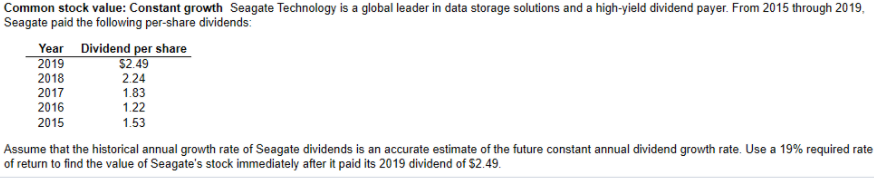

Common stock value: Constant growth Seagate Technology is a global leader in data storage solutions and a high-yield dividend payer. From 2015 through 2019, Seagate paid the following per-share dividends: IT Year Dividend per share 2019 $2.49 2018 2.24 2017 1.83 2016 1.22 2015 1.53 Assume that the historical annual growth rate of Seagate dividends is an accurate estimate of the future constant annual dividend growth rate. Use a 19% required rate of return to find the value of Seagate's stock immediately after it paid its 2019 dividend of $2.49.

Common stock value: Constant growth Seagate Technology is a global leader in data storage solutions and a high-yield dividend payer. From 2015 through 2019, Seagate paid the following per-share dividends: IT Year Dividend per share 2019 $2.49 2018 2.24 2017 1.83 2016 1.22 2015 1.53 Assume that the historical annual growth rate of Seagate dividends is an accurate estimate of the future constant annual dividend growth rate. Use a 19% required rate of return to find the value of Seagate's stock immediately after it paid its 2019 dividend of $2.49.

Intermediate Financial Management (MindTap Course List)

13th Edition

ISBN:9781337395083

Author:Eugene F. Brigham, Phillip R. Daves

Publisher:Eugene F. Brigham, Phillip R. Daves

Chapter8: Basic Stock Valuation

Section: Chapter Questions

Problem 12P

Related questions

Question

Transcribed Image Text:Common stock value: Constant growth Seagate Technology is a global leader in data storage solutions and a high-yield dividend payer. From 2015 through 2019,

Seagate paid the following per-share dividends:

IT

Year Dividend per share

2019

$2.49

2018

2.24

2017

1.83

2016

1.22

2015

1.53

Assume that the historical annual growth rate of Seagate dividends is an accurate estimate of the future constant annual dividend growth rate. Use a 19% required rate

of return to find the value of Seagate's stock immediately after it paid its 2019 dividend of $2.49.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Recommended textbooks for you

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Fundamentals Of Financial Management, Concise Edi…

Finance

ISBN:

9781337902571

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Fundamentals Of Financial Management, Concise Edi…

Finance

ISBN:

9781337902571

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

Fundamentals of Financial Management, Concise Edi…

Finance

ISBN:

9781285065137

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

Fundamentals of Financial Management, Concise Edi…

Finance

ISBN:

9781305635937

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning