Compare the performance of both companies with each other, for each of the calculated indicators and determine if it is necessary to make any adjustment or adjustments to better position the firm with the lowest performance, facing the end of the next fiscal year. Explain what adjustments you propose and why.

Compare the performance of both companies with each other, for each of the calculated indicators and determine if it is necessary to make any adjustment or adjustments to better position the firm with the lowest performance, facing the end of the next fiscal year. Explain what adjustments you propose and why.

College Accounting, Chapters 1-27 (New in Accounting from Heintz and Parry)

22nd Edition

ISBN:9781305666160

Author:James A. Heintz, Robert W. Parry

Publisher:James A. Heintz, Robert W. Parry

Chapter15: Financial Statements And Year-end Accounting For A Merchandising Business

Section: Chapter Questions

Problem 4CE

Related questions

Question

Compare the performance of both companies with each other, for each of the calculated indicators and determine if it is necessary to make any adjustment or adjustments to better position the firm with the lowest performance, facing the end of the next fiscal year. Explain what adjustments you propose and why.

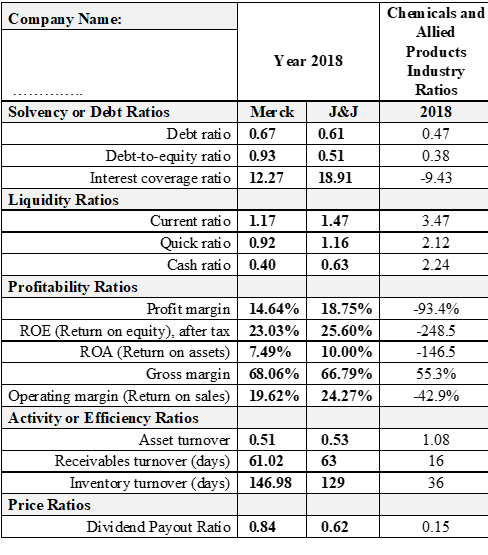

Transcribed Image Text:Chemicals and

Company Name:

Allied

Products

Y ear 2018

Industry

Ratios

Solvency or Debt Ratios

Merck

J&J

2018

Debt ratio 0.67

Debt-to-equity ratio 0.93

0.61

0.47

0.51

0.38

Interest coverage ratio 12.27

18.91

-9.43

Liquidity Ratios

Current ratio 1.17

Quick ratio 0.92

Cash ratio 0.40

1.47

3.47

1.16

2.12

0.63

2.24

Profitability Ratios

Profit margin 14.64% 18.75%

-93.4%

ROE (Return on equity), after tax

23.03%

25.60%

-248.5

ROA (Return on assets) 7.49%

10.00%

-146.5

Gross margin 68.06% 66.79%

Oper ating margin (Return on sales) 19.62% 24.27%

55.3%

42.9%

Activity or Efficiency Ratios

Asset turnover 0.51

Receivables turnover (days) 61.02

0.53

1.08

63

16

Inventory turnover (days) 146.98

129

36

Price Ratios

Dividend Payout Ratio 0.84

0.62

0.15

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you

College Accounting, Chapters 1-27 (New in Account…

Accounting

ISBN:

9781305666160

Author:

James A. Heintz, Robert W. Parry

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

College Accounting, Chapters 1-27 (New in Account…

Accounting

ISBN:

9781305666160

Author:

James A. Heintz, Robert W. Parry

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning