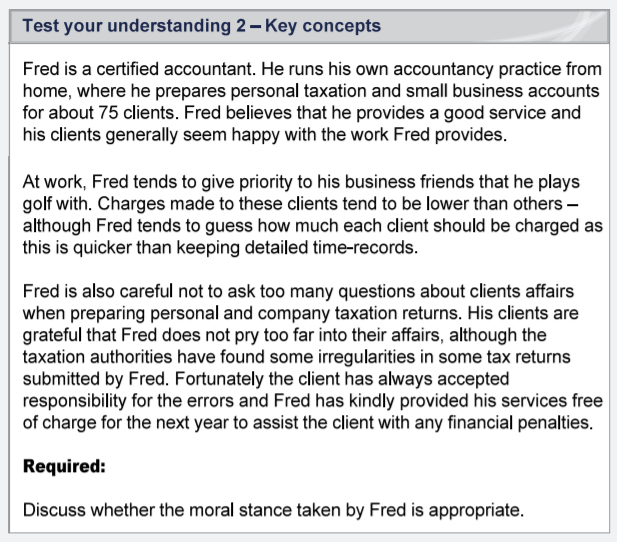

Test your understanding 2 – Key concepts Fred is a certified accountant. He runs his own accountancy practice fro home, where he prepares personal taxation and small business account for about 75 clients. Fred believes that he provides a good service and his clients generally seem happy with the work Fred provides. At work, Fred tends to give priority to his business friends that he plays golf with. Charges made to these clients tend to be lower than others - although Fred tends to guess how much each client should be charged this is quicker than keeping detailed time-records. Fred is also careful not to ask too many questions about clients affairs when preparing personal and company taxation returns. His clients are grateful that Fred does not pry too far into their affairs, although the taxation authorities have found some irregularities in some tax returns submitted by Fred. Fortunately the client has always accepted responsibility for the errors and Fred has kindly provided his services fre of charge for the next year to assist the client with any financial penalties Required: Discuss whether the moral stance taken by Fred is appropriate.

Test your understanding 2 – Key concepts Fred is a certified accountant. He runs his own accountancy practice fro home, where he prepares personal taxation and small business account for about 75 clients. Fred believes that he provides a good service and his clients generally seem happy with the work Fred provides. At work, Fred tends to give priority to his business friends that he plays golf with. Charges made to these clients tend to be lower than others - although Fred tends to guess how much each client should be charged this is quicker than keeping detailed time-records. Fred is also careful not to ask too many questions about clients affairs when preparing personal and company taxation returns. His clients are grateful that Fred does not pry too far into their affairs, although the taxation authorities have found some irregularities in some tax returns submitted by Fred. Fortunately the client has always accepted responsibility for the errors and Fred has kindly provided his services fre of charge for the next year to assist the client with any financial penalties Required: Discuss whether the moral stance taken by Fred is appropriate.

Chapter26: Tax Practice And Ethics

Section: Chapter Questions

Problem 3RP

Related questions

Question

Transcribed Image Text:Test your understanding 2- Key concepts

Fred is a certified accountant. He runs his own accountancy practice from

home, where he prepares personal taxation and small business accounts

for about 75 clients. Fred believes that he provides a good service and

his clients generally seem happy with the work Fred provides.

At work, Fred tends to give priority to his business friends that he plays

golf with. Charges made to these clients tend to be lower than others -

although Fred tends to guess how much each client should be charged as

this is quicker than keeping detailed time-records.

Fred is also careful not to ask too many questions about clients affairs

when preparing personal and company taxation returns. His clients are

grateful that Fred does not pry too far into their affairs, although the

taxation authorities have found some irregularities in some tax returns

submitted by Fred. Fortunately the client has always accepted

responsibility for the errors and Fred has kindly provided his services free

of charge for the next year to assist the client with any financial penalties.

Required:

Discuss whether the moral stance taken by Fred is appropriate.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 4 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781337280570

Author:

Scott, Cathy J.

Publisher:

South-Western College Pub

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781337280570

Author:

Scott, Cathy J.

Publisher:

South-Western College Pub

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning