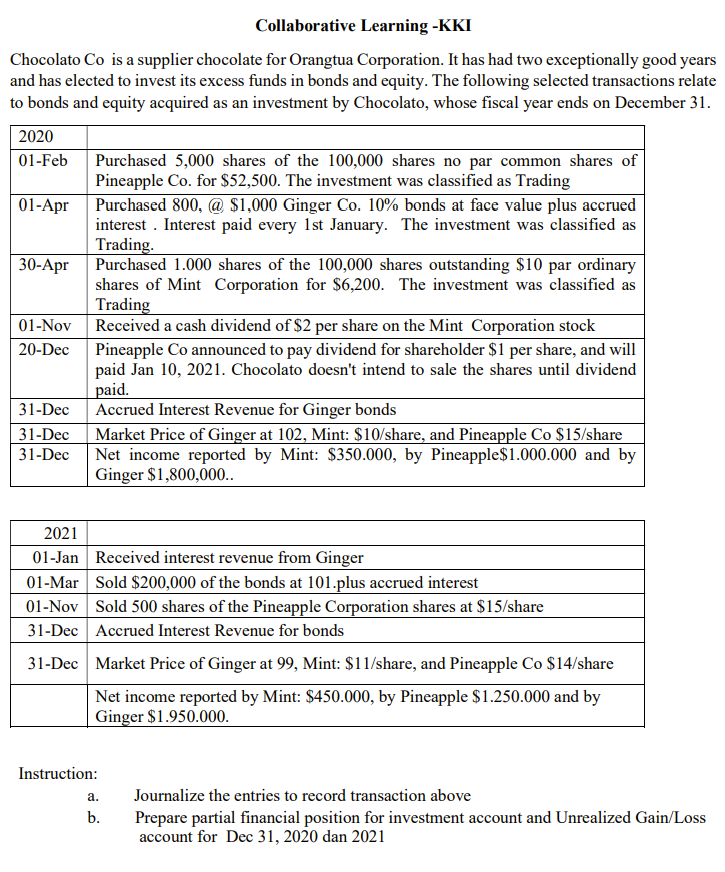

Collaborative Learning -KKI Chocolato Co is a supplier chocolate for Orangtua Corporation. It has had two exceptionally good years and has elected to invest its excess funds in bonds and equity. The following selected transactions relate to bonds and equity acquired as an investment by Chocolato, whose fiscal year ends on December 31. 2020 01-Feb Purchased 5,000 shares of the 100,000 shares no par common shares of Pineapple Co. for $52,500. The investment was classified as Trading Purchased 800, @ $1,000 Ginger Co. 10% bonds at face value plus accrued interest . Interest paid every 1st January. The investment was classified as Trading. Purchased 1.000 shares of the 100,000 shares outstanding $10 par ordinary shares of Mint Corporation for $6,200. The investment was classified as Trading 01-Apr 30-Apr | 01-Nov Received a cash dividend of $2 per share on the Mint Corporation stock 20-Dec Pineapple Co announced to pay dividend for shareholder $1 per share, and will paid Jan 10, 2021. Chocolato doesn't intend to sale the shares until dividend paid. Accrued Interest Revenue for Ginger bonds Market Price of Ginger at 102, Mint: $10/share, and Pineapple Co $15/share Net income reported by Mint: $350.000, by Pineapple$1.000.000 and by Ginger $1,800,000.. 31-Dec 31-Dec 31-Dec 2021 01-Jan Received interest revenue from Ginger 01-Mar Sold $200,000 of the bonds at 101.plus accrued interest 01-Nov Sold 500 shares of the Pineapple Corporation shares at $15/share 31-Dec Accrued Interest Revenue for bonds 31-Dec Market Price of Ginger at 99, Mint: $11/share, and Pineapple Co $14/share Net income reported by Mint: $450.000, by Pineapple $1.250.000 and by Ginger $1.950.000. Instruction: а. Journalize the entries to record transaction above b. Prepare partial financial position for investment account and Unrealized Gain/Loss account for Dec 31, 2020 dan 2021

Collaborative Learning -KKI Chocolato Co is a supplier chocolate for Orangtua Corporation. It has had two exceptionally good years and has elected to invest its excess funds in bonds and equity. The following selected transactions relate to bonds and equity acquired as an investment by Chocolato, whose fiscal year ends on December 31. 2020 01-Feb Purchased 5,000 shares of the 100,000 shares no par common shares of Pineapple Co. for $52,500. The investment was classified as Trading Purchased 800, @ $1,000 Ginger Co. 10% bonds at face value plus accrued interest . Interest paid every 1st January. The investment was classified as Trading. Purchased 1.000 shares of the 100,000 shares outstanding $10 par ordinary shares of Mint Corporation for $6,200. The investment was classified as Trading 01-Apr 30-Apr | 01-Nov Received a cash dividend of $2 per share on the Mint Corporation stock 20-Dec Pineapple Co announced to pay dividend for shareholder $1 per share, and will paid Jan 10, 2021. Chocolato doesn't intend to sale the shares until dividend paid. Accrued Interest Revenue for Ginger bonds Market Price of Ginger at 102, Mint: $10/share, and Pineapple Co $15/share Net income reported by Mint: $350.000, by Pineapple$1.000.000 and by Ginger $1,800,000.. 31-Dec 31-Dec 31-Dec 2021 01-Jan Received interest revenue from Ginger 01-Mar Sold $200,000 of the bonds at 101.plus accrued interest 01-Nov Sold 500 shares of the Pineapple Corporation shares at $15/share 31-Dec Accrued Interest Revenue for bonds 31-Dec Market Price of Ginger at 99, Mint: $11/share, and Pineapple Co $14/share Net income reported by Mint: $450.000, by Pineapple $1.250.000 and by Ginger $1.950.000. Instruction: а. Journalize the entries to record transaction above b. Prepare partial financial position for investment account and Unrealized Gain/Loss account for Dec 31, 2020 dan 2021

Chapter1: Financial Statements And Business Decisions

Section: Chapter Questions

Problem 1Q

Related questions

Question

Transcribed Image Text:Collaborative Learning -KKI

Chocolato Co is a supplier chocolate for Orangtua Corporation. It has had two exceptionally good years

and has elected to invest its excess funds in bonds and equity. The following selected transactions relate

to bonds and equity acquired as an investment by Chocolato, whose fiscal year ends on December 31.

2020

01-Feb

Purchased 5,000 shares of the 100,000 shares no par common shares of

Pineapple Co. for $52,500. The investment was classified as Trading

01-Apr Purchased 800, @ $1,000 Ginger Co. 10% bonds at face value plus accrued

interest . Interest paid every 1st January. The investment was classified as

Trading.

30-Apr Purchased 1.000 shares of the 100,000 shares outstanding $10 par ordinary

shares of Mint Corporation for $6,200. The investment was classified as

Trading

01-Nov Received a cash dividend of $2 per share on the Mint Corporation stock

20-Dec Pineapple Co announced to pay dividend for shareholder $1 per share, and will

paid Jan 10, 2021. Chocolato doesn't intend to sale the shares until dividend

paid.

Accrued Interest Revenue for Ginger bonds

Market Price of Ginger at 102, Mint: $10/share, and Pineapple Co $15/share

Net income reported by Mint: $350.000, by Pineapple$1.000.000 and by

Ginger $1,800,000..

31-Dec

31-Dec

31-Dec

2021

01-Jan Received interest revenue from Ginger

01-Mar Sold $200,000 of the bonds at 101.plus accrued interest

01-Nov Sold 500 shares of the Pineapple Corporation shares at $15/share

31-Dec Accrued Interest Revenue for bonds

31-Dec Market Price of Ginger at 99, Mint: $11/share, and Pineapple Co $14/share

|Net income reported by Mint: $450.000, by Pineapple $1.250.000 and by

Ginger $1.950.000.

Instruction:

а.

Journalize the entries to record transaction above

b.

Prepare partial financial position for investment account and Unrealized Gain/Loss

account for Dec 31, 2020 dan 2021

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 3 steps with 3 images

Recommended textbooks for you

Accounting

Accounting

ISBN:

9781337272094

Author:

WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:

Cengage Learning,

Accounting Information Systems

Accounting

ISBN:

9781337619202

Author:

Hall, James A.

Publisher:

Cengage Learning,

Accounting

Accounting

ISBN:

9781337272094

Author:

WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:

Cengage Learning,

Accounting Information Systems

Accounting

ISBN:

9781337619202

Author:

Hall, James A.

Publisher:

Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis…

Accounting

ISBN:

9780134475585

Author:

Srikant M. Datar, Madhav V. Rajan

Publisher:

PEARSON

Intermediate Accounting

Accounting

ISBN:

9781259722660

Author:

J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:

McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:

9781259726705

Author:

John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:

McGraw-Hill Education