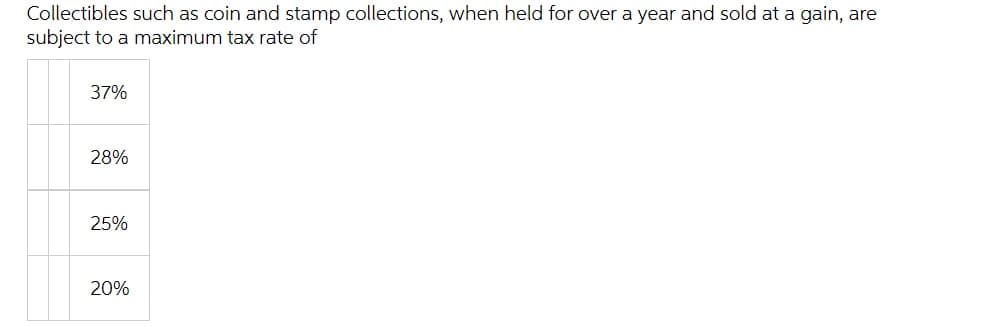

Collectibles such as coin and stamp collections, when held for over a year and sold at a gain, are subject to a maximum tax rate of 37% 28% 25% 200

Q: Standard and actual costs for direct materials for the manufacture of 1,000 units of product were as…

A: Introduction: The main goal of variance analysis is to identify differences between expected and…

Q: What is different than traditional costing that uses a volume-based driver? Can you give me some…

A: There are many different types of costing methods, out of which the selection of costing method to…

Q: Robert corporation purchased some equipment by issuing $20.000 non interest bearing, four year note…

A: When any assets is purchased by issuing notes Payable at discount then purchaser record following…

Q: Chris has to decide between 2 SME's who want to assist in his project. Vendor 1 has a 30% chance of…

A: When you consider an alternative there are various probabilities of gaining or losing, the mean…

Q: 11. Stanley invests $500 into an account that earns 9%p.a. compounding monthly. At the start of each…

A: Stanley Invests $500 into the account The compounding Interest rate is 9% Start of each new month,…

Q: Required: 1. Prepare an amortization schedule for the Jagd showing only 2020 and 2021. (Enter all…

A: Company has purchased bonds whose coupon rate is 7.5% has been purchased for $409,686 but the face…

Q: simplify this

A: Traditional costing and activity based cost in our one of the most widely use technique in order to…

Q: 2018 2019 2020 2021 (a) 2018 $131.000 97,000 (306,000) 223.000 The tax rates listed were all enacted…

A: Deffered Tax Assets :— A deferred tax asset is an asset to the Company that usually arises when the…

Q: Required: a. Complete the income statements for both divisions and the corporation as a whole.…

A: The income or money that a business enterprise derives from its business activities is called…

Q: calculate pension expense b) calculate net defined obligation liability/asset surplus or deficit.

A: The employee benefit expenses will be computed as per IAS 19. ie all the cost associated with…

Q: Accounting Question #1 Famzy Corp. borrowed $600,000 in the form of a mortgage on February 1, 2022,…

A: In the context of the given question, we are required to prepare the journal entries in the books of…

Q: The following information was extracted from the book of XY Ltd for the year 30 September 2016.…

A: Financial Statement - Financial statements include information about the financial activity and…

Q: ● ● 1. If the variable cost is P15/unit, fixed cost is 265,000; and Sales is P55. Find the BEPs, and…

A: Break Even Point :— It is the point where there is no profit or no loss. It is point where profit is…

Q: Which one of the following statements is correct? Select one: a. The net change in the…

A: Consolidated Financial statement :— The Grouping of Financial statement by the Parent Company along…

Q: Two years ago, Bethesda Corporation bought a delivery truck for $30,000 (not subject to the luxury…

A: Recognized gain/loss $ 20,500 Character of recognized gain or loss:- Ordinary…

Q: why would it be wise for a financial manager to learn advanced capital budgeting techniques?

A: Capital budgeting is a technique to evaluate various investment opportunities. Capital budgeting…

Q: 5. As a result of a more intense effort by sales people, sales are increased by 10%; operating…

A: 1. The Margin, Turnover and ROI is calculated without considering the adjustments. 2. The above is…

Q: When AAA Company filed for liquidation with the Securities and Exchange Commission, it prepared the…

A: Introduction: A person or organization that loaned money without needing specific assets as…

Q: QUESTION 51) Kathy and Annise are a married couple who file jointly. In the current year, they have…

A: The adjusted gross income is reached making after an adjustment in the gross income. The adjusted…

Q: Compute Rome’s regular hourly and overtime rates.

A: Sometimes Business Entities have shortage of time and they have to fulfill the given order within…

Q: Which of the following is a true statement with respect to FICA? Select one: a. W-2 employees and…

A: FICA is the Federal Insurance Contributions Act is what it is called, and it is taken out of every…

Q: Rick Hall owns a card shop, Hall's Cards. The following cash information is available for the month…

A: The bank reconciliation statement is prepared to recognize errors or omissions in the bank statement…

Q: C) Going back to the original data, the team speculates that they might be able to achieve…

A: The latest income statement of Carolina Manufacturing company is given to us. The income statement…

Q: Kross company purchases an equity investment in Penno Company at a purchase price of 5,000,000…

A: Equity Method of Accounting: Companies typically utilise the equity method of accounting to…

Q: Storage Washing Average gallons on hand Number of batches a. Calculate the activity rates it b.…

A: Activity Based Costing :— Activity-based costing is a costing method that identifies activities in…

Q: Aeldaentos Pte Ltd. has provided the following data for the month of April. There were no beginning…

A: The manufacturing overhead is said to be underapplied when actual overhead cost is more than the…

Q: The following list of accounts is taken from the December 31, 2020, unadjusted trial balance of…

A: Adjusting entries are those journal entries which are passed at the end of the period for accurate…

Q: Compute Stefani's total earnings for this semimonthly period.

A: Sometimes Business Entities have shortage of time and they have to fulfill the given order within…

Q: 13- If you are able to save $25000 in year 1, and amounts decreasing by 3% each year through year…

A: Future value is the value of a current Investment at a future date based on a certain interest rate.…

Q: At December 31, 2020, the following account balances were selected from the records of beverage…

A: Retained earnings is the amount of earnings accumulated over the period of time. Shareholders equity…

Q: Quality Motor Company is an auto repair shop that uses standards to control its labor time and labor…

A: Variance is difference between actual expenditure and standard expenditure or difference between…

Q: Cane Company manufactures two products called Alpha and Beta that sell for $155 and $115,…

A: Introduction:- Costs are classified into variable or fixed. Variable costs are vary in respect of…

Q: 11) On April 1, a company acquired equipment at the cost of $525,400. The equipment is expected to…

A: Depreciation is considered as an expense charge on the value of the Asset. It can be calculated by…

Q: A company's outstanding stock consists of 1,700 shares of cumulative 5% preferred stock with a $100…

A: Out of the profit earned by the business organizations, some of their profit is distributed to the…

Q: 6. What is the ROI related to this year’s investment opportunity? (Do not round intermediate…

A: Return of investment (ROI) stands for the Income, as a percentage of the Investment, that a Business…

Q: Steam Room Inc. (SRI) has 15,000 shares issued in total. Assume that on January 1, 2021, Omega…

A: When one company is holding shares in another company from 20% to 50% , then it is called as…

Q: The 7-year $1,000 par bonds of Vail Inc. pay 9% interest. The market’s required yield to maturity on…

A: Bond :— Bond are Debt instruments and represent Loans Make to the issuer. government and Corporate…

Q: Low Heel Trading's financial year ends on 30 June. The owner of the business, Nancy, provided the…

A: The journal entries are prepared to record the day-to-day transactions of the business on regular…

Q: Crane Company issued $1,730,000 of bonds on January 1, 2022. (a) Prepare the journal entry to record…

A: When bonds are redeemed at par, we will Credit Cash Account.

Q: May 1 Beginning inventory 150 units 5 Sale 100 units Purchase 50 units Purchase 200 units 200 units…

A: FIFO :— It is one of the method of inventory valuation, under this method it is assumed that first…

Q: EMSN Corp. purchased PPE on January 1, 2020 for $7,221,000. The production estimates the asset will…

A: Hi student Since there are multiple questions, we will answer only first question. Depreciation is…

Q: Beginning inventory, purchases, and sales for Item XJ-56 are as follows: May 1 Beginning…

A: LIFO is last in first out inventory costing or inventory system in which units which are purchased…

Q: Distribution center inventory (end-of-quarter): United states Canada Europe 497 45 19 53 5 34 20 9…

A: Inventory Turn over Ratio :— Inventory turnover is a financial ratio showing how many times a…

Q: strategy for accounrting firm to adopt digital transformation

A: Firms must get over their reservations about the digital, cloud-based world of today. The more…

Q: Requirement 7. Calculate the following ratios as of January 31, 2025 for Milton Delivery Service:…

A: Return on Assets: Return on assets (ROA), which is often referred to as return on total assets, is a…

Q: The standard price of materials is $4.6 per pound and the standard quantity allowed for actual…

A: The variance is the difference between actual data and standard data of production. Direct materials…

Q: Sanchez Trucking has been experiencing delays at its warehouse operations. Management hired a…

A: 1. total hours per crew = no of members in a crew x full time hours per member 2. required crews =…

Q: Which of the following would be considered a negative indicator when conducting a financial…

A: Financial analysis: Financial analysis is the process of evaluating finance-related transactions of…

Q: Avila Co. sold $10,000 of merchandise to Beasley Corp. on account with terms of 1/10, n/30. The…

A: Note: 1/10, n/30: Here, 1 represents the discount rate if payment is made within ten days. And if…

Q: Skinner Corp. required additional cash for its operation and used its accounts receivable to raise…

A: "Since you have posted a question with multiple subparts, we will solve the first three subparts for…

