Complete the following sentence: "The put-call parity relationship between American options..." O 1. is given by the following expression: St - K s Ct - Pt s St - K exp(-Ro (T-t)) O II. cannot be derived because these options can be exercised before the expiration date. O II. ields a larger value of the call option than for the European option counterparts. O IV. None of the above.

Complete the following sentence: "The put-call parity relationship between American options..." O 1. is given by the following expression: St - K s Ct - Pt s St - K exp(-Ro (T-t)) O II. cannot be derived because these options can be exercised before the expiration date. O II. ields a larger value of the call option than for the European option counterparts. O IV. None of the above.

Financial Management: Theory & Practice

16th Edition

ISBN:9781337909730

Author:Brigham

Publisher:Brigham

Chapter8: Financial Options And Applications In Corporate Finance

Section: Chapter Questions

Problem 5MC: In 1973, Fischer Black and Myron Scholes developed the Black-Scholes option pricing model (OPM). (1)...

Related questions

Question

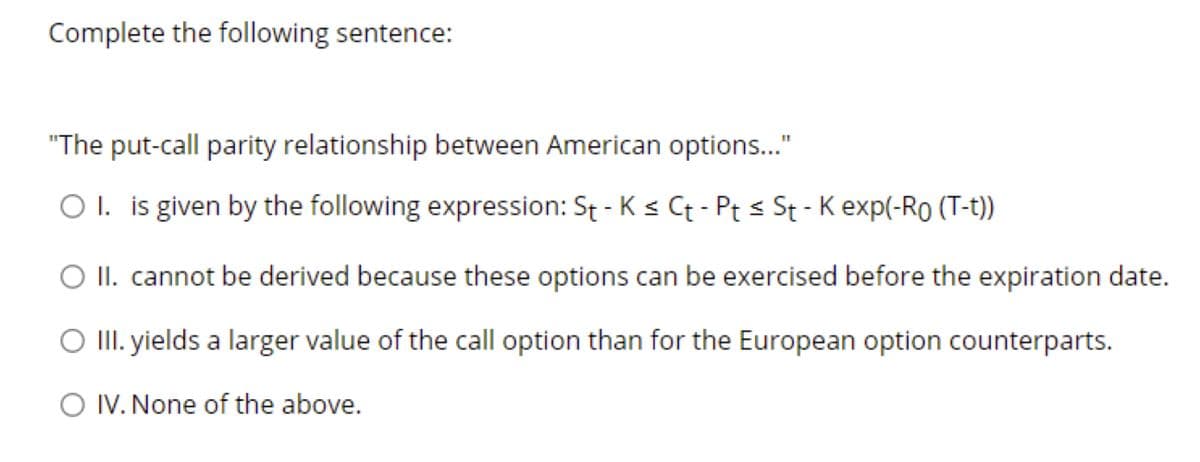

Transcribed Image Text:Complete the following sentence:

"The put-call parity relationship between American options..."

O I. is given by the following expression: St - K < Ct - Pt s St - K exp(-Ro (T-t))

O II. cannot be derived because these options can be exercised before the expiration date.

O II. yields a larger value of the call option than for the European option counterparts.

O IV. None of the above.

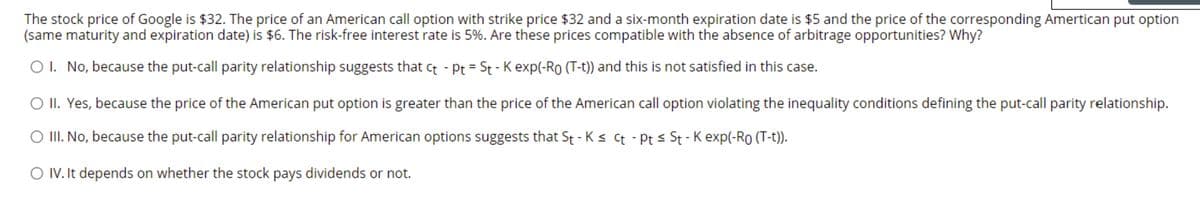

Transcribed Image Text:The stock price of Google is $32. The price of an American call option with strike price $32 and a six-month expiration date is $5 and the price of the corresponding Amertican put option

(same maturity and expiration date) is $6. The risk-free interest rate is 5%. Are these prices compatible with the absence of arbitrage opportunities? Why?

O I. No, because the put-call parity relationship suggests that ct - Pt = St - K exp(-Ro (T-t)) and this is not satisfied in this case.

O II. Yes, because the price of the American put option is greater than the price of the American call option violating the inequality conditions defining the put-call parity relationship.

O II. No, because the put-call parity relationship for American options suggests that St - K s Ct - Pt s St - K exp(-Ro (T-t)).

O IV. It depends on whether the stock pays dividends or not.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning