Q: Required: 1. Compute the net present value of Project A. (Enter negative values with a minus sign.…

A: Net present value (NPV) of an alternative/project refers to the variance between the initial…

Q: Suppose an investor is appraising an investment under the following conditions: a. Pi 0.15 Forecast…

A: Since multiple questions are asked , we will answer 1st question for you as per prescribed…

Q: Your firm is considering what has been estimated to be a positive NPV project (NPV > 0). What can…

A: Net Present Value (NPV) is based on the time value of money and is calculated as the sum of present…

Q: a. What price should Vencap offer for the investment opportunity if it requires a 9.9% return on…

A: Market price of the share when multiplied with the number of shares acquired by the company gives…

Q: Which of the following is correct about the security market line (SML)? Investment projects that…

A: Security market line is the graphical representation of the values of stock against the risk…

Q: There Is no correlation between net present value and Internal rate of return. A project with a…

A: Net present value that is NPV difference between present value of cash flow and initial investment.…

Q: Let A and B be two risky assets. If you choose A, you will get 64TL by 30% chance, or 1TL by 70%…

A: A decision tree is done to choose between a many decisions with a expected outcome on average.…

Q: Consider the following two statements concerning risk analysis: 1. Sensitivity analysis provides…

A: Risk analysis is defined as the identification as well as analysis process of the potential issues,…

Q: Coefficient of variation of Which project has a lower absoute risk level which project project would…

A: Standard Deviation: It is a measure of absolute risk for the investment. Greater the standard…

Q: select all that applies) Group of answer choices a) will never make an investment with a risk-free…

A: risk loving person who are seeking to take additional risky order to earn higher returns as well as…

Q: Which of the following best explains the limitations of using WACC as a discount rate for evaluating…

A: Thanks for the Question: Bartleby's Guideline “Since you have asked multiple question, we will solve…

Q: If you have a project combined with above-average market risk, which one of the following decisions…

A: WACC is the average rate cost of capital calculated by multiplying the cost of funds by its weight.…

Q: Which of the following will NOT increase the value of a real (call) option?

A: The following does not increase the value of the real (call) option: An increase in the probability…

Q: Dupont Chemicals is considering Projects S and L whose cash flows are shown below. These projects…

A: We will have to use the two main capital budgeting tools here. The two main tools of capital…

Q: Consider the following two statements concerning risk analysis: 1. Sensitivity analysis provides…

A: Risk analysis is referred as the process of analyzing as well as identifying the potential issues,…

Q: Companies often have to increase their initial investment costs to obtain real options. Whymight…

A: The company spends huge capital on the projects that will add value to the organization but if the…

Q: How would you rank the following alternative risky investment projects? Explain your answer…

A: Investment decision refers to the decisions taken by either potential investors or existing…

Q: A firm would accept a project with a net present value of zero because Select one: a. the return on…

A: Net Present value is used to take capital budgeting decisions i.e. whether the project should be…

Q: Tesar Chemicals is considering Projects S and L, whose cash flows are shown below. These projects…

A: IRR of Project S and L are: IRR of Project S is higher than Project L.

Q: Alternate & Co is attempting to choose the best of two alternatives asset investment A and B, each…

A: Note: Since we only answer up to 3 sub-parts, we’ll answer the first 3. Please resubmit the question…

Q: Which of the following is FALSE regarding scenario analysis? Scenario analysis ignores…

A: Financial analysis is the process of determining the economic and financial attractiveness of a…

Q: Your opinion is that CSCO has an expected rate of return of 0.1375. It has a beta of 1.3. The…

A: Given, CSCO Expected rate of return = 0.1375 Beta = 1.3 Risk Free Rate = 0.04 Market expected…

Q: Indicate whether its True or False. Then write the explanation! The twin advantages with using…

A: Capital budgeting techniques are used to determine whether the investment should be undertaken or…

Q: Treynor Industries is investing in a new project. The minimum rate of return the firm requires on…

A: INVESTING IS SIMPLY PUTTING YOUR MONEY IN SOME FINANCIAL SCHEME , SHARES OR PROPERTY ETC

Q: Should companies bid for a project with a price under the "project bid price"? No, this will not…

A: The project bid price is the final price of the project which the buyer is willing to pay.…

Q: An increase in the market risk premium will generally make the security market line steeper O reduce…

A: Instead of holding the risk-free assets, the additional return which the investors receive for…

Q: If a firm is planning for an international project, the manager should understand that the project's…

A: NPV refers to net present value. It is calculated by discounting all cash inflows and cash outflows.…

Q: Rank the following risky investment projects based on stochastic dominance. Project P Payoff…

A: Risk is defined as an uncertain outcome that differs from the expected outcome. It includes the…

Q: he project is accepted Select one: a. None of the option b. If the profitability index is negative…

A: The profitability index is defined as the profit investment ratio (PIR) or value investment ratio…

Q: a. Suppose an investor is appraising an investment under the following conditions: Forecast NPV Pi…

A: Given: Forecast Pi NPV 1 0.15 $30,000.00 2 0.15 $20,000.00 3 0.5 $15,000.00 4 0.2…

Q: O One can use the IRR rule for investment decision making without knowing the discount rate O The…

A: Question 2: The concerned question belongs to Time value of money where different methoda are used…

Q: A firm is considering what has been estimated to be a positive NPV project (NPV > 0). What can you…

A: The capital budgeting decision depends upon the cash inflow and outflow of the projects. The project…

Q: rojects. The ihta Tal fates of return are as folloWS: Internal Rate Project of Return 11 12% 15 13…

A: IRR is the rate at which Present value of cash Inflows is equal to Present Value of cash Outflows.…

Q: What Suppose your organization is deciding which of four projects to bid on. Information on each is…

A: Expected monetary value is the expected return that can be made from a business or investment…

F3

Step by step

Solved in 2 steps

- Which of the following statements is correct? a. Since investors prefer more return and less risk, one will never hold a dominated asset in the risk-return sense. In other words, if asset A has a higher expected return and lower standard-deviation than asset B, then investors would only hold asset A in their optimal portfolio. b. The IRR method correctly ranks mutually exclusive projects. c. When an investment project is evaluated today, the spending that occurred in the last year has to be included in the NPV analysis. d. The payback period criterion properly considers the time value of money. e. When there are two mutually exclusive projects, the project with the highest NPV should be chosen.Suppose a firm uses the WACC as the single hurdle rate in determining the value of capital budgeting projects rather than using risk adjusted hurdle rates. Choose the statement that actually completes the sentence describing the possible outcomes for the firm: the firm will tend to Accept profitable, low risk projects and reject unprofitable, high risk projects Accept profitable, low risk projects and accept unprofitable, high risk projects Reject profitable, low risk projects and reject unprofitable high risk projects Become less risky overtime Reject profitable, low risk projects and accept unprofitable, high risk projectsWSP Inc. is involved in a wide range of unrelated projects. The company will pursue any project that it thinks will create value for its stockholders. Consequently, the risk level of the company’s projects tends to vary a great deal from project to project. If WSP Inc. does not risk-adjust its discount rate for specific projects properly, which of the following is likely to occur over time? Check all that apply. The firm will increase in value. The firm’s overall risk level will increase. The firm could potentially reject projects that provide a higher rate of return than the company should require. When a project involves an entirely new product line, the firm may be able to obtain betas from to calculate a weighted average cost of capital (WACC) for its new product line. Consider the case of another company. Chrome Printing is evaluating two mutually exclusive projects. They both require a $1 million investment today and have expected NPVs of…

- Wolseley manufacturing Co. invests in a group of risky projects, which increases the unsystematic risk of the firm, but does not change the systematic risk of the firm. All else the same, the expected risk premium on its common stock is most likely to: Select one: a. Increase, because the difference between the expected return on the firm's stock and the risk-free rate will widen. b. Increase or decrease, depending on the internal rate of return of the new projects. c. Decrease, because the difference between the expected return on the firm's stock and the risk-free rate will widen. d. Decrease, because the difference between the expected return on the firm's stock and the risk-free rate will narrow. e. Remain unchanged, because the level of systematic risk is unchanged.Financial advisors generally recommend that their clients allocate more to higher risk–return asset classes (like equities) if their investment horizons are long. Is this advice consistent with the basic M-V model? Does adding a shortfall constraint to the M-V model make a difference? If so, how? If not, why not? Assuming investment opportunities change over time, what type of asset return behavior would justify this advice within the M-V framework?If you could only have one piece of information to help you understand the discount rate for evaluating a project at hand, which of the following would you prefer? The project has different systematic risk than the firm overall. Group of answer choices How the project's expected cash flows are effected by the overall economy The firm's credit rating The firm's cost of equity The firm's WACC

- ND Inc. is considering Projects S and L, whose cash flows are shown below. These projects are mutually exclusive, equally risky, and not repeatable. The CEO believes the IRR is the best selection criterion, while the CFO advocates other methods. If the decision is made by choosing the project with the higher IRR, how much, if any, value will be forgone, i.e., what's the NPV and IRR of the chosen project(s). What is the Payback period and discounted payback period?Suppose a firm uses a constant WACC in determining the value of capital budgeting projects rather than using a project beta. The firm will tend to A. accept profitable, low risk projects and reject unprofitable, high risk projects B. accept profitable, low risk projects and accept unprofitable, high risk projects C. reject profitable, low risk projects and accept unprofitable, high risk projects D. reject profitable , low risk projects and reject unprofitable, high risk projectsIf the net present value (NPV) of a project is negative: Group of answer choices accepting the project will decrease the value of the firm. the project is acceptable. the project's discounted payback period is shorter than the useful life of the project. the internal rate of return is high than the firm's required rate of return.

- Which of the following will NOT increase the value of a real (call) option? Group of answer choices: A decrease in the probability that a competitor will enter the market of the project in question. An increase in the risk-free rate A decrease in the cost of obtaining the real option Lengthening the time in which a real option must be exercised. A decrease in the volatility of the underlying source of risk.If a firm uses its weighted average cost of capital (WACC) as the discount rate for all of the projects it undertakes then the firm will tend to: I. reject some positive net present value projects. II. accept some negative net present value projects. III. favor low risk projects over high risk projects. IV. increase its overall level of risk over time. Group of answer choices I and III only III and IV only I, II, and III only I, II, and IV only I, II, III, and IVND Inc. is considering Projects S and L, whose cash flows are shown below. These projects are mutually exclusive, equally risky, and not repeatable. The CEO believes the IRR is the best selection criterion, while the CFO advocates other methods. If the decision is made by choosing the project with the higher IRR, how much, if any, value will be forgone, i.e., what's the Profitability index? Discuss your results of these methods and make a recommendation on the projects to the CEO about which one to go for and why?