Company A sold 1 million barrels of oil to a Norwegian petrol station, today for 120 Nok per barrel. Company A expects to receive the full payments from the petrol station in 3 months’. Company A is informed that the petrol station will pay for the oil in Norwegian Krone. Company A wants a strategy to reduce the uncertainty around the expected payment from the petrol station. Company A is faced with the following market rates: Spot exchange Rate Nok 6.0312/$ 3-month forward rate Nok 6.0186/$ U.S. dollar 3-month interest rate 5% Norwegian Krone 3-month interest rate 4.45% Based on the above info, what hedging strategy works the best for Company A? Explain why Company A should choose such hedging strategy. How much U.S.dollar will Company A receive at the end of 3 months by using this hedging strategy?

Company A, is a participant in both the currency and petrochemical markets. Although it is a Norwegian company, because it operates within the global oil market, it considers the U.S. dollar($), rather than the Norwegian krone (Nok), as its functional currency. Answer the following:

Company A sold 1 million barrels of oil to a Norwegian petrol station, today for 120 Nok per barrel. Company A expects to receive the full payments from the petrol station in 3 months’. Company A is informed that the petrol station will pay for the oil in Norwegian Krone. Company A wants a strategy to reduce the uncertainty around the expected payment from the petrol station. Company A is faced with the following market rates:

Spot exchange Rate Nok 6.0312/$

3-month forward rate Nok 6.0186/$

U.S. dollar 3-month interest rate 5%

Norwegian Krone 3-month interest rate 4.45%

Based on the above info, what hedging strategy works the best for Company A? Explain why Company A should choose such hedging strategy.

How much U.S.dollar will Company A receive at the end of 3 months by using this hedging strategy?

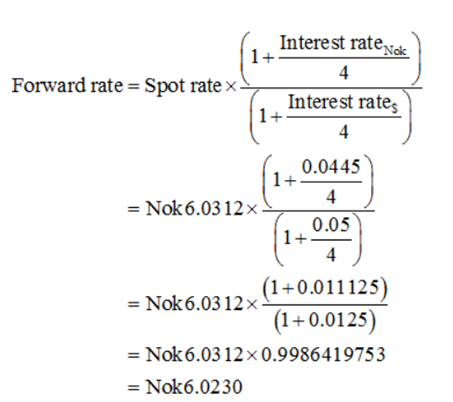

Spot rate in 3 months (forward rate as per interest rates) as per the rates of interest can be computed as follows:

The computed forward rate as per the rate of interest (Nok6.023/$) is more than given 3-month forward rate (Nok6.0186$). Therefore, when the spot rate in three months is Nok6.0230, fewer U.S. dollars would be received. While considering, given 3-month forwarded rate, extra U.S. dollars can be received. Therefore, hedging strategy of purchasing the forward rate contract must be selected.

Step by step

Solved in 2 steps with 2 images