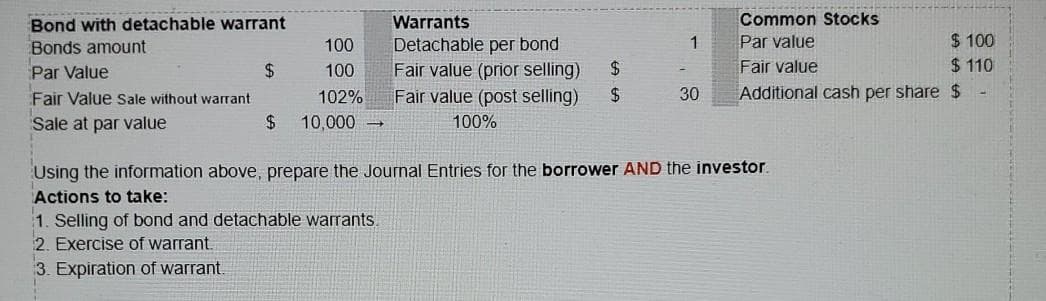

Common Stocks Bond with detachable warrant Bonds amount Warrants $ 100 $ 110 1 Par value Detachable per bond Fair value (prior selling) Fair value (post selling) 100 Par Value $ 100 $ Fair value Fair Value sale without warrant 102% $ 30 Additional cash per share $ Sale at par value %24 10,000 → 100% Using the information above, prepare the Journal Entries for the borrower AND the investor. Actions to take: 1. Selling of bond and detachable warrants. 2. Exercise of warrant. 3. Expiration of warrant.

Q: A $1,000 face value bond with a quoted price of 98 is selling for Question 39 options: $1,000…

A: Bonds are considered a financial instrument used to raise finance for the organization. It is also…

Q: Problem 10: On January 1, 20x1, SENECTITUDE OLD AGE Co. issued its 12%, 3-yenr, P2,000,000…

A: Issue date= Jan 1, 20X1 12% convertible bonds at 110 Conversion ratio= 1 bond= 8 shares

Q: Evaluate the following statements: S1 The proceeds of a bond with a face amount of P100,000,000…

A: Proceeds of a bond with a face amount of P100,000,000 which sells at 102 = P100,000,000 X 102/100…

Q: Bond A Bond B Years to maturity 5 years 10 years Coupon rate 5% 5% Par value 1000 1000…

A: Bonds: Bonds are a debt instrument on which interest is paid. They can be issued at a discount/par…

Q: Amount issued Offered $340 million Issued at a price of 100.00% plus accrued interest (proceeds to…

A: Format:- Price of Bond + Accrued Interest From 1 June to 15 June Amount to be paid %

Q: ond A FV $1,000 PMT $40 N 18 YTM 3% PV -$1,137.54 Bond B FV $1,000 PMT $30 N 12 PV -$980 YTM…

A: Bonds with long maturity are more risky than bond with short maturity. So interest on long maturity…

Q: On January 1, 20x1, Zevrek Co. issues bonds with face amount of ₱4,000,000 for ₱4,100,000. The bonds…

A: INTRODUCTION: Retirement is the point in a human's life when they decide to stop working…

Q: The 7-year $1,000 par bonds of Vail Inc. pay 9% interest. The market’s required yield to maturity on…

A: Bond :— Bond are Debt instruments and represent Loans Make to the issuer. government and Corporate…

Q: owv21 Online teachin X signment/takeAssignmentMain.do?invoker…

A: Present value: This is the amount of future value reduced or discounted at a rate of interest till…

Q: O Tony Hawk's Adventure (THA) issued callable bonds on January 1, 2021. THA's accountant has…

A: Bonds - Bonds are issued by the company as debt. It carried fixed rate of interest till its…

Q: 6. [HW] $100,000 bond redeemable at par on October 1, 2038, is purchased on January 15, 2017.…

A: The question is based on the concept of valuation of bond . the value of a bond can be calculated as…

Q: A P 1,000, 5% bond pays dividend semiannually and will be redeemed at 110% on June 21, 2004. It is…

A: Note: All the Given Options are wrong, we will solve the correct one for you as per the details…

Q: The 13-year, $1,000 par value bonds of Waco Industries pay 7 percent interest annually. The market…

A: Time Period 13 Par Value $1,000.00 Coupon Rate 7% Market Price $ 935.00 Required YTM 6%

Q: 00 4% bond with interest payable annually will mature on May 1, 1998. The date of purchase is July…

