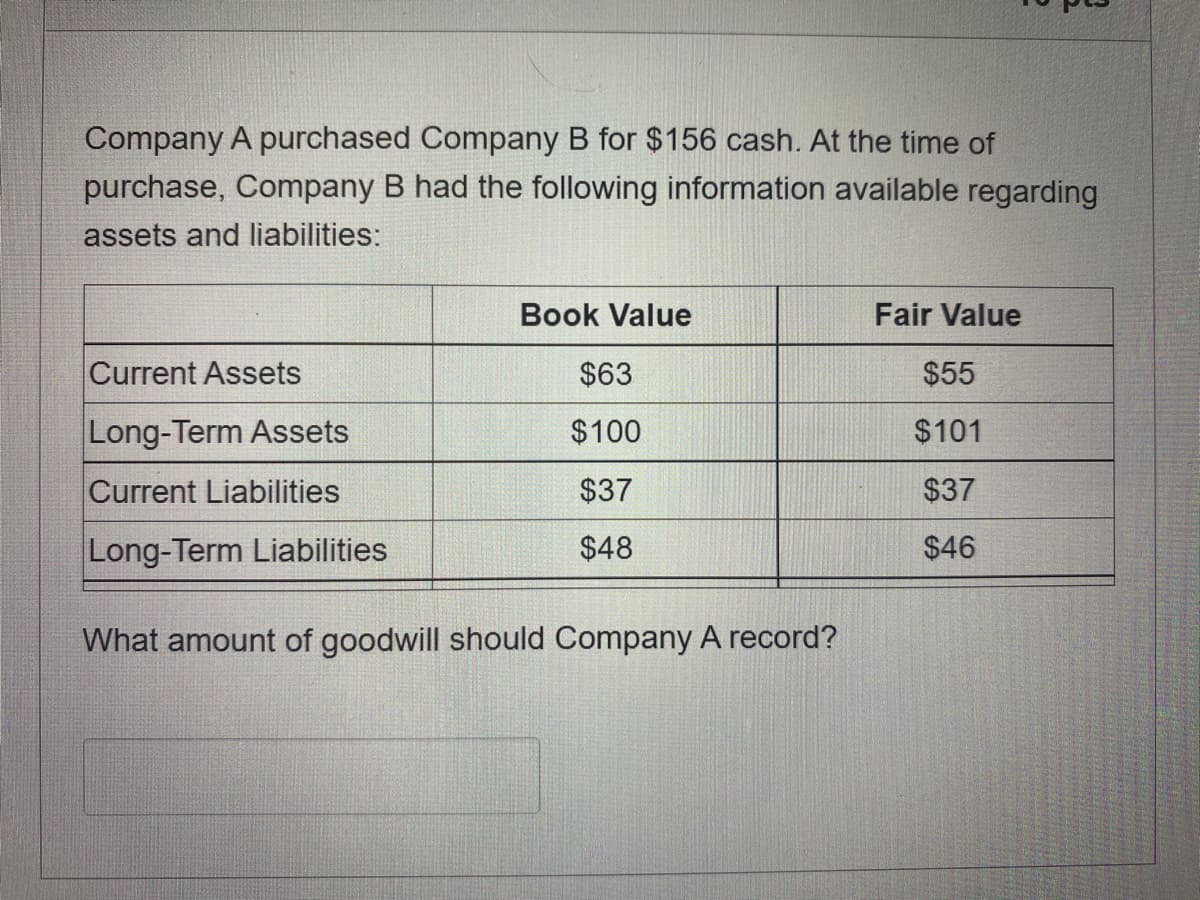

Company A purchased Company B for $156 cash. At the time of purchase, Company B had the following information available regarding assets and liabilities: Book Value Fair Value Current Assets $63 $55 Long-Term Assets $100 $101 Current Liabilities $37 $37 Long-Term Liabilities $48 $46 What amount of goodwill should Company A record?

Q: On July 1, 2002, TJR issued 2,000 of its 8 percent, $1,000 bonds for $1,752,000. The bonds were issu...

A: Solution Given Face value 2000000 Coupon rate 8% Issue price 1752000 Yield 1...

Q: total tax expense?

A: Tax rate 30 % for 2020 year And 25 % for 2021 year Total tax expense as follows

Q: Read the problem and answer the questions worksheet 1. There are 1,000 iron bars in stock, and 1,500...

A: “Since you have asked multiple questions, we will solve the first question for you. If you want any ...

Q: ABC Company was engaged in leasing machinery. The following were obtained from the incomplete record...

A: The accrued rent income is the rent earned but not received yet. It is treated as a current asset i...

Q: Ray Company had the following liabilities on December 31, 2021: · Trade accounts payable, net...

A: Current liabilities (CL) which refers to the liabilities that it is short term and of financial nat...

Q: Santos started a retail merchandise business on January 1, 2021. During the year ended December 31, ...

A: Inventory purchases can be computed by Adding payments to trade creditor and account payable balance...

Q: A corporation’s ordinary shares currently pays an annual dividend of P5.40 per share. The required ...

A: Annual dividend (D0) = P5.40 Required return (r) = 12% Growth rate (g) = 0%

Q: The following data relate to store equipment of BBB Company for 2021: · Store Equipment at ...

A: Store Equipment at cost, Jan. 1- P100,000 Store Equipment at cost, Dec. 31- P105,000 Accumulated...

Q: please answer this thank you

A: In this question, we have to find out the taxable income of Kagura under different circumstances.

Q: 12. Viaje Manufacturing incurred P106,000 of direct labor and P11,000 of indirect labor. The proper ...

A: Solution: Production cost such as direct materials, direct labor and manufacturing overhead applied ...

Q: On July 1, 2021, an interest payment date, $150,000 of converted into 3,000 shares of Mack Co. commo...

A: Introduction:- The following basic information as follows under- On July 1, 2021, an interest payme...

Q: Upper Limit on Misstatements Calculations: Monetary Unit Sampling. Clyde Billy isconducting the audi...

A: Disclaimer:- “Since you have posted a question with multiple sub-parts, we will solve first three su...

Q: · Payment of quick response insurance premium for calendar year (payment was made during the 1...

A: Solution: Total expenses for a particular quarter is based on expenses incurred in that period which...

Q: James Company has an arrangement with with Jorge Company that operates a customer loyalty program. T...

A: Customer loyalty programs are accounted for as per IFRS 15. Such a program is used by a company to i...

Q: Why is EBITDA controversial?

A: Earnings Before Interest, Taxes, Depreciation, and Amortization (EBITDA) is a metric used to assess ...

Q: Yeontan Company is engaged in a small export business. The company maintain limited records. Most of...

A: Net Purchases = Cash purchases + Cash payment to trade creditors - Decrease in Accounts payable - De...

Q: cO X HAS cASH BALANCE OF $33 AND SHORT TERM LOAN BALANCE OF $200 AT THE BEGINNING OF QTR 1. THE NET ...

A: Given: Cash Balance = $33 Loan Balance = $200 1st QRT = $89 Cash outflow = $44 Firm pays = 2% Minimu...

Q: Lilo started operating a service proprietorship on April 1, 2021 with an initial cash investment of ...

A: Introduction:- Cash basis accounting:- Under this method. revenues recognized when cash is received,...

Q: Lulu Company and its divisions are engaged solely in manufacturing operations. The following data pe...

A: Answer: Option D. 6

Q: Job no. C12 was completed in November at a cost of P18,500, subdivided as follows: direct material, ...

A: Answer) The correct answer in the given question is: Account Titles and Explanation Debit ...

Q: 2. If a company sells goods that cost P70,000 for P82,000, the firm will: a. reduce Finished-Goods I...

A: Since you have asked multiple question, we will solve the first question for you. If you want any sp...

Q: What is the operating cash flow in 2015? What is the change of working capital in 2015? What is the ...

A: Cash flow statement (CFS) is a financial statement which shows the flows of cash and cash equivalent...

Q: On June 30, 2021, Line Company incurred a P100,000 net loss from disposal of a business segment. Als...

A: Loss from disposal of business segment = P 100000 Property taxes paid = 40000

Q: Information about direct materials cost follows for a local company: Standard price per materials gr...

A: Standard price (SP) = $19 Actual quantity used (AQ) = 2450 grams Price variance = $19600 F Actual pr...

Q: Benchmarking The call center of Wobegon Electric Company handles 1.32 million calls per year. The av...

A: Solution Working note Cost per hour (A) Minutes per hour (B) Cost per minutes (A/B) ...

Q: A trial balance will indicate the existence of an error if: a The purchase of ...

A: The existence of an error can only be seen in a trial balance in the cases where the trial balance d...

Q: 13. Which of the following would most likely be a product cost? a. Salary of VP of sales. b. Adverti...

A: Solution 13: Product cost are the cost that is capitalized in inventory cost or that is incurred in ...

