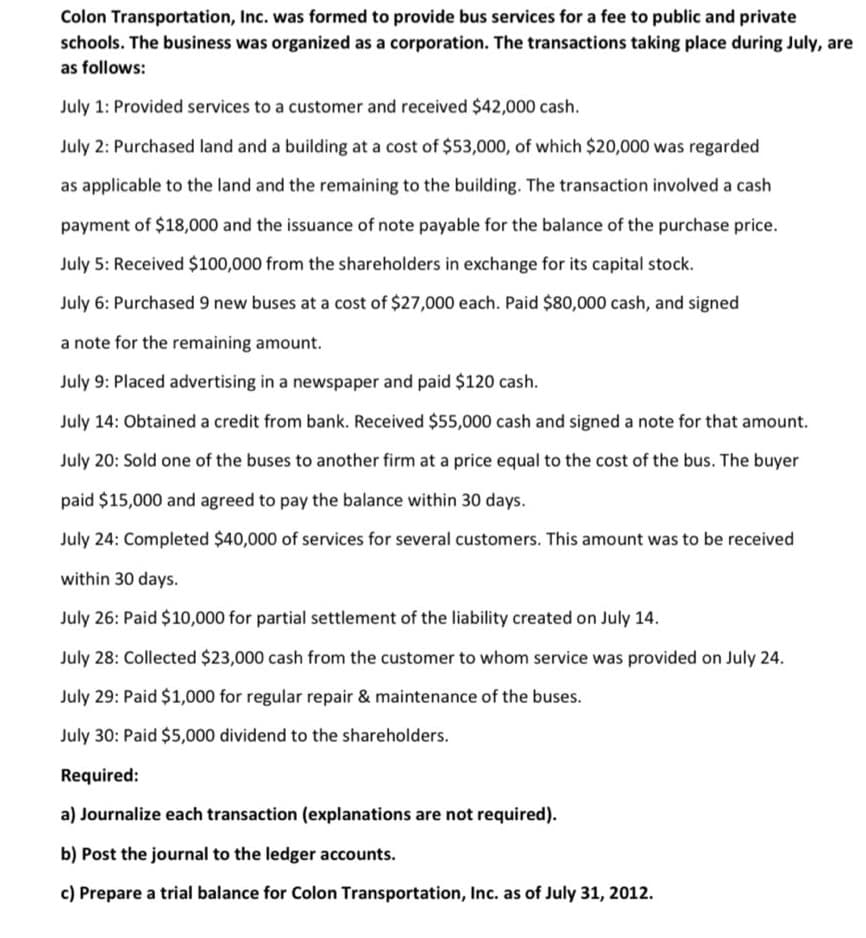

Colon Transportation, Inc. was formed to provide bus services for a fee to public and private schools. The business was organized as a corporation. The transactions taking place during July, are as follows: July 1: Provided services to a customer and received $42,000 cash. July 2: Purchased land and a building at a cost of $53,000, of which $20,000 was regarded as applicable to the land and the remaining to the building. The transaction involved a cash payment of $18,000 and the issuance of note payable for the balance of the purchase price. July 5: Received $100,000 from the shareholders in exchange for its capital stock. July 6: Purchased 9 new buses at a cost of $27,000 each. Paid $80,000 cash, and signed a note for the remaining amount. July 9: Placed advertising in a newspaper and paid $120 cash. July 14: Obtained a credit from bank. Received $55,000 cash and signed a note for that amount. July 20: Sold one of the buses to another firm at a price equal to the cost of the bus. The buyer paid $15,000 and agreed to pay the balance within 30 days. July 24: Completed $40,000 of services for several customers. This amount was to be received within 30 days. July 26: Paid $10,000 for partial settlement of the liability created on July 14. July 28: Collected $23,000 cash from the customer to whom service was provided on July 24. July 29: Paid $1,000 for regular repair & maintenance of the buses. July 30: Paid $5,000 dividend to the shareholders. Required: a) Journalize each transaction (explanations are not required). b) Post the journal to the ledger accounts. c) Prepare a trial balance for Colon Transportation, Inc. as of July 31, 2012.

Colon Transportation, Inc. was formed to provide bus services for a fee to public and private schools. The business was organized as a corporation. The transactions taking place during July, are as follows: July 1: Provided services to a customer and received $42,000 cash. July 2: Purchased land and a building at a cost of $53,000, of which $20,000 was regarded as applicable to the land and the remaining to the building. The transaction involved a cash payment of $18,000 and the issuance of note payable for the balance of the purchase price. July 5: Received $100,000 from the shareholders in exchange for its capital stock. July 6: Purchased 9 new buses at a cost of $27,000 each. Paid $80,000 cash, and signed a note for the remaining amount. July 9: Placed advertising in a newspaper and paid $120 cash. July 14: Obtained a credit from bank. Received $55,000 cash and signed a note for that amount. July 20: Sold one of the buses to another firm at a price equal to the cost of the bus. The buyer paid $15,000 and agreed to pay the balance within 30 days. July 24: Completed $40,000 of services for several customers. This amount was to be received within 30 days. July 26: Paid $10,000 for partial settlement of the liability created on July 14. July 28: Collected $23,000 cash from the customer to whom service was provided on July 24. July 29: Paid $1,000 for regular repair & maintenance of the buses. July 30: Paid $5,000 dividend to the shareholders. Required: a) Journalize each transaction (explanations are not required). b) Post the journal to the ledger accounts. c) Prepare a trial balance for Colon Transportation, Inc. as of July 31, 2012.

Chapter11: Long-term Assets

Section: Chapter Questions

Problem 5PB: Johnson, Incorporated, had the following transactions during the year: Purchased a building for...

Related questions

Question

Transcribed Image Text:Colon Transportation, Inc. was formed to provide bus services for a fee to public and private

schools. The business was organized as a corporation. The transactions taking place during July, are

as follows:

July 1: Provided services to a customer and received $42,000 cash.

July 2: Purchased land and a building at a cost of $53,000, of which $20,000 was regarded

as applicable to the land and the remaining to the building. The transaction involved a cash

payment of $18,000 and the issuance of note payable for the balance of the purchase price.

July 5: Received $100,000 from the shareholders in exchange for its capital stock.

July 6: Purchased 9 new buses at a cost of $27,000 each. Paid $80,000 cash, and signed

a note for the remaining amount.

July 9: Placed advertising in a newspaper and paid $120 cash.

July 14: Obtained a credit from bank. Received $55,000 cash and signed a note for that amount.

July 20: Sold one of the buses to another firm at a price equal to the cost of the bus. The buyer

paid $15,000 and agreed to pay the balance within 30 days.

July 24: Completed $40,000 of services for several customers. This amount was to be received

within 30 days.

July 26: Paid $10,000 for partial settlement of the liability created on July 14.

July 28: Collected $23,000 cash from the customer to whom service was provided on July 24.

July 29: Paid $1,000 for regular repair & maintenance of the buses.

July 30: Paid $5,000 dividend to the shareholders.

Required:

a) Journalize each transaction (explanations are not required).

b) Post the journal to the ledger accounts.

c) Prepare a trial balance for Colon Transportation, Inc. as of July 31, 2012.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 4 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781337280570

Author:

Scott, Cathy J.

Publisher:

South-Western College Pub

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781337280570

Author:

Scott, Cathy J.

Publisher:

South-Western College Pub