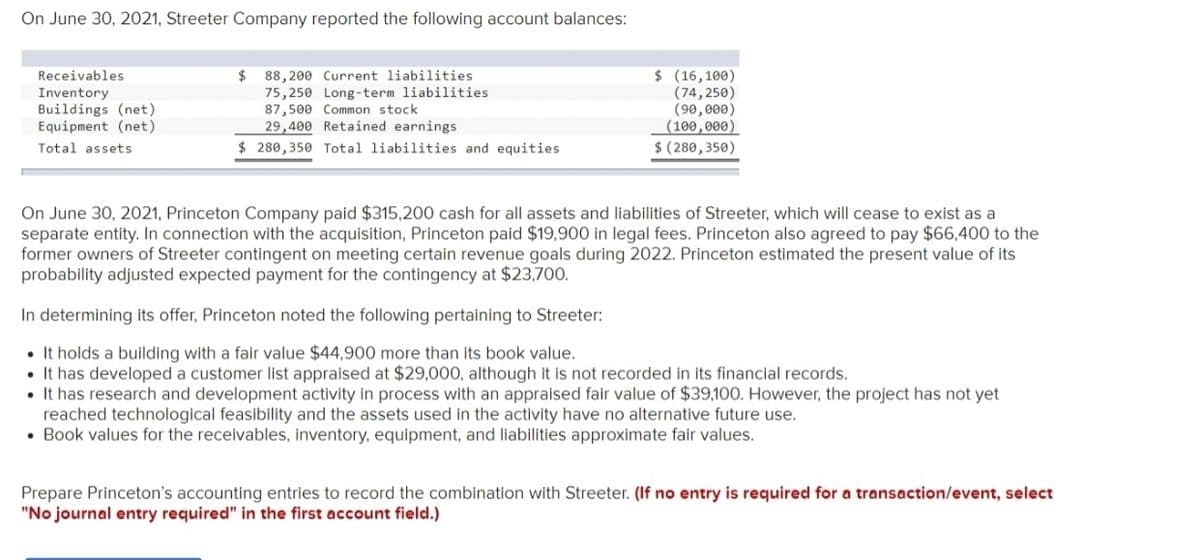

On June 30, 2021, Streeter Company reported the following account balances: $ (16,100) (74, 250) (90,000) (100,000) $ (280,350) Receivables 2$ Inventory Buildings (net) Equipment (net) 88,200 Current liabilities 75,250 Long-term liabilities 87,500 Common stock 29,400 Retained earnings $ 280,350 Total liabilities and equities Total assets On June 30, 2021, Princeton Company paid $315,200 cash for all assets and liabilities of Streeter, which will cease to exist as a separate entity. In connection with the acquisition, Princeton paid $19,900 in legal fees. Princeton also agreed to pay $66,400 to the former owners of Streeter contingent on meeting certain revenue goals during 2022. Princeton estimated the present value of its probability adjusted expected payment for the contingency at $23,700. In determining its offer, Princeton noted the following pertaining to Streeter: • It holds a building with a fair value $44,900 more than its book value. • It has developed a customer list appraised at $29,000, although it is not recorded in its financial records. • It has research and development activity in process with an appraised fair value of $39,100. However, the project has not yet reached technological feasibility and the assets used in the activity have no alternative future use. • Book values for the receivables, inventory, equipment, and liabilities approximate fair values. Prepare Princeton's accounting entries to record the combination with Streeter. (If no entry is required for a transaction/event, select "No journal entry required" in the first account field.)

On June 30, 2021, Streeter Company reported the following account balances: $ (16,100) (74, 250) (90,000) (100,000) $ (280,350) Receivables 2$ Inventory Buildings (net) Equipment (net) 88,200 Current liabilities 75,250 Long-term liabilities 87,500 Common stock 29,400 Retained earnings $ 280,350 Total liabilities and equities Total assets On June 30, 2021, Princeton Company paid $315,200 cash for all assets and liabilities of Streeter, which will cease to exist as a separate entity. In connection with the acquisition, Princeton paid $19,900 in legal fees. Princeton also agreed to pay $66,400 to the former owners of Streeter contingent on meeting certain revenue goals during 2022. Princeton estimated the present value of its probability adjusted expected payment for the contingency at $23,700. In determining its offer, Princeton noted the following pertaining to Streeter: • It holds a building with a fair value $44,900 more than its book value. • It has developed a customer list appraised at $29,000, although it is not recorded in its financial records. • It has research and development activity in process with an appraised fair value of $39,100. However, the project has not yet reached technological feasibility and the assets used in the activity have no alternative future use. • Book values for the receivables, inventory, equipment, and liabilities approximate fair values. Prepare Princeton's accounting entries to record the combination with Streeter. (If no entry is required for a transaction/event, select "No journal entry required" in the first account field.)

Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Chapter16: Retained Earnings And Earnings Per Share

Section: Chapter Questions

Problem 9P

Related questions

Topic Video

Question

Transcribed Image Text:On June 30, 2021, Streeter Company reported the following account balances:

$ (16,100)

(74, 250)

(90,000)

(100,000)

$ (280,350)

Receivables

2$

Inventory

Buildings (net)

Equipment (net)

88,200 Current liabilities

75,250 Long-term liabilities

87,500 Common stock

29,400 Retained earnings

$ 280,350 Total liabilities and equities

Total assets

On June 30, 2021, Princeton Company paid $315,200 cash for all assets and liabilities of Streeter, which will cease to exist as a

separate entity. In connection with the acquisition, Princeton paid $19,900 in legal fees. Princeton also agreed to pay $66,400 to the

former owners of Streeter contingent on meeting certain revenue goals during 2022. Princeton estimated the present value of its

probability adjusted expected payment for the contingency at $23,700.

In determining its offer, Princeton noted the following pertaining to Streeter:

• It holds a building with a fair value $44,900 more than its book value.

• It has developed a customer list appraised at $29,000, although it is not recorded in its financial records.

• It has research and development activity in process with an appraised fair value of $39,100O. However, the project has not yet

reached technological feasibility and the assets used in the activity have no alternative future use.

• Book values for the receivables, inventory, equipment, and liabilities approximate fair values.

Prepare Princeton's accounting entries to record the combination with Streeter. (If no entry is required for a transaction/event, select

"No journal entry required" in the first account field.)

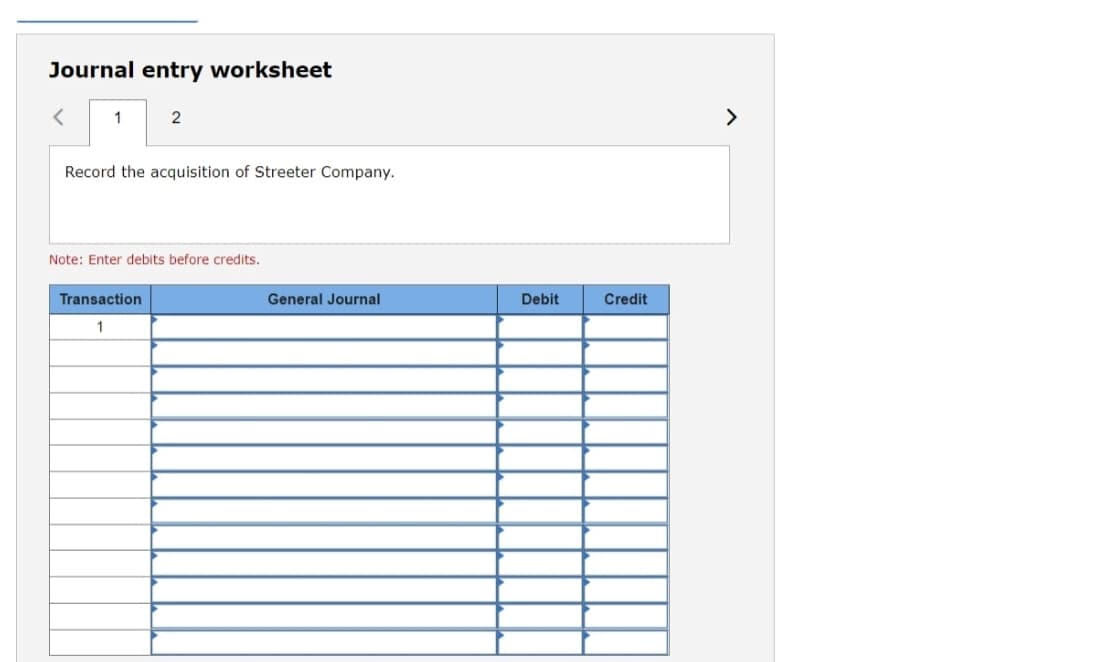

Transcribed Image Text:Journal entry worksheet

1

2

>

Record the acquisition of Streeter Company.

Note: Enter debits before credits.

Transaction

General Journal

Debit

Credit

1

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 3 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

Financial Accounting

Accounting

ISBN:

9781337272124

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

Financial Accounting

Accounting

ISBN:

9781337272124

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning