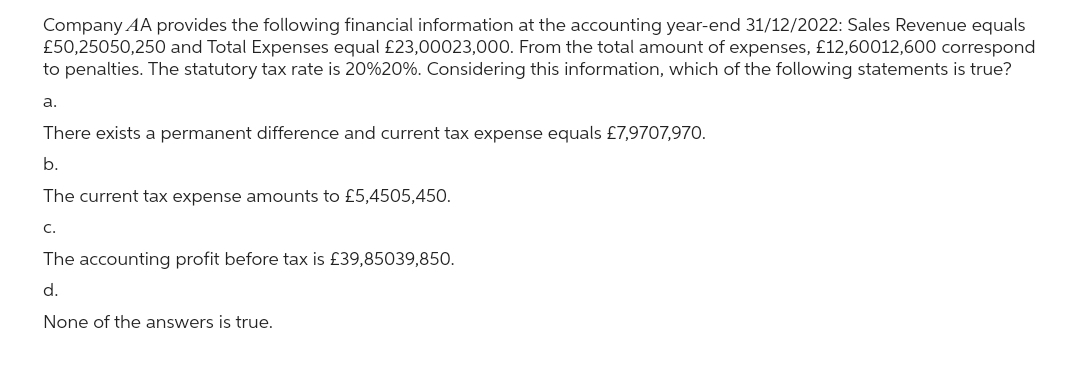

Company AA provides the following financial information at the accounting year-end 31/12/2022: Sales Revenue equals £50,25050,250 and Total Expenses equal £23,00023,000. From the total amount of expenses, £12,60012,600 correspond to penalties. The statutory tax rate is 20%20%. Considering this information, which of the following statements is true? a. There exists a permanent difference and current tax expense equals £7,9707,970. b. The current tax expense amounts to £5,4505,450. C. The accounting profit before tax is £39,85039,850. d. None of the answers is true.

Company AA provides the following financial information at the accounting year-end 31/12/2022: Sales Revenue equals £50,25050,250 and Total Expenses equal £23,00023,000. From the total amount of expenses, £12,60012,600 correspond to penalties. The statutory tax rate is 20%20%. Considering this information, which of the following statements is true? a. There exists a permanent difference and current tax expense equals £7,9707,970. b. The current tax expense amounts to £5,4505,450. C. The accounting profit before tax is £39,85039,850. d. None of the answers is true.

SWFT Essntl Tax Individ/Bus Entities 2020

23rd Edition

ISBN:9780357391266

Author:Nellen

Publisher:Nellen

Chapter3: Taxes On The Financial Statements

Section: Chapter Questions

Problem 14P

Related questions

Question

Kk.74.

Transcribed Image Text:Company AA provides the following financial information at the accounting year-end 31/12/2022: Sales Revenue equals

£50,25050,250 and Total Expenses equal £23,00023,000. From the total amount of expenses, £12,60012,600 correspond

to penalties. The statutory tax rate is 20%20%. Considering this information, which of the following statements is true?

a.

There exists a permanent difference and current tax expense equals £7,9707,970.

b.

The current tax expense amounts to £5,4505,450.

C.

The accounting profit before tax is £39,85039,850.

d.

None of the answers is true.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 3 steps

Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT