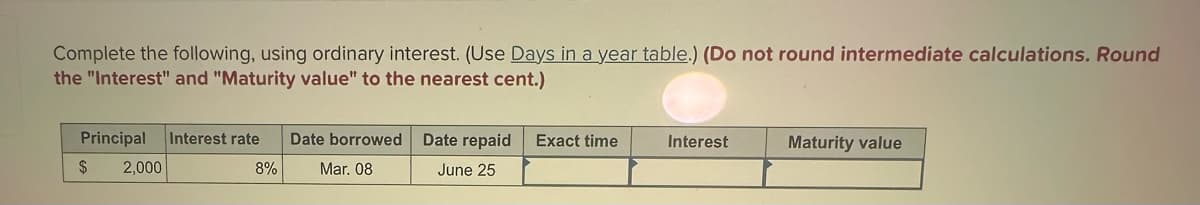

Complete the following, using ordinary interest. (Use Days in a year table.) (Do not round intermediate calculations. Ro the "Interest" and "Maturity value" to the nearest cent.) Principal Interest rate $ 8% 2,000 Date borrowed Mar. 08 Date repaid Exact time June 25 Interest Maturity value

Complete the following, using ordinary interest. (Use Days in a year table.) (Do not round intermediate calculations. Ro the "Interest" and "Maturity value" to the nearest cent.) Principal Interest rate $ 8% 2,000 Date borrowed Mar. 08 Date repaid Exact time June 25 Interest Maturity value

Chapter1: Financial Statements And Business Decisions

Section: Chapter Questions

Problem 1Q

Related questions

Question

Transcribed Image Text:Complete the following, using ordinary interest. (Use Days in a year table.) (Do not round intermediate calculations. Round

the "Interest" and "Maturity value" to the nearest cent.)

Principal Interest rate

$

2,000

8%

Date borrowed

Mar. 08

Date repaid

June 25

Exact time

Interest

Maturity value

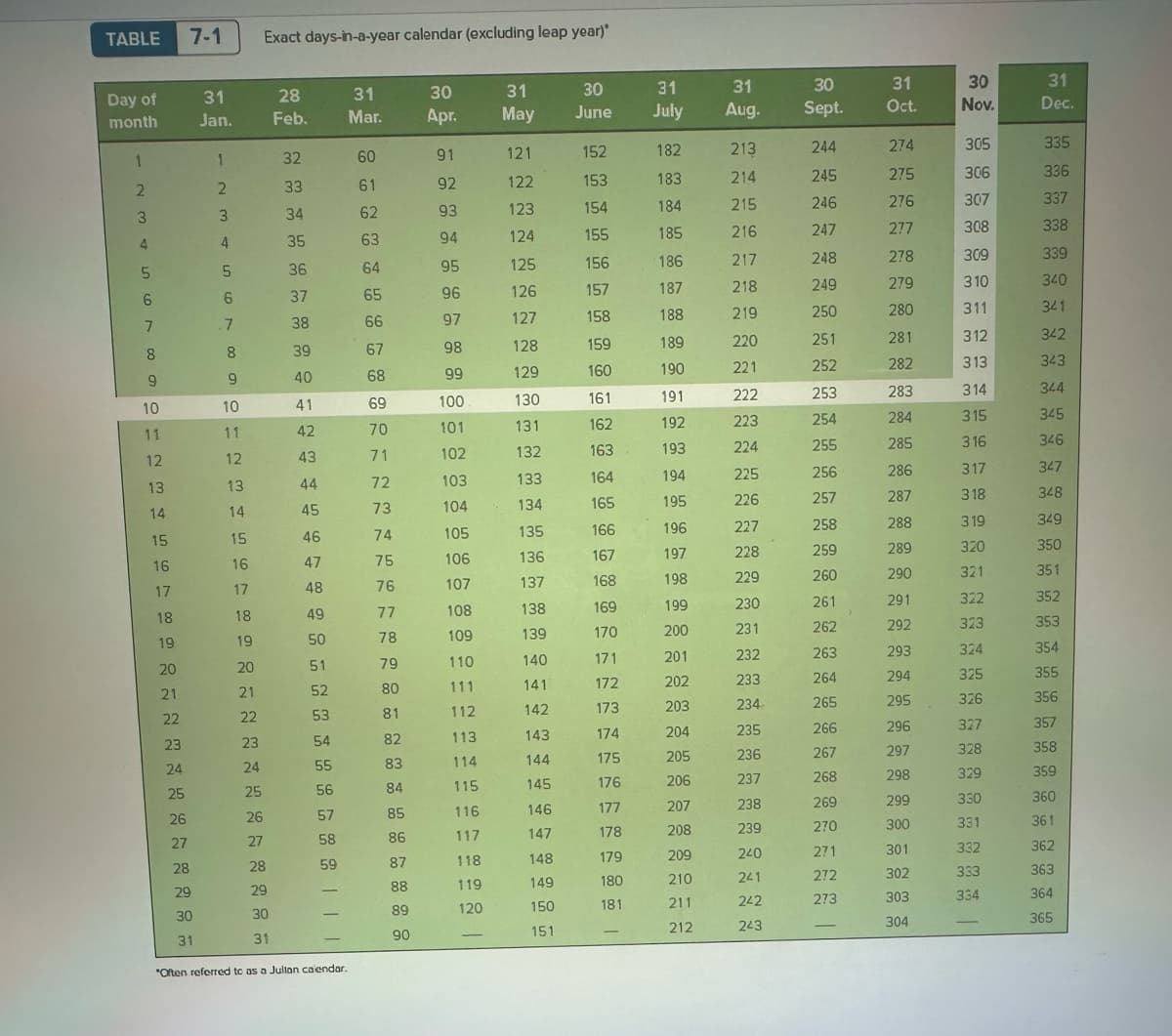

Transcribed Image Text:TABLE

Day of

month

1

2

3

4

5

6

7

8

9

10

11

12

13

14

15

16

17

18

19

20

21

22

23

24

25

26

7-1

27

28

29

30

31

31

Jan.

1

2

3

4

5

6

.7

8

9

10

12

13

14

15

16

17

18

19

20

21

22

23

24

25

Exact days-in-a-year calendar (excluding leap year)

26

27

28

29

30

31

28

Feb.

32

33

34

35

36

37

38

39

40

41

42

43

44

45

46

47

48

49

50

51

52

53

54

55

56

57

58

59

"Often referred to as a Julian calendar.

31

Mar.

STRANKAKK

60

61

62

63

64

65

66

67

68

69

70

71

72

73

74

75

76

77

78

79

80

81

82

83

84

85

86

87

88

89

90

30

Apr.

91

92

93

94

95

96

97

98

99

100

101

102

103

104

105

106

107

108

109

110

111

112

113

114

115

116

117

118

119

120

-

31

May

121

122

123

124

125

126

127

128

129

130

131

132

133

134

135

136

137

138

139

140

1411

142

143

144

145

146

147

148

149

150

151

30

June

31

July

164

165

166

167

168

169

170

171

172

173

174

175

176

177

178

179

180

181

182

183

184

152

153

154

155

156

157

158

159

189

160

190

161

191

162

192

163 193

185

186

187

188

194

195

196

197

198

199

200

201

202

203

204

205

206

207

208

209

210

211

212

31

Aug.

213

214

215

216

217

218

219

220

221

222

223

224

225

226

227

228

229

230

231

232

233

234

235

236

237

238

239

240

241

242

243

30

Sept.

244

245

246

247

248

249

250

251

252

253

254

255

256

257

258

259

260

261

262

263

264

265

266

267

268

269

270

271

272

273

-

31

Oct.

274

275

276

277

278

279

280

281

282

283

284

285

286

287

288

289

290

291

292

293

294

295

296

297

298

299

300

301

302

303

304

30

Nov.

305

306

307

308

309

310

311

312

313

314

315

316

317

318

319

320

321

322

323

324

325

326

327

328

329

330

331

332

333

334

31

Dec.

335

336

337

338

339

340

341

342

343

344

345

346

347

348

349

350

351

352

353

354

355

356

357

358

359

360

361

362

363

364

365

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Accounting

Accounting

ISBN:

9781337272094

Author:

WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:

Cengage Learning,

Accounting Information Systems

Accounting

ISBN:

9781337619202

Author:

Hall, James A.

Publisher:

Cengage Learning,

Accounting

Accounting

ISBN:

9781337272094

Author:

WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:

Cengage Learning,

Accounting Information Systems

Accounting

ISBN:

9781337619202

Author:

Hall, James A.

Publisher:

Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis…

Accounting

ISBN:

9780134475585

Author:

Srikant M. Datar, Madhav V. Rajan

Publisher:

PEARSON

Intermediate Accounting

Accounting

ISBN:

9781259722660

Author:

J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:

McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:

9781259726705

Author:

John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:

McGraw-Hill Education