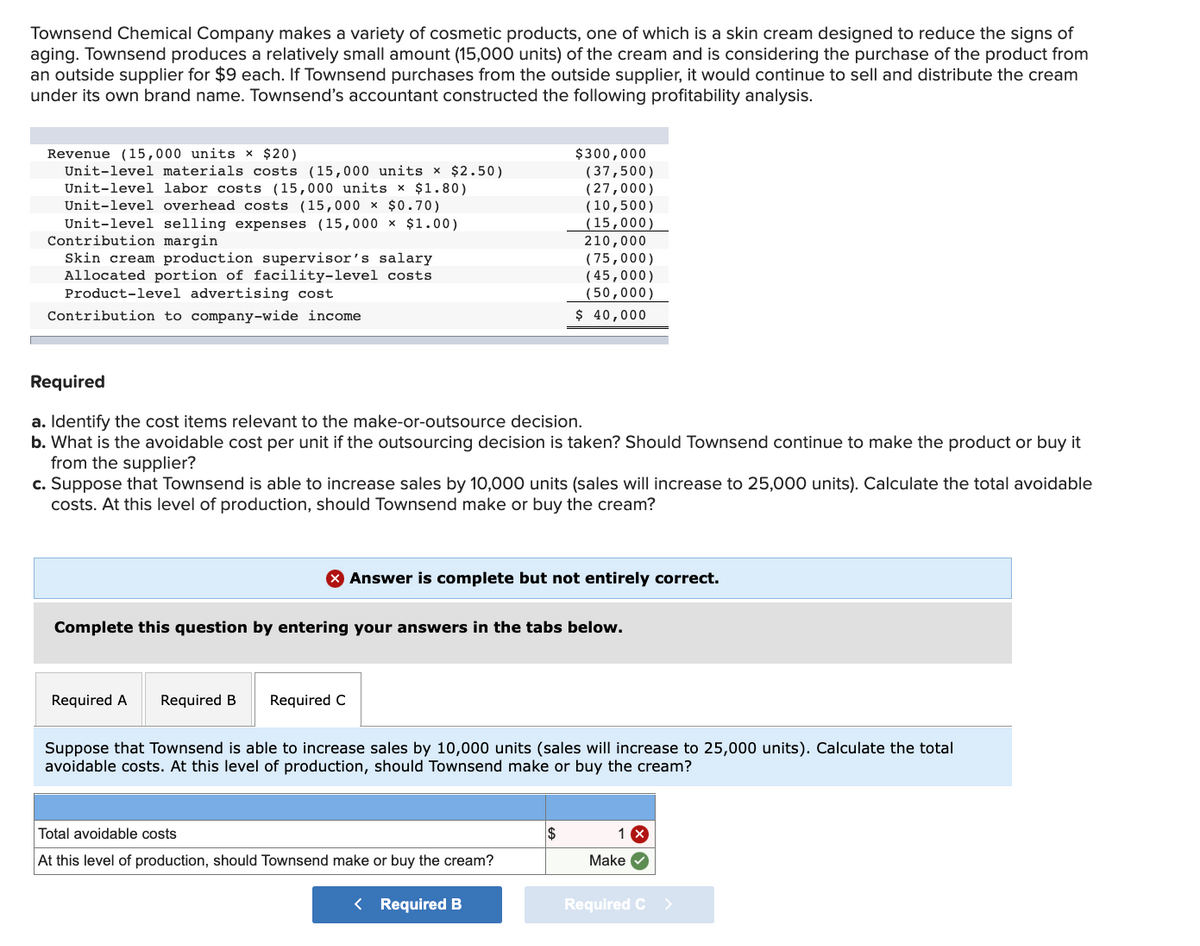

Townsend Chemical Company makes a variety of cosmetic products, one of which is a skin cream designed to reduce the signs of aging. Townsend produces a relatively small amount (15,000 units) of the cream and is considering the purchase of the product from an outside supplier for $9 each. If Townsend purchases from the outside supplier, it would continue to sell and distribute the cream under its own brand name. Townsend's accountant constructed the following profitability analysis. $300,000 (37,500) (27,000) (10,500) |(15,000) 210,000 (75,000) (45,000) (50,000) Revenue (15,000 units x $20) Unit-level materials costs (15,000 units x $2.50) Unit-level labor costs (15,000 units × $1.80) Unit-level overhead costs (15, 000 x $0.70) Unit-level selling expenses (15,000 × $1.00) Contribution margin Skin cream production supervisor's salary Allocated portion of facility-level costs Product-level advertising cost Contribution to company-wide income $ 40,000 Required a. Identify the cost items relevant to the make-or-outsource decision. b. What is the avoidable cost per unit if the outsourcing decision is taken? Should Townsend continue to make the product or buy it from the supplier? c. Suppose that Townsend is able to increase sales by 10,000 units (sales will increase to 25,000 units). Calculate the total avoidable costs. At this level of production, should Townsend make or buy the cream?

Townsend Chemical Company makes a variety of cosmetic products, one of which is a skin cream designed to reduce the signs of aging. Townsend produces a relatively small amount (15,000 units) of the cream and is considering the purchase of the product from an outside supplier for $9 each. If Townsend purchases from the outside supplier, it would continue to sell and distribute the cream under its own brand name. Townsend's accountant constructed the following profitability analysis. $300,000 (37,500) (27,000) (10,500) |(15,000) 210,000 (75,000) (45,000) (50,000) Revenue (15,000 units x $20) Unit-level materials costs (15,000 units x $2.50) Unit-level labor costs (15,000 units × $1.80) Unit-level overhead costs (15, 000 x $0.70) Unit-level selling expenses (15,000 × $1.00) Contribution margin Skin cream production supervisor's salary Allocated portion of facility-level costs Product-level advertising cost Contribution to company-wide income $ 40,000 Required a. Identify the cost items relevant to the make-or-outsource decision. b. What is the avoidable cost per unit if the outsourcing decision is taken? Should Townsend continue to make the product or buy it from the supplier? c. Suppose that Townsend is able to increase sales by 10,000 units (sales will increase to 25,000 units). Calculate the total avoidable costs. At this level of production, should Townsend make or buy the cream?

Managerial Accounting

15th Edition

ISBN:9781337912020

Author:Carl Warren, Ph.d. Cma William B. Tayler

Publisher:Carl Warren, Ph.d. Cma William B. Tayler

Chapter11: Differential Analysis And Product Pricing

Section: Chapter Questions

Problem 2CMA

Related questions

Question

100%

Transcribed Image Text:Townsend Chemical Company makes a variety of cosmetic products, one of which is a skin cream designed to reduce the signs of

aging. Townsend produces a relatively small amount (15,000 units) of the cream and is considering the purchase of the product from

an outside supplier for $9 each. If Townsend purchases from the outside supplier, it would continue to sell and distribute the cream

under its own brand name. Townsend's accountant constructed the following profitability analysis.

Revenue (15,000 units x $20)

Unit-level materials costs (15,000 units x $2.50)

Unit-level labor costs (15,000 units x $1.80)

Unit-level overhead costs (15,000 × $0.70)

Unit-level selling expenses (15,000 × $1.00)

Contribution margin

Skin cream production supervisor's salary

Allocated portion of facility-level costs

Product-level advertising cost

$300,000

(37,500)

(27,000)

(10,500)

(15,000)

210,000

( 75,000)

( 45,000)

(50,000)

$ 40,000

Contribution to company-wide income

Required

a. Identify the cost items relevant to the make-or-outsource decision.

b. What is the avoidable cost per unit if the outsourcing decision is taken? Should Townsend continue to make the product or buy it

from the supplier?

c. Suppose that Townsend is able to increase sales by 10,000 units (sales will increase to 25,000 units). Calculate the total avoidable

costs. At this level of production, should Townsend make or buy the cream?

Answer is complete but not entirely correct.

Complete this question by entering your answers in the tabs below.

Required A

Required B

Required C

Suppose that Townsend is able to increase sales by 10,000 units (sales will increase to 25,000 units). Calculate the total

avoidable costs. At this level of production, should Townsend make or buy the cream?

Total avoidable costs

1 X

At this level of production, should Townsend make or buy the cream?

Make

< Required B

Required C >

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

Excel Applications for Accounting Principles

Accounting

ISBN:

9781111581565

Author:

Gaylord N. Smith

Publisher:

Cengage Learning

Principles of Cost Accounting

Accounting

ISBN:

9781305087408

Author:

Edward J. Vanderbeck, Maria R. Mitchell

Publisher:

Cengage Learning