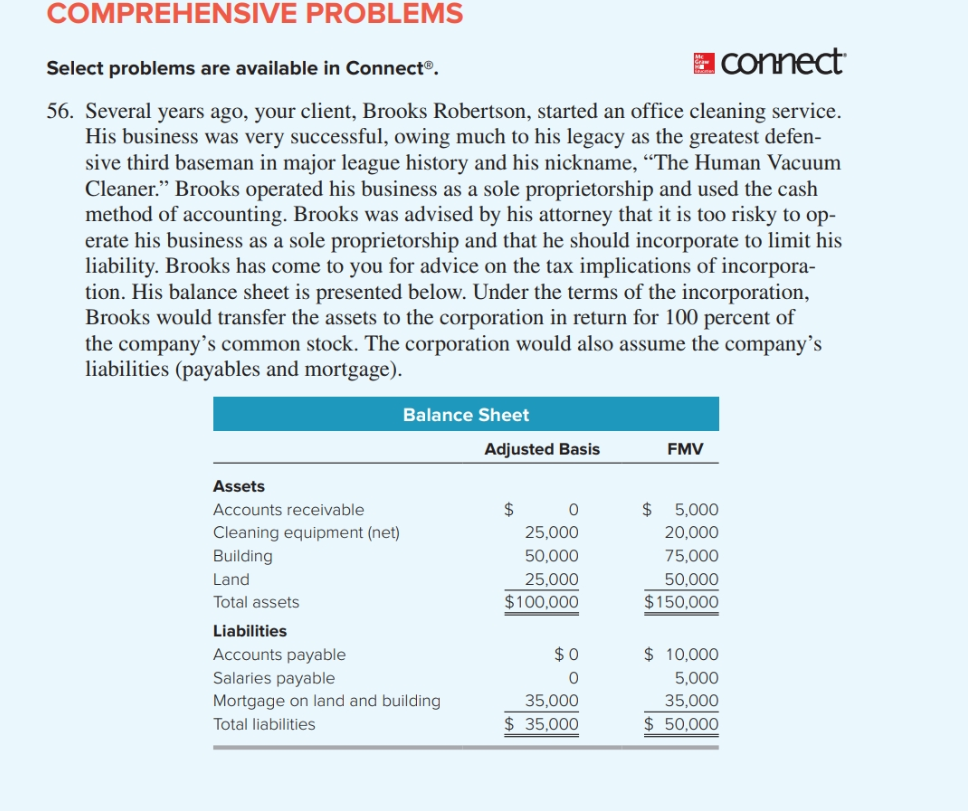

COMPREHENSIVE PROBLEMS a connect Select problems are available in Connect®. 56. Several years ago, your client, Brooks Robertson, started an office cleaning service. His business was very successful, owing much to his legacy as the greatest defen- sive third baseman in major league history and his nickname, “The Human Vacuum Cleaner." Brooks operated his business as a sole proprietorship and used the cash method of accounting. Brooks was advised by his attorney that it is too risky to op- erate his business as a sole proprietorship and that he should incorporate to limit his liability. Brooks has come to you for advice on the tax implications of incorpora- tion. His balance sheet is presented below. Under the terms of the incorporation, Brooks would transfer the assets to the corporation in return for 100 percent of the company's common stock. The corporation would also assume the company's liabilities (payables and mortgage). Balance Sheet Adjusted Basis FMV Assets Accounts receivable 2$ 5,000 Cleaning equipment (net) 25,000 20,000 Building 50,000 75,000 Land 25,000 50,000 Total assets $100,000 $150,000 Liabilities Accounts payable $0 $ 10,000 Salaries payable 5,000 Mortgage on land and building 35,000 35,000 Total liabilities $ 35,000 $ 50,000 1) How would you answer the question in part (b) if Brooks had taken back a 10-year note worth $25,000 plus stock worth $75,000 plus the liability assumption? b) How much, if any, gain or loss (on a per-asset basis) does Brooks recognize?|

COMPREHENSIVE PROBLEMS a connect Select problems are available in Connect®. 56. Several years ago, your client, Brooks Robertson, started an office cleaning service. His business was very successful, owing much to his legacy as the greatest defen- sive third baseman in major league history and his nickname, “The Human Vacuum Cleaner." Brooks operated his business as a sole proprietorship and used the cash method of accounting. Brooks was advised by his attorney that it is too risky to op- erate his business as a sole proprietorship and that he should incorporate to limit his liability. Brooks has come to you for advice on the tax implications of incorpora- tion. His balance sheet is presented below. Under the terms of the incorporation, Brooks would transfer the assets to the corporation in return for 100 percent of the company's common stock. The corporation would also assume the company's liabilities (payables and mortgage). Balance Sheet Adjusted Basis FMV Assets Accounts receivable 2$ 5,000 Cleaning equipment (net) 25,000 20,000 Building 50,000 75,000 Land 25,000 50,000 Total assets $100,000 $150,000 Liabilities Accounts payable $0 $ 10,000 Salaries payable 5,000 Mortgage on land and building 35,000 35,000 Total liabilities $ 35,000 $ 50,000 1) How would you answer the question in part (b) if Brooks had taken back a 10-year note worth $25,000 plus stock worth $75,000 plus the liability assumption? b) How much, if any, gain or loss (on a per-asset basis) does Brooks recognize?|

College Accounting (Book Only): A Career Approach

13th Edition

ISBN:9781337280570

Author:Scott, Cathy J.

Publisher:Scott, Cathy J.

Chapter3: The General Journal And The General Ledger

Section: Chapter Questions

Problem 1A: Why Does It Matter? ECOTOUR EXPEDITIONS, INC., Jamestown, Rhode Island You probably have never...

Related questions

Question

100%

I need only the answer of the F you guys already gave me the B, but im going to send both because they are attached.

Transcribed Image Text:COMPREHENSIVE PROBLEMS

a connect

Select problems are available in Connect®.

56. Several years ago, your client, Brooks Robertson, started an office cleaning service.

His business was very successful, owing much to his legacy as the greatest defen-

sive third baseman in major league history and his nickname, “The Human Vacuum

Cleaner." Brooks operated his business as a sole proprietorship and used the cash

method of accounting. Brooks was advised by his attorney that it is too risky to op-

erate his business as a sole proprietorship and that he should incorporate to limit his

liability. Brooks has come to you for advice on the tax implications of incorpora-

tion. His balance sheet is presented below. Under the terms of the incorporation,

Brooks would transfer the assets to the corporation in return for 100 percent of

the company's common stock. The corporation would also assume the company's

liabilities (payables and mortgage).

Balance Sheet

Adjusted Basis

FMV

Assets

Accounts receivable

2$

5,000

Cleaning equipment (net)

25,000

20,000

Building

50,000

75,000

Land

25,000

50,000

Total assets

$100,000

$150,000

Liabilities

Accounts payable

$0

$ 10,000

Salaries payable

5,000

Mortgage on land and building

35,000

35,000

Total liabilities

$ 35,000

$ 50,000

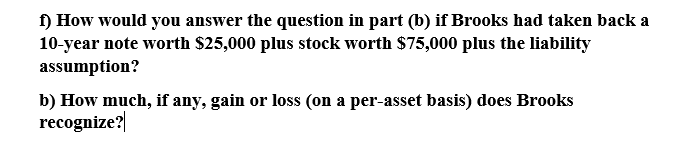

Transcribed Image Text:1) How would you answer the question in part (b) if Brooks had taken back a

10-year note worth $25,000 plus stock worth $75,000 plus the liability

assumption?

b) How much, if any, gain or loss (on a per-asset basis) does Brooks

recognize?|

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781337280570

Author:

Scott, Cathy J.

Publisher:

South-Western College Pub

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781337280570

Author:

Scott, Cathy J.

Publisher:

South-Western College Pub

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,