company is considering constructing a plant to manufacture a proposed new product. The land costs 300,000.00, the building 00,000.00, the equipment costs 250,000.00 and 100,000.00 additional working capital is required. It is expected that the product will re ales of P750,000 per year for 10 years, at which time the land can be sold for 400,000.00, the building for 350,000.00 and the equipme 0,000.00. All of the working capital would be recovered at the end of year 10. The annual expenses for labor, materials, and all other iten stimated to total 475,000.00. If the company requires a MARR of 15% per year on projects of comparable risk, determine if it should inv he new product line. Evaluate using all methods. .) Rate of Return Please answer in this format. Given: Formula (Please use this formula): net annual profit Rate of return = capita invested Note: If there is a required value before using the given formula, then solve for it to be able to use the given formula. Solution: .) Annual Worth Method Please answer in this format. Given: Formula (Please use this formula): MARR stands for Minimum Attractive Rate of Return In this method, the minimum required profit (MRP) is included as a cost or expenses. This computed as: MRP = Initiallnvest x MARR Then excess is computed as: Excess = Income - Expenses Note: If there is a required value before using the given formula, then solve for it to be able to use the given formula. Solution:

company is considering constructing a plant to manufacture a proposed new product. The land costs 300,000.00, the building 00,000.00, the equipment costs 250,000.00 and 100,000.00 additional working capital is required. It is expected that the product will re ales of P750,000 per year for 10 years, at which time the land can be sold for 400,000.00, the building for 350,000.00 and the equipme 0,000.00. All of the working capital would be recovered at the end of year 10. The annual expenses for labor, materials, and all other iten stimated to total 475,000.00. If the company requires a MARR of 15% per year on projects of comparable risk, determine if it should inv he new product line. Evaluate using all methods. .) Rate of Return Please answer in this format. Given: Formula (Please use this formula): net annual profit Rate of return = capita invested Note: If there is a required value before using the given formula, then solve for it to be able to use the given formula. Solution: .) Annual Worth Method Please answer in this format. Given: Formula (Please use this formula): MARR stands for Minimum Attractive Rate of Return In this method, the minimum required profit (MRP) is included as a cost or expenses. This computed as: MRP = Initiallnvest x MARR Then excess is computed as: Excess = Income - Expenses Note: If there is a required value before using the given formula, then solve for it to be able to use the given formula. Solution:

Cornerstones of Cost Management (Cornerstones Series)

4th Edition

ISBN:9781305970663

Author:Don R. Hansen, Maryanne M. Mowen

Publisher:Don R. Hansen, Maryanne M. Mowen

Chapter19: Capital Investment

Section: Chapter Questions

Problem 28P: Friedman Company is considering installing a new IT system. The cost of the new system is estimated...

Related questions

Question

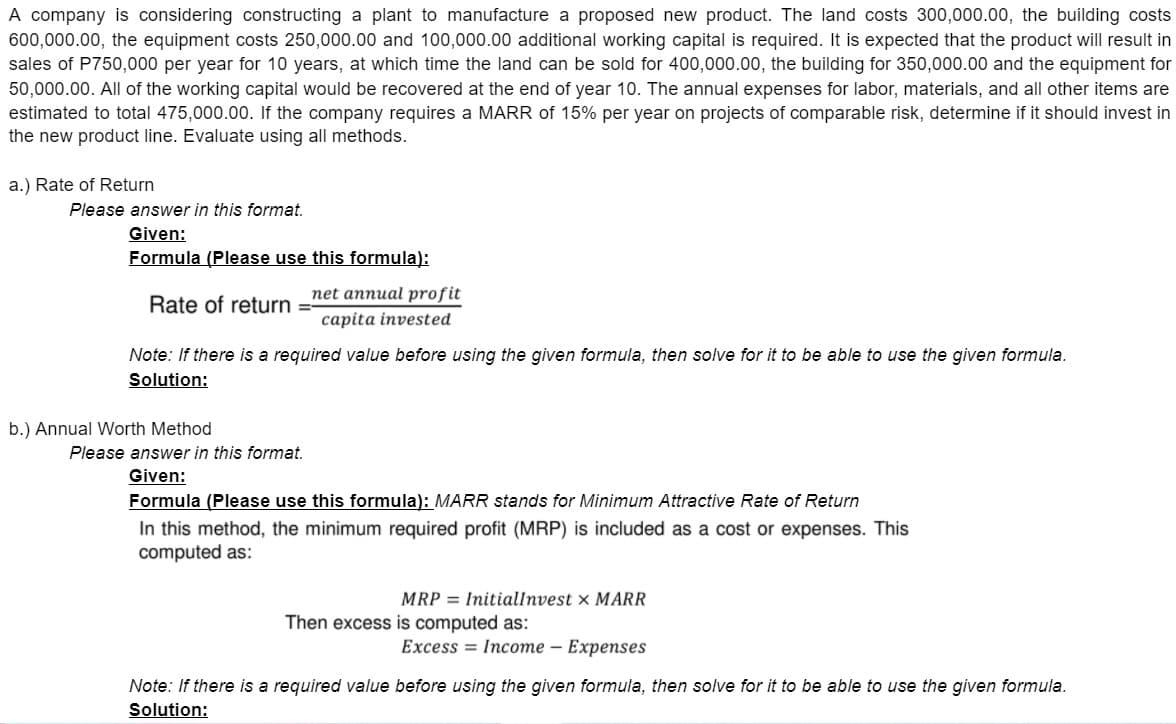

Transcribed Image Text:A company is considering constructing a plant to manufacture a proposed new product. The land costs 300,000.00, the building costs

600,000.00, the equipment costs 250,000.00 and 100,000.00 additional working capital is required. It is expected that the product will result in

sales of P750,000 per year for 10 years, at which time the land can be sold for 400,000.00, the building for 350,000.00 and the equipment for

50,000.00. All of the working capital would be recovered at the end of year 10. The annual expenses for labor, materials, and all other items are

estimated to total 475,000.00. If the company requires a MARR of 15% per year on projects of comparable risk, determine if it should invest in

the new product line. Evaluate using all methods.

a.) Rate of Return

Please answer in this format.

Given:

Formula (Please use this formula):

net annual profit

Rate of return

capita invested

Note: If there is a required value before using the given formula, then solve for it to be able to use the given formula.

Solution:

b.) Annual Worth Method

Please answer in this format.

Given:

Formula (Please use this formula): MARR stands for Minimum Attractive Rate of Return

In this method, the minimum required profit (MRP) is included as a cost or expenses. This

computed as:

MRP = Initiallnvest x MARR

Then excess is computed as:

Excess 3D Incоте - Еxpenses

Note: If there is a required value before using the given formula, then solve for it to be able to use the given formula.

Solution:

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Fundamentals Of Financial Management, Concise Edi…

Finance

ISBN:

9781337902571

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

Excel Applications for Accounting Principles

Accounting

ISBN:

9781111581565

Author:

Gaylord N. Smith

Publisher:

Cengage Learning