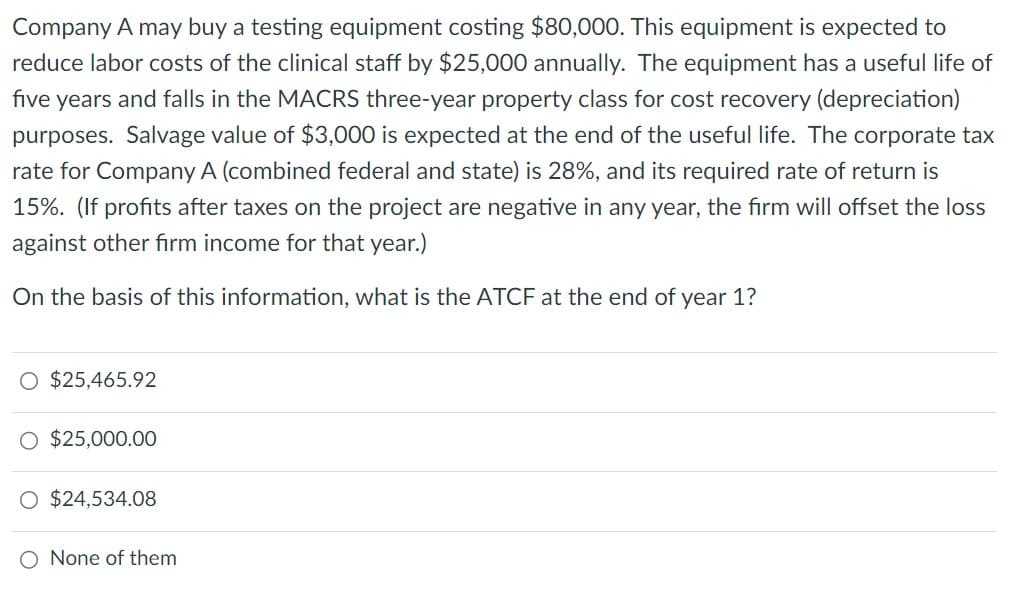

Company A may buy a testing equipment costing $80,000. This equipment is expected to reduce labor costs of the clinical staff by $25,000 annually. The equipment has a useful life of five years and falls in the MACRS three-year property class for cost recovery (depreciation) purposes. Salvage value of $3,000 is expected at the end of the useful life. The corporate tax rate for Company A (combined federal and state) is 28%, and its required rate of return is 15%. (If profits after taxes on the project are negative in any year, the firm will offset the loss against other firm income for that year.) On the basis of this information, what is the ATCF at the end of year 1?

Company A may buy a testing equipment costing $80,000. This equipment is expected to reduce labor costs of the clinical staff by $25,000 annually. The equipment has a useful life of five years and falls in the MACRS three-year property class for cost recovery (depreciation) purposes. Salvage value of $3,000 is expected at the end of the useful life. The corporate tax rate for Company A (combined federal and state) is 28%, and its required rate of return is 15%. (If profits after taxes on the project are negative in any year, the firm will offset the loss against other firm income for that year.) On the basis of this information, what is the ATCF at the end of year 1?

Chapter10: Capital Budgeting: Decision Criteria And Real Option

Section: Chapter Questions

Problem 14P

Related questions

Question

Haresh

Transcribed Image Text:Company A may buy a testing equipment costing $80,000. This equipment is expected to

reduce labor costs of the clinical staff by $25,000 annually. The equipment has a useful life of

five years and falls in the MACRS three-year property class for cost recovery (depreciation)

purposes. Salvage value of $3,000 is expected at the end of the useful life. The corporate tax

rate for Company A (combined federal and state) is 28%, and its required rate of return is

15%. (If profits after taxes on the project are negative in any year, the firm will offset the loss

against other firm income for that year.)

On the basis of this information, what is the ATCF at the end of year 1?

O $25,465.92

O $25,000.00

O $24,534.08

O None of them

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps with 4 images

Recommended textbooks for you

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

Fundamentals Of Financial Management, Concise Edi…

Finance

ISBN:

9781337902571

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning