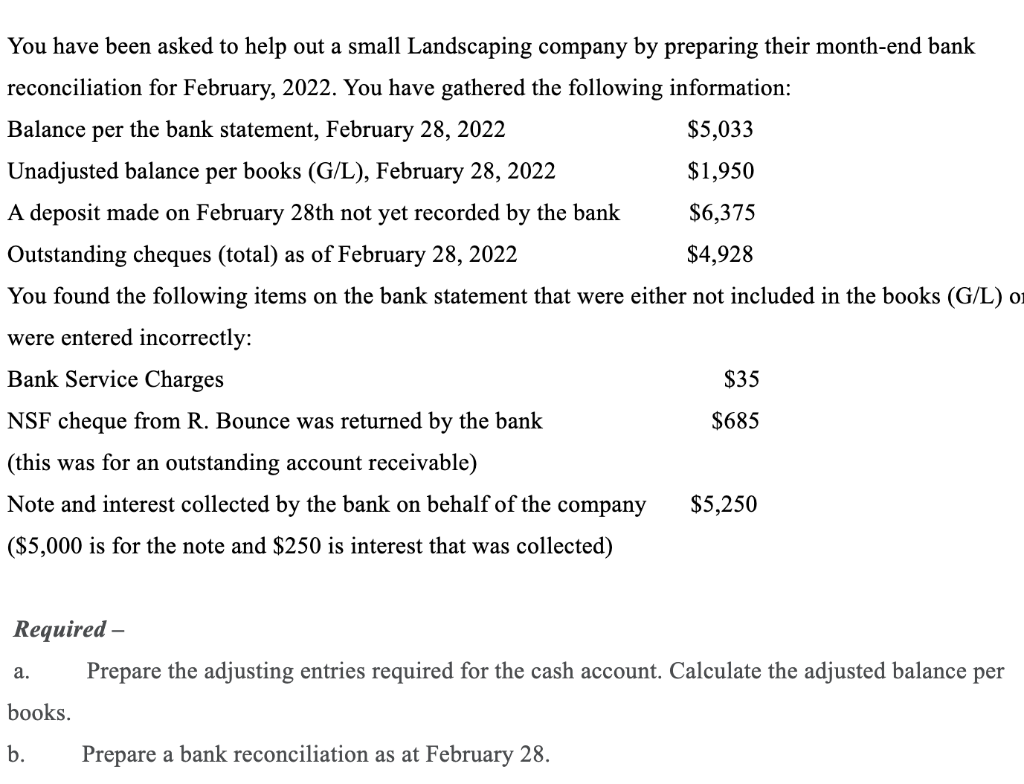

You have been asked to help out a small Landscaping company by preparing their month-end bank reconciliation for February, 2022. You have gathered the following information: Balance per the bank statement, February 28, 2022 $5,033 Unadjusted balance per books (G/L), February 28, 2022 $1,950 A deposit made on February 28th not yet recorded by the bank $6,375 Outstanding cheques (total) as of February 28, 2022 $4,928 You found the following items on the bank statement that were either not included in the books (G/L) o were entered incorrectly: Bank Service Charges $35 NSF cheque from R. Bounce was returned by the bank $685 (this was for an outstanding account receivable) Note and interest collected by the bank on behalf of the company $5,250 ($5,000 is for the note and $250 is interest that was collected) Required – а. Prepare the adjusting entries required for the cash account. Calculate the adjusted balance per books. b. Prepare a bank reconciliation as at February 28.

You have been asked to help out a small Landscaping company by preparing their month-end bank reconciliation for February, 2022. You have gathered the following information: Balance per the bank statement, February 28, 2022 $5,033 Unadjusted balance per books (G/L), February 28, 2022 $1,950 A deposit made on February 28th not yet recorded by the bank $6,375 Outstanding cheques (total) as of February 28, 2022 $4,928 You found the following items on the bank statement that were either not included in the books (G/L) o were entered incorrectly: Bank Service Charges $35 NSF cheque from R. Bounce was returned by the bank $685 (this was for an outstanding account receivable) Note and interest collected by the bank on behalf of the company $5,250 ($5,000 is for the note and $250 is interest that was collected) Required – а. Prepare the adjusting entries required for the cash account. Calculate the adjusted balance per books. b. Prepare a bank reconciliation as at February 28.

College Accounting (Book Only): A Career Approach

13th Edition

ISBN:9781337280570

Author:Scott, Cathy J.

Publisher:Scott, Cathy J.

Chapter6: Bank Accounts, Cash Funds, And Internal Controls

Section: Chapter Questions

Problem 1PA

Related questions

Question

Transcribed Image Text:You have been asked to help out a small Landscaping company by preparing their month-end bank

reconciliation for February, 2022. You have gathered the following information:

Balance per the bank statement, February 28, 2022

$5,033

Unadjusted balance per books (G/L), February 28, 2022

$1,950

A deposit made on February 28th not yet recorded by the bank

$6,375

Outstanding cheques (total) as of February 28, 2022

$4,928

You found the following items on the bank statement that were either not included in the books (G/L) or

were entered incorrectly:

Bank Service Charges

$35

NSF cheque from R. Bounce was returned by the bank

$685

(this was for an outstanding account receivable)

Note and interest collected by the bank on behalf of the company

$5,250

($5,000 is for the note and $250 is interest that was collected)

Required –

а.

Prepare the adjusting entries required for the cash account. Calculate the adjusted balance per

books.

b.

Prepare a bank reconciliation as at February 28.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781337280570

Author:

Scott, Cathy J.

Publisher:

South-Western College Pub

Century 21 Accounting Multicolumn Journal

Accounting

ISBN:

9781337679503

Author:

Gilbertson

Publisher:

Cengage

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781337280570

Author:

Scott, Cathy J.

Publisher:

South-Western College Pub

Century 21 Accounting Multicolumn Journal

Accounting

ISBN:

9781337679503

Author:

Gilbertson

Publisher:

Cengage

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Financial Accounting

Accounting

ISBN:

9781305088436

Author:

Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Financial Accounting

Accounting

ISBN:

9781337272124

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning