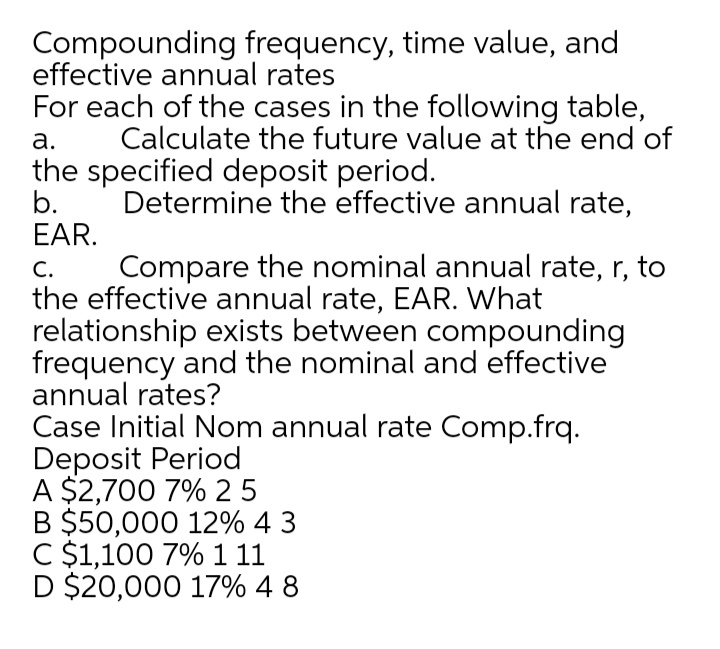

Compounding frequency, time value, and effective annual rates For each of the cases in the following table, а. Calculate the future value at the end of the specified deposit period. b. EAR. Determine the effective annual rate, C. Compare the nominal annual rate, r, to the effective annual rate, EAR. What relationship exists between compounding frequency and the nominal and effective annual rates? Case Initial Nom annual rate Comp.frq. Deposit Period A $2,700 7% 25 B $50,000 12% 4 3 C $1,100 7% 1 11 D $20,000 17% 4 8

Compounding frequency, time value, and effective annual rates For each of the cases in the following table, а. Calculate the future value at the end of the specified deposit period. b. EAR. Determine the effective annual rate, C. Compare the nominal annual rate, r, to the effective annual rate, EAR. What relationship exists between compounding frequency and the nominal and effective annual rates? Case Initial Nom annual rate Comp.frq. Deposit Period A $2,700 7% 25 B $50,000 12% 4 3 C $1,100 7% 1 11 D $20,000 17% 4 8

Chapter4: Time Value Of Money

Section: Chapter Questions

Problem 1Q

Related questions

Question

Transcribed Image Text:Compounding frequency, time value, and

effective annual rates

For each of the cases in the following table,

а.

Calculate the future value at the end of

the specified deposit period.

b.

EAR.

Determine the effective annual rate,

С.

Compare the nominal annual rate, r, to

the effective annual rate, EAR. What

relationship exists between compounding

frequency and the nominal and effective

annual rates?

Case Initial Nom annual rate Comp.frq.

Deposit Period

A $2,700 7% 25

B $50,000 12% 4 3

C $1,100 7% 1 11

D $20,000 17% 4 8

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 5 steps with 10 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you