Q: Salmone Company reported the following purchases and sales of its only product. Salmone uses a perpe...

A: under perpetual inventory system estimation of of inventory based on electronic record is done not o...

Q: The master budget at Western Company last period called for sales of 240,000 units at $8.00 each. Th...

A: Flexible budget is prepared for the actual units of activity . Formula Variable cost = actual ...

Q: You have been asked to help out a small Landscaping company by preparing their month-end bank reconc...

A: Bank reconciliation statement is the one which is prepared to reconcile the differences between the ...

Q: 9. Which of the following statements is not true. (A) Capitalized leases should be reported on the s...

A: A lease is a contract between a property owner and someone who wishes to use their asset. In a lease...

Q: Nelter Corporation, which has only one product, has provided the following data concerning its most ...

A: Variable Costing: In management accounting, the notion of variable costs is known as variable costin...

Q: ABC Enterprises is a multi-divisional firm that makes and sells personal protective equipment to hea...

A: Introduction:- ABC Enterprises is a multi-divisional corporation that manufactures and distributes p...

Q: You have been given the choice to reduce your mortgage interest rate for each point received by the ...

A: The answer is stated below:

Q: If a corporation has an average tax rate of 30 percent, what is the approximate after cost of debt f...

A: Tax rate = 30% Bond price = P1120 Par value = P1000 Coupon rate = 12% Coupon amount = 1000*0.12 = 12...

Q: an entity has an existing note maturing within 12 months from the balance sheet date. The entity has...

A: solution concept In case where there is a debt maturing within 12 months from the balance sheet date...

Q: (please solve it fast i will give thumbs up)

A: Given: Annual gross premiums are 200 q53 = 0.006 and q54 = 0.007 i = 0.05 Annual expenses are 5% of ...

Q: Mr. Cruz bought 5,000 MXT shares at P2.00. He received cash dividends of P0.20 per share. The par ...

A: Number of shares = 5000 Purchase price = P2.00 Sale price = P3.00

Q: For each of the following (1) identify the type of account as an asset, liability, equity, revenue, ...

A: Assets Assets are resources that are controlled which results from prior transactions that are expec...

Q: Medical Essentials anticipate the following sales forecast for the months indicated. The company pro...

A: The budgets are prepared on the basis of estimation and forecasting. The sales budget and production...

Q: The sale of a depreciable asset resulting in a loss indicates that the proceeds from the sale were a...

A: Since you have asked multiple questions, we will solve the first question for you . If you want any...

Q: On January 1, 2021, your company sold $400,000 of 5%, 10 year bonds when the market rate was 6%. The...

A: Part E Bonds sold on Aug 1, 2021 Interest paid annually on July, 31 The year ends December 31 Dat...

Q: For each of the following (1) identify the type of account as an asset, liability, equity, revenue, ...

A: Introduction: Balance sheet: All Assets and liabilities are shown in balance sheet. It tells the net...

Q: ABC Company acquired a fire insurance on Nov. 1, 2021. The company paid P12,000 for the said annual ...

A: Total insurance for the year = P12000 Period covered in current year = 2 Months (i.e. Nov.1 to Dec 3...

Q: For how long would P1,000,000 have to be invested at 5% simple interest for it to double its value? ...

A: Formula: Maturity value = Bond amount x Interest rate x Time period

Q: Under the accrual basis, Professional Fees by Atty. Bruno for the year 2021 amounts to A. 3,059,100...

A: Accrual system of accounting says that every thing which is accrued has to be provided in books of a...

Q: · Sales revenue- P500,000 · Cost of Goods Sold- P350,000 · Operating Expenses- P...

A: Solution: Other comprehensive income before tax will include all revenues or expenses taken before t...

Q: In a perpetual inventory system, purchases of merchandise on account are recorded by debiting: a ...

A: In a perpetual inventory system, Purchases account is not maintained because inventory account is di...

Q: A student loan with a simple annual interest rate of 2.5% must be paid back in ten years. A student ...

A: Given data, Interest rate(r)=2.5% or 0.025 per annum Total interest(I)=P2,000 Time(t)=10 years

Q: In 2021, Cream company reported cash basis income of P 7,800,000. Tracing back its records, accounts...

A: Accrual basis: Under accrual basis accounting, revenue and expenses are recognized when they are inc...

Step by step

Solved in 2 steps

- Buchanan Imports purchased McLaren Corporation for $5,000,000 cash when McLaren had net assets worth $4,500,000. A. What is the amount of goodwill in this transaction? B. What is Buchanans journal entry to record the purchase of McLaren? C. What journal entry should Buchanan write when the company internally generates additional goodwill in the year following the purchase of McLaren?Farm Fresh Agriculture Company purchased Sunny Side Egg Distribution for $400,000 cash when Sunny Side had net assets worth $390,000. A. What is the amount of goodwill in this transaction? B. What is Farm Fresh Agriculture Companys journal entry to record the purchase of Sunny Side Egg Distribution? C. What journal entry should Farm Fresh Agriculture Company write when the company tests for impairment and determines that goodwill is worth $1,000 in the year following the purchase of Sunny Side?Assume the same information as in RE11-3, except that Albany Corporation purchased the asset on April 1, Year 1. Calculate the depreciation for Year 1 and Year 2 using the double-declining-balance method. Round to the nearest dollar.

- (d) Ebersole, Inc. has been concerned about whether intangible assets could generate cash in case of liquidation. As a consequence, goodwill arising from a purchase transaction during the current year and recorded at $750,000 was written off as follows. Retained Earnings 750,000 Goodwill 750,000Arizona Corp. acquired the business Data Systems for $320,000 cash and assumed all liabilities at the date of purchase. Data's books showed tangible assets of $260,000, liabilities of $40,000, and stockholder's equity of $220,000. An appraiser assessed the fair market value of the tangible assets at $250,000 at the date of acquisition. Compute the amount of good will acquired Record the qcquisition in a financial statements model When will teh goodwill be written off under the impairment rules Record the acquisition in general journal formatLoop Pole Co., acquired all the assets and current liabilities of North Pole Co.,. The North Pole Co., details as follows, Cash OMR 20,000, Building OMR 30,000, Equipment OMR 50,000, Creditors OMR 10,000 and Retained earnings OMR 30,000. Calculate goodwill or capital reserve. Select one: a. Capital Reserve OMR 90,000 b. Goodwill OMR 90,000 c. Goodwill OMR 70,000 d. Capital reserve OMR 70,000

- S Company had the following balances at the time it was acquired by P Company:Cash P36,000Accounts receivable 457,000Inventories 120,000Property, plant and equipment 696,400Goodwill 200,000Accounts payable 350,800P Company paid P1.4M for the net assets of S Company. It was determined that fair market values of inventories and property, plant and equipment were P133,000 and P900,000, respectively.An assumed contingent liability with a fair value amounting to P20,000 and such amount is considered a reliable measurement. Also, a P50,000 future losses or reorganization/ restructuring costs are expected to be incurred as a result of the business combination.In the books of P Company, how will be the amount of Goodwill arising from business combination?A purchased B, paying $850,000 cash. The books values and fair values of acquired assets and liabilities were: Book asset - Fair Value Current assets net: $130,000 - $125,000 Property, plant, equip: 600,000 - 750,000 Liabilities: 175,000 - 175000 A would record goodwill of: A. $0. B. $150,000 C. $345,000 D. $850,000Lake Incorporated purchased all of the stock of Huron Company, paying $950,000 cash. Lake also assumed all of the liabilities of Huron. Book values and fair values of the acquired assets and liabilities were: Book value Fair value Current assets (net) $130,000 $125,000 Property, plant & equipment (net) 600,000 750,000 Liabilities 150,000 175,000 Required:What amount of Goodwill should Lake Inc. record in connection with this purchase?

- Floyd Company purchases Haeger Company for $2,400,000 cash on January 1, 2021. The book value of Haeger Company’s net assets, as reflected on its December 31, 2020 balance sheet is $1,860,000. An analysis by Floyd on December 31, 2020 indicates that the fair value of Haeger’s tangible assets exceeded the book value by $180,000, and the fair value of identifiable intangible assets exceeded book value by $135,000. How much goodwill should be recognized by Floyd Company when recording the purchase of Haeger Company?First Company purchased Second Company for $19,000,000 cash. At the time of purchase, Second Company's assets had a market value of $28,000,000 and the liabilities had a market value of $13,000,000. At the time of the purchase, Second Company's assets had a book value of $15,000,000, and the liabilities had a book value of $9,000,000. What amount of goodwill is recorded?The following assets are exchanged between Company A and Company B: Company A Company B Asset original cost $53,400 $65,100 Accumulated depreciation 32,630 39,600 Net book value 20,770 25,500 Fair value of asset 24,200 28,600 In addition, Company A paid Company B $4,400 cash.Required:Prepare the journal entry to record the transaction for Company A and B