A: Bond price is the current reduced amount of future cash flows generated by the bond. Specify the…

Q: The 12-year $1,000 par bonds of Vail Inc. pay 11 percent interest. The market's required yield to…

A: GIVEN, N=12 year par = $1000 coupon rate = 11% market price = $1100

Q: 6. [HW] $100,000 bond redeemable at par on October 1, 2038, is purchased on January 15, 2017.…

A: Solution a.Calculation of Cash Price Equation Cash Price = Quoted Price + Accrued Interest (Since…

Q: A. В E F 1 On January 1, Ruiz Company issued bonds as follows: 2 Face Value: 3 Number of Years: 4…

A: The bond price of a bond is the current worth of a bond on the basis of the present value of all the…

Q: 5-year, $1,000 par value bonds of Waco Industries pay 6 percent interest annually. The market…

A: given, n = 15 years par = $1000 coupon rate = 6% market price = $1065

Q: E Corp k America Corp 3.400 4.200 August 1, 2024 August 26, 2024 125.76 102.71 ach of the three…

A: In this problem we have to calculate price of each bond.

Q: (b) Issuance of $2 million, 8% bonds at face value. Complete the following table, and indicate which…

A: Required table is given below:

Q: Complete the table

A: Solution: A Bond is document that promises by its issuer to pay its lender/buyer their principal…

Q: a. Calculate the value of the bond. b. How does the value change if the market's required yield…

A: Information Provided: Coupon payment = $120 Par value = $1000 Maturity = 15 Yield to maturity = 10%…

Q: 37. Share warrants (from the bonds with detachable warrants) a.5,400 b.9,000 c.14,400 d.0…

A: (a) The share warrants with bonds is calculated below:- Share warrants =* Fair value of warrants *…

Q: Annual Interest Payment: PV of Face Value: +PV of Interest Payments: =Bond Selling Price: $…

A: The bond is said to be issued at discount if the selling price if less than face value and at…

Q: 8. A bond issued with a par value of $200,000 and a carrying amount of $195,500 is retired at 98.5.…

A: The bonds are the financial instruments for the business used to raise the money from the market or…

Q: 9- şuppose that a company issues €10.000 face value discount bond maturing in one year. What is the…

A: Comany issues bond Face Value= 10.000 Yield to maturity = 5% Maturity =1 year Price of Bond =…

Q: LL Determine the interest payment for the following three bonds. (Assume a $1,000 par value.) (Round…

A: Interest = Par value * Coupon % /Frequency of payment

Q: Bond Premium and Discount Markway Inc. is contemplating selling bonds. The issue is to be composed…

A:

Q: A company issues a $ 20,000 bond at a coupon rate of 7.5% payable semi-annually. Joan purchased this…

A: A financial instrument that doesn’t affect the ownership of the common shareholders or management of…

Q: A $1,000 3% convertible and callable corporate bond with exactly 10 years to maturity is currently…

A: Given, Conversion value exceeds by $70 Decrease in stock price by 1% Face value is $1,000

Q: Hilpert Inc. 10-year bonds yield 5.2% and 10-year corporate bonds yield 7.5%. The maturity risk…

A: Current Yield (CY)= 7.5% Bond Yield = 5.2% Liquidity Premium = 0.2% maturity Risk Premium = 1.1%…

Q: Determine the yield to maturity. b. What is the value of the bonds to you given the yield to…

A: Information Provided: Par value = $1000 Market price = $860 YTM on comparable bond = 13% Annual…

Q: stion 1 A) Explain any four of the following types of bond issues: Secured bonds.…

A: Step 1 A bond is an instrument of the bond issuer's indebtedness to the bondholders.

Q: Problem 7-14 On December 31,2020, Cey Company had outstanding 12% P5,000,000 face amount…

A: Convertible bonds are those bonds which can be converted into defined shares of the company at a,…

Q: Question 12 Gulf Company issued bonds with par value of $500,000 for cash of $530,000. What is the…

A: Answer C. Bond Premium, an adjunct account

Q: The 11-year $1,000 par bonds of Vail Inc. pay 14 percent interest. The market's required yield to…

A: Here, Market's required yield to maturity on a comparable-risk bond = 11% To Find: Part A. Yield…

Step by step

Solved in 2 steps with 4 images

- 31. On January 1, 2021, a company issued P2,000,000, 16% bonds at 102. Each P1,000 bonds has one detachable warrant that allows the holder to purchase ten shares of P50 par value stock at P70 per share. The bonds would have been sold at 99 without the warrants. In 2022, 800 of the warrants were exercised. How much is the credit to share premium when the warrants were exercised? 32. On December 31, 2019, A Company issued 5,000 of 8% 10-year P1,000 face value bonds with detachable warrants at 110. Each bond carried a detachable warrant for 10 ordinary shares of P100 par value at a specified option price of P120. Immediately after issuance, the market value of the bonds without warrants was P4,800,000 and the market value of the warrants was P1,200,000. What is the share premium from the subsequent exercise of all share warrants? 33. The following information was provided by a company regarding its currently maturing obligations as of December 31, 2021: On December 31, 2021, the…E17.3 (LO 1) (Entries for Held-to-Maturity Securities) On January 1, 2020, Hi and Lois Company purchased 12% bonds having a maturity value of $300,000 for $322,744.44. The bonds provide the bondholders with a 10% yield. They are dated January 1, 2020, and mature January 1, 2025, with interest received on January 1 of each year. Hi and Lois Company uses the effective-interest method to allocate unamortized discount or premium. The bonds are classified in the held-to-maturity category. Instructions a. Prepare the journal entry at the date of the bond purchase. b. Prepare a bond amortization schedule. c. Prepare the journal entry to record the interest revenue and the amortization at December 31, 2020. d. Prepare the journal entry to record the interest revenue and the amortization at December 31, 2021. E17.4 (LO 1) (Entries for Available-for-Sale Securities) Assume the same information as in E17.3 except that the securities are classified as available-for-sale. The fair value of the…January 1, 2021, Marceline the Vampire Queen Co. purchased P1,000,000 10% bonds classified atamortized cost. The bonds were purchased to yield 12%. Interest is payable annually every December 31.The bonds mature on December 31, 2025. On December 31, 2021, the bonds were selling at 99. OnJanuary 2, 2023, Marceline the Vampire Queen Co. sold P500,000 face value bonds at 101. The bondswere selling at 103 on December 31, 2023. Based on the above and the result of your audit, answer thefollowing: Present value of 1 for 3 periods at 12%: 0.635518078 Present value of an annuity of 1 for 10 periods at 12%: 3.037349347 3. How much is the gain/loss on sale on January 2, 2023?

- January 1, 2021, Marceline the Vampire Queen Co. purchased P1,000,000 10% bonds classified atamortized cost. The bonds were purchased to yield 12%. Interest is payable annually every December 31.The bonds mature on December 31, 2025. On December 31, 2021, the bonds were selling at 99. OnJanuary 2, 2023, Marceline the Vampire Queen Co. sold P500,000 face value bonds at 101. The bondswere selling at 103 on December 31, 2023. Based on the above and the result of your audit, answer thefollowing: Present value of 1 for 3 periods at 12%: 0.635518078 Present value of an annuity of 1 for 10 periods at 12%: 3.037349347 3. How much is the gain/loss on sale on January 2, 2023? 4. How much is the interest income on December 31, 2023? 5. How much is the discount amortization on December 31, 2022?January 1, 2021, Marceline the Vampire Queen Co. purchased P1,000,000 10% bonds classified atamortized cost. The bonds were purchased to yield 12%. Interest is payable annually every December 31.The bonds mature on December 31, 2025. On December 31, 2021, the bonds were selling at 99. OnJanuary 2, 2023, Marceline the Vampire Queen Co. sold P500,000 face value bonds at 101. The bondswere selling at 103 on December 31, 2023. Based on the above and the result of your audit, answer thefollowing: Present value of 1 for 3 periods at 12%: 0.635518078 Present value of an annuity of 1 for 10 periods at 12%: 3.037349347 2. The carrying amount of the investment in bonds on December 31, 2021 is ?January 1, 2021, Marceline the Vampire Queen Co. purchased P1,000,000 10% bonds classified atamortized cost. The bonds were purchased to yield 12%. Interest is payable annually every December 31.The bonds mature on December 31, 2025. On December 31, 2021, the bonds were selling at 99. OnJanuary 2, 2023, Marceline the Vampire Queen Co. sold P500,000 face value bonds at 101. The bondswere selling at 103 on December 31, 2023. Based on the above and the result of your audit, answer thefollowing: Present value of 1 for 3 periods at 12%: 0.635518078 Present value of an annuity of 1 for 10 periods at 12%: 3.037349347 3. How much is the gain/loss on sale on January 2, 2023? 4. How much is the interest income on December 31, 2023? 5. How much is the discount amortization on December 31, 2022? Date Nominal Interest Effective Interest Amortization Carrying Amount 1/1/2021 12/31/2021 12/31/2022 1/2/2023 12/31/2023 12/31/2024…

- January 1, 2021, Marceline the Vampire Queen Co. purchased P1,000,000 10% bonds classified atamortized cost. The bonds were purchased to yield 12%. Interest is payable annually every December 31.The bonds mature on December 31, 2025. On December 31, 2021, the bonds were selling at 99. OnJanuary 2, 2023, Marceline the Vampire Queen Co. sold P500,000 face value bonds at 101. The bondswere selling at 103 on December 31, 2023. Based on the above and the result of your audit, answer thefollowing: Present value of 1 for 3 periods at 12%: 0.635518078 Present value of an annuity of 1 for 10 periods at 12%: 3.037349347 2. The carrying amount of the investment in bonds on December 31, 2021 is ? 3. How much is the gain/loss on sale on January 2, 2023? 4. How much is the interest income on December 31, 2023? 5. How much is the discount amortization on December 31, 2022?On January 1, 2021, Marceline the Vampire Queen Co. purchased P1,000,000 10% bonds classified at amortized cost. The bonds were purchased to yield 12%. Interest is payable annually every December 31. The bonds mature on December 31, 2025. On December 31, 2021, the bonds were selling at 99. OnJanuary 2, 2023, Marceline the Vampire Queen Co. sold P500,000 face value bonds at 101. The bonds were selling at 103 on December 31, 2023. Based on the above and the result of your audit, answer the following: Present value of 1 for 3 periods at 12%: 0.635518078 Present value of an annuity of 1 for 10 periods at 12%: 3.037349347 1. The purchase price of the bonds on January 1, 2021 is closest to a. 927,800 b. 1,075,796 c. 946,480 d. 939,253 2. The carrying amount of the investment in bonds on December 31, 2021 is closest to a. 1,063,376 b. 960,058 c. 951,963 d. 939,226 3. How much is the gain/loss on sale on January 2, 2023? a. 21,981 gain b. 21,981 loss c. 41,963 gain d. 41,963 loss 4. How much…On January 1, 2021, Marceline the Vampire Queen Co. purchased P1,000,000 10% bonds classified at amortized cost. The bonds were purchased to yield 12%. Interest is payable annually every December 31. The bonds mature on December 31, 2025. On December 31, 2021, the bonds were selling at 99. OnJanuary 2, 2023, Marceline the Vampire Queen Co. sold P500,000 face value bonds at 101. The bonds were selling at 103 on December 31, 2023. Based on the above and the result of your audit, answer the following: Present value of 1 for 3 periods at 12%: 0.635518078 Present value of an annuity of 1 for 10 periods at 12%: 3.037349347 1. provide amortization table 2. provide journal entries note: be mindful about the dates

- Durable Co.’s December 30, 20X0, balance sheet contained the following items in the long-term liabilities section: Unsecured 9.375% registered bonds (P25,000 maturing annually beginning in 20x4) ₱275,000 11.5% convertible bonds, callable beginning in 20x9, due 2010 125,000 Secured 9.875% guarantee security bonds, due 2x10 ₱250,000 10.0% commodity backed bonds (P50,000 maturing annually beginning in 20x5) 200,000 What are the total amounts of serial bonds and debenture bonds?Q14 An entity issued 1 500 debentures with face value of R20 000 each. The coupon rate on the debentures is 12% paid annually in arrears. In order to speed the sale of the debentures, the directors decided to issue them at 10% discount. What amount would be recorded by the entity in its statement of financial position under non-current liabilities? Select one: a. R20 000 b. R15 000 000 c. R30 000 000 d. R27 000 000Mf2. On January 1, 2022. Sarasota Company purchased 12% bonds having a maturity value of $430,000 for $462,600.36. The bonds provide the bondholders with a 10% yield. They are dated January 1, 2022, and mature January 1, 2027, with interest receivable December 31 of each year. Sarasota elected the fair value option for this held-for-collection investment. Prepare any entry necessary at December 31, 2022, assuming the fair value of the bonds is $464,400. (Round answers to 2 decimal places, e.g. 5,275.25. Credit account titles are automatically indented when the amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter O for the amounts.)