Step by step

Solved in 3 steps

- Trade receivables have a carrying amount of P4,000. The related revenue has already been included in taxable profit (tax loss). How much is the tax base of the asset? The tax rate is 40%.12. The records for Ivanhoe Co. show this data for 2021: ● Gross profit on installment sales recorded on the books was $350,000. Gross profit from collections of installment receivables was $210,000. ● Life insurance on officers was $3,100. ● Machinery was acquired in January for $230,000. Straight-line depreciation over a ten-year life (no salvage value) is used. For tax purposes, MACRS depreciation is used and Ivanhoe may deduct 14% for 2021. ● Interest received on tax exempt Iowa State bonds was $8,300. ● The estimated warranty liability related to 2021 sales was $20,900. Repair costs under warranties during 2021 were $12,900. The remainder will be incurred in 2022. ● Pretax financial income is $530,000. The tax rate is 20%. (a) Prepare a schedule starting with pretax financial income and compute taxable income. (Enter negative amounts using either a negative sign preceding the number e.g. -45 or parentheses e.g. (45).) Schedule…10. Payments made for income taxes P760,000 Income tax payable increased by 200,000 Deferred tax liability, Jan. 1 360,000 Deferred tax liability, Dec. 31 470,000 Deferred tax asset, Jan. 1 85,000 Deferred tax asset, Dec. 31 65,000 Income tax expense under accrual basis accounting is a. 1,090,000 b. 960,000 c. 850,000 d. 830,000

- Company M uses the cost recovery method. During 19A, it sells goods with a cost of $15,000 for $25,000, payable in installments of $10,000, $10,000 and $5,000, respectively, beginning in 19A. How much profit should be recognized each year?UMPI’s end of year pretax financial income for 2018 was $720,000. Included in it was $40,000 in interest income on municipal bonds, warranty expense accrued for $15,000, a $25,000 fine for dumping hazardous waste, and depreciation of $40,000. Depreciation for tax purposes was $65,000. Their tax rate was 21%. Format the income tax expense section of the income statement, starting with “income before income taxes”.A company which started its operation in the year 8. The pannel set the MARR at 10% after-tax. CCA rate = 20% FOR EQUIPTMENT. a) What is the remaining Undepreciated Capital cost at the end of year 20 12? b) What is the equivalent annual worth of the tax savings associated with these transactions if the corporate tax rate is 40%?

- 14) The records for Ehrlich Co. show this data for 2021: Accrued revenue recorded on the books was $480,000. Revenue cash collections was $320,000. Life insurance on officers was $2,800. Fine for pollution violation was $1,000. Machinery was acquired in January for $300,000. Straight-line depreciation over a ten-year life (no salvage value) is used. For tax purposes, accelerated depreciation is used and Ehrlich may deduct 15% for 2021. Interest received on tax exempt Florida State bonds was $9,000. The estimated warranty liability related to 2021 sales was $23,000. Repair costs under warranties during 2021 were $12,000. Pretax financial income is $700,000. The tax rate is 25% for this and future years. Instructions (a) Prepare a schedule starting with pretax financial income and compute taxable income. (b) Prepare the journal entry to record income taxes for 2021. (c ) Show the income statement presentation of income tax expense, starting with "income before tax"Use the following information for Taco Swell, Incorporated, (assume the tax rate is 23 percent): 2020 2021 Sales $ 18,049 $ 18,858 Depreciation 2,406 2,514 Cost of goods sold 5,840 6,761 Other expenses 1,364 1,193 Interest 1,125 1,340 Cash 8,691 9,337 Accounts receivable 11,518 13,572 Short-term notes payable 1,704 1,671 Long-term debt 29,150 35,304 Net fixed assets 72,838 77,700 Accounts payable 6,287 6,730 Inventory 20,475 21,892 Dividends 2,129 2,344 For 2021, calculate the cash flow from assets, cash flow to creditors, and cash flow to stockholders. (A negative answer should be indicated by a minus sign. Do not round intermediate calculations and round your answers to 2 decimal places, e.g., 32.16.)The tax on $2,600 of profit on a capital asset is deferred. A person in a 40 percent tax bracket will have to pay what amount of taxes when the asset is sold? (Round your answer to the nearest whole number.)

- Corporation borrowed $80,000.00 at 11% compounded semi-annually for 14 years to buy a warehouse. Equal payments are made at the end of every 6 months. (a) Determine the size of the semi-annualpayments. (b) Compute the interest included in payment 9. (c) Determine the principal repaid in payment period 6. (d) Construct a partial amortization schedule showing details of the first three payments, the last three payments, and totals.The firm invests $1,000 today, and realizes after tax cashflows in the amounts of $110, $660, and $880 at the ends of years 1-3, respectively. WACC=10%. Find NPV.A man invested P110,000 for 31 days. The net interest after deducting 20%withholding tax is P890.36. Find the rate of return annually.· A. 11.50 %· B. 11.75 %· C. 11.95 %· D. 12.32 %