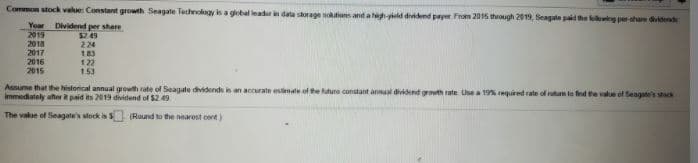

Common stock value: Constant growth Seagate Technology is a global leadur in data storage nolutins and a hegh-yeld dividend payer From 2015 through 2019, Seagate paid he wing per ahare dvidend Year 2019 2018 2017 2016 2015 Dividend per share $7 49 224 183 1.22 1.53 Assume that the historical annual grewth rate of Seagate dividends in an accurate estimale of te ure constant annaal dividend growth rate Use a 19% equired rate of rotum ta fed te value of Seagate's stack Immediately after it paid its 2019 dividend of $2 49 The vakue of Seagate's stock is (Round to the nearest cent)

Common stock value: Constant growth Seagate Technology is a global leadur in data storage nolutins and a hegh-yeld dividend payer From 2015 through 2019, Seagate paid he wing per ahare dvidend Year 2019 2018 2017 2016 2015 Dividend per share $7 49 224 183 1.22 1.53 Assume that the historical annual grewth rate of Seagate dividends in an accurate estimale of te ure constant annaal dividend growth rate Use a 19% equired rate of rotum ta fed te value of Seagate's stack Immediately after it paid its 2019 dividend of $2 49 The vakue of Seagate's stock is (Round to the nearest cent)

Intermediate Financial Management (MindTap Course List)

13th Edition

ISBN:9781337395083

Author:Eugene F. Brigham, Phillip R. Daves

Publisher:Eugene F. Brigham, Phillip R. Daves

Chapter11: Determining The Cost Of Capital

Section: Chapter Questions

Problem 5P

Related questions

Question

Transcribed Image Text:Common stock value: Constant growth Seagate Technology is a global leadur in data storage nolutins and a hegh-yeld dividend payer From 2015 through 2019, Seagate paid he wing per ahare dvidend

Year

2019

2018

2017

2016

2015

Dividend per share

$7 49

224

183

1.22

1.53

Assume that the historical annual grewth rate of Seagate dividends in an accurate estimale of te ure constant annaal dividend growth rate Use a 19% equired rate of rotum ta fed te value of Seagate's stack

Immediately after it paid its 2019 dividend of $2 49

The vakue of Seagate's stock is

(Round to the nearest cent)

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps with 2 images

Recommended textbooks for you

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

PFIN (with PFIN Online, 1 term (6 months) Printed…

Finance

ISBN:

9781337117005

Author:

Randall Billingsley, Lawrence J. Gitman, Michael D. Joehnk

Publisher:

Cengage Learning

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

PFIN (with PFIN Online, 1 term (6 months) Printed…

Finance

ISBN:

9781337117005

Author:

Randall Billingsley, Lawrence J. Gitman, Michael D. Joehnk

Publisher:

Cengage Learning

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Financial Reporting, Financial Statement Analysis…

Finance

ISBN:

9781285190907

Author:

James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

Publisher:

Cengage Learning