a) Calculate on the following ratios for AZ Trading for 2020 and 2021: i. Debt-to-equity ratio ii. Net profit margin iii. Current ratio

a) Calculate on the following ratios for AZ Trading for 2020 and 2021: i. Debt-to-equity ratio ii. Net profit margin iii. Current ratio

Cornerstones of Financial Accounting

4th Edition

ISBN:9781337690881

Author:Jay Rich, Jeff Jones

Publisher:Jay Rich, Jeff Jones

Chapter7: Operating Assets

Section: Chapter Questions

Problem 24CE

Related questions

Question

a) Calculate on the following ratios for AZ Trading for 2020 and 2021:

i. Debt-to-equity ratio

ii. Net profit margin

iii. Current ratio

iv. Inventory turnover ratio

b) Provide comments in terms of liquidity, profitability, efficiency and solvency based on the computed ratios in (a) above.

c) List THREE (3) objectives of ratio analysis.

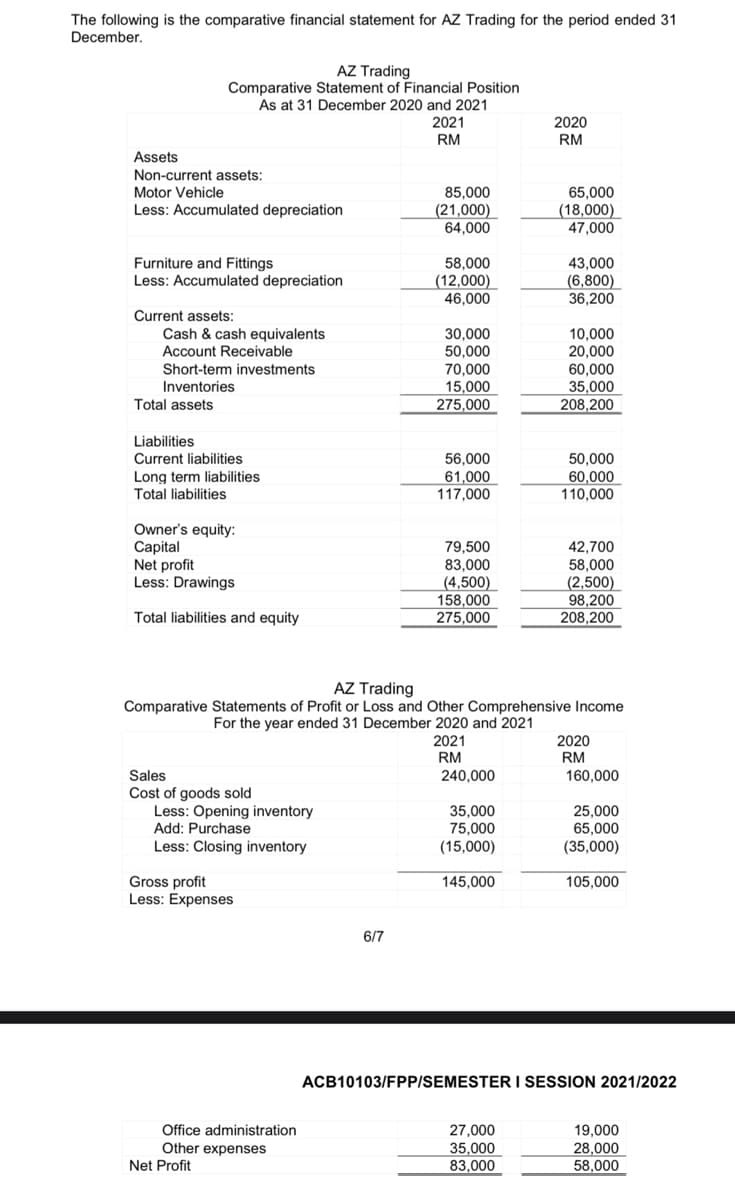

Transcribed Image Text:The following is the comparative financial statement for AZ Trading for the period ended 31

December.

AZ Trading

Comparative Statement of Financial Position

As at 31 December 2020 and 2021

2021

2020

RM

RM

Assets

Non-current assets:

Motor Vehicle

85,000

(21,000)

64,000

65,000

(18,000)

47,000

Less: Accumulated depreciation

Furniture and Fittings

Less: Accumulated depreciation

58,000

(12,000)

46,000

43,000

(6,800)

36,200

Current assets:

Cash & cash equivalents

Account Receivable

Short-term investments

30,000

50,000

70,000

15,000

275,000

10,000

20,000

60,000

35,000

Inventories

Total assets

208,200

Liabilities

56,000

61,000

117,000

50,000

60,000

110,000

Current liabilities

Long term liabilities

Total liabilities

Owner's equity:

Capital

Net profit

Less: Drawings

79,500

83,000

(4,500)

158,000

275,000

42,700

58,000

(2,500)

98,200

208,200

Total liabilities and equity

AZ Trading

Comparative Statements of Profit or Loss and Other Comprehensive Income

For the year ended 31 December 2020 and 2021

2021

RM

2020

RM

Sales

Cost of goods sold

Less: Opening inventory

Add: Purchase

Less: Closing inventory

240,000

160,000

35,000

75,000

(15,000)

25,000

65,000

(35,000)

Gross profit

Less: Expenses

145,000

105,000

6/7

ACB10103/FPP/SEMESTER I SESSION 2021/2022

Office administration

Other expenses

Net Profit

27,000

35,000

83,000

19,000

28,000

58,000

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning