Compute: 1. The minimum required return by Cross-Ocean’s preferred shareholders 2. The overall minimum required return for Cross-Ocean’s stakeholders

Q: Golf Ball Inc. expects earnings to be $10,000 per year in perpetuity if it pays out all of its…

A: Amount invested in upgrading is $1000 Earnings is $10,000 Required rate of return is 12%.

Q: is/are generally the least liquid asset that a corporation possesses Select one: O a. Cash O b.…

A: Inventory is generally the least liquid current asset that a firm possesses. This is due to the…

Q: Certain Concrete Company deposits $2,000 at the end of each quarter into an account paying 11%…

A: A series of periodical equal cash flows over a finite period is referred to as annuity. Since the…

Q: Question 9 Dividends on CCN corporation are expected to grow at a 9% per year. Assume that the…

A: Fundamental price of the share is calculated using Gordon Growth formula. It determines whether the…

Q: A $8500 bond bearing interest at 4.3% payable semi-annually is due in 7 years. Money is worth 5.9%…

A: Par value = $8500 Coupon rate = 4.3% Frequency of payment = Semi annual

Q: The risk-free rate is 3 percent, the expected return on the PSEi is 13 percent, and its standard…

A: Here, Risk Free Rate is 3% Expected Return of Market is 13% Standard Deviation of Market is 23%…

Q: What is the capital structure of this company based on market values? Bond issue #1, maturity 12…

A: The Capital Structure consists of different sources of funds that are mainly used for financing the…

Q: Suppose that there is a constant technological progress (A) and population growth (n) in a sample…

A: The technical process is technology's work technique, and it consists of an organized series of…

Q: 1. Compute the payback period for the new equipment. Round your answer to two decimal places. fill…

A: Payback period is the period within which the sum invested by the company in a project will be…

Q: Auto Tires, Inc. sells tires to service stations for an average of $45 each. The variable costs of…

A: Break even level is calculated as ratio of fixed costs and contribution margin per tire

Q: a. Calculate the interest component of Payment 30. Interest component of Payment 30 $C b. Calculate…

A: Loan amortization refers to a schedule which is prepared to shows the periodic loan payments, amount…

Q: What is the value of a perpetuity of P100 per year if the discount rate is 5% and the cash flows do…

A: Present Value: It represents the present value of the future sum of the amount and is computed by…

Q: What value due financial ratios offer investors in reviewing the financial performance of firms?

A: A ratio is an arithmetical relationship between two different figures. Financial ratio analysis is a…

Q: how much money

A: The amount borrowed refers to the principal amount which is borrowed from the bank or financial…

Q: The exact simple interest on P450 for the period from January 10, 2004 to a "specific date" is P…

A: Exact simple interest is P450 Start date is January 10, 2004 Interest amount is 70.22 Interest rate…

Q: Ashley received a loan of $1,300 at 4.25% compounded quarterly. She had to make payments at the end…

A: We need to use loan amortization formula to calculate quarterly payment. PMT =P*i1-1(1+i)n where…

Q: A $30 000, 3% bond redeemable at par is purchased 7 years before maturity to yield 5.5% compounded…

A: Par value (FV) = $30,000 Coupon rate = 3% Quarterly coupon amount (C) = 30,000*0.03/4 = $225 Years…

Q: bugh Syron Books Inc. recently reported $18 million of net income. Its EBIT was $25.2 million, and…

A: First we need to calculate earning before tax by using this equation Earning before tax =Net…

Q: A price level adjusted mortgage (PLAM) is made with the following terms: Amount $95,800 Initial…

A: Given: Particulars Amount Amount $95,800 Interest rate 4% Term 30 Points 6% Inflation…

Q: Compare the intarest earned by $8,000 for five years at 8% simpile interest with interest eamed by…

A: Simple interest is different from compound interest. In case of compound interest the interest is…

Q: On January 2, 2021, an Australian Copper Exploration Company was investigating the feasibility of…

A: Net present value is the difference between the present value of cash inflows and present value of…

Q: X-treme Vitamin Company is considering two investments, both of which cost $20,000. The cash flows…

A: The payback period is the amount of time required to break even, i.e., to recover the initial…

Q: If the actual benefits turned out to be $590 million in year 1 (8,) and then no further benefits.…

A: The bid amount: The maximum amount that the City of Nairobi can bid is the present value of the…

Q: Over time, a portfolio manager’s cumulated trade implementation shortfall will equal

A: Trade implementation shortfall is Cumulated direct transaction costs and liquidity costs , Cumulated…

Q: Beatrice wants to buy one of the bonds below. Calculate the price she would have to pay. Assume both…

A: Here, Coupon Rate of ABC and DEF is 5% Face Value of ABC and DEF is 10,000 Yield of ABC and DEF is…

Q: payback period for Project A and Project B

A: Net present value refers to the amount of discounted cash flow that is used to calculate the present…

Q: You are a portfolio manager of a global equity fund of funds UITF. You decided to hold a portfolio…

A: The portfolio expected return is calculated as sum of weighted return of each investment. Weight of…

Q: Question 6 Assume that a bond makes 10 equal annual payments of \$1,000$1,000 starting one year…

A: The current price of bond is calculated as the present value of coupon and one time payment

Q: Jane has $6000 invested at 7% and 8%. How many dollars would she have to invest at 8% so that her…

A: Here we will have to determine how much money has been invested in each so that total interest is…

Q: Find the monthly payment for the loan. (Round your answer to the nearest cent.) New-car financing…

A: The monthly payment on the car loan can be calculated with the help of present value of annuity…

Q: a. Determine the interest rate if the money was compounded continuously. b. Determine the effective…

A: Effective annual rate (EAR) refers to a real interest rate which an investor is expect from his…

Q: Nick buys a $25 000, 5.4% bond with quarterly interest coupons, 3 years before maturity, to yield…

A: Par value (FV) = $25,000 Coupon rate = 5.4% Coupon amount (C) = 25000*0.054/4 = $337.50 Years to…

Q: Adam purchases a retirement annuity that will pay him $1,500 at the end of every six months for the…

A: Semi Annual Payment $ 1,500.00 Time Period (years) 8 Interest rate 4% Monthly…

Q: Which of the following firms is the most leveraged? O Cash coverage ratio 1.64 Cash coverage ratio…

A: Hi There, Thanks for posting the questions. As per our Q&A guidelines, must be answered only one…

Q: When purchasing a $100,000 house, a borrower is comparing two loan alternatives. The first loan is…

A:

Q: The risk free rate of interest is 2.0%. Inflation is expected to be 8.0% this year, 6.5% next year…

A: The rate on the bond can be calculated by adding up the risk-free rate, average inflation, liquidity…

Q: 2) Assume there are two bidders who are competing at a private-value auction, decided by a sealed…

A: The object will be offered to the bidder with the highest valuation at a price equal to their…

Q: Network Systems is introducing a new network card. Suppose Network Systems knows its fixed costs are…

A: Breakeven refers to the point at which the original cost equals the market price which is determined…

Q: A man bonowed $3700 from a bank for 6 months A friend was cosigner of the man's personal note. The…

A: On simple interest it should be noted that the interest amount is computed only on the principal…

Q: Companies often come across projects that have positive NPV opportunities in which the company does…

A: Net present value is the difference between the present value of cash inflows and present value of…

Q: a. Pay-back period b. Discounted Pay-back period c. Internal Rate of Return (IRR)

A: Payback period is the period within which the sum invested by the company in a project will be…

Q: following table contains data to calculate forward rates using pure expectations theory. a) Find the…

A: Solved in excel using forward rate formulas

Q: Refer to the balance sheet below for the Bank of Pecunia. Assets Liabilities $1,630 Deposits held by…

A: When Bank of pecunia purchases $230 worth of foreign assets then, Cash (i,eDomestic Assets)…

Q: A lottery offers you a choice of $1,000,000 per year for 30 years or a lump-sum payment. What…

A: Solution: - When an equal amount is paid each period, it is called as annuity.

Q: Teal and Associates needs to borrow $65,000. The best loan they can find is one at 12% that must be…

A: An amortization is referred to as loan where the amount is reduced gradually on basis of fixed…

Q: Write the present value function, letting x represent the number of years.

A: Given thatF = future value = $50,000Interest rate = r = 2.8% = 0.028Number of period per year =…

Q: A $660,000 townhome in Richmond Hill was purchased with a down payment of 20% of the amount. A…

A: Given That: Cost of Townhome=$660000 Down payment = 20% Down payment amount = 20% of…

Q: You decide to provide yourself with a retirement account by depositing X into an account at the…

A: An immediate annuity is an ordinary annuity where the payments start immediately after being…

Q: Albatross Airline’s fixed operating costs are $5.7 million, and its variable cost ratio is 0.25. The…

A: Given: Particulars Amount Sales $10,000,000 Fixed cost $5,700,000 Shares 70000 Preference…

Q: Which of the following factors is/are included in Fama and French’s (2015, “A five-factor asset…

A: The Fama/French 5 factors are made up of six value-weight portfolios based on size and…

Compute:

1. The minimum required return by Cross-Ocean’s preferred shareholders

2. The overall minimum required return for Cross-Ocean’s stakeholders

Step by step

Solved in 2 steps with 2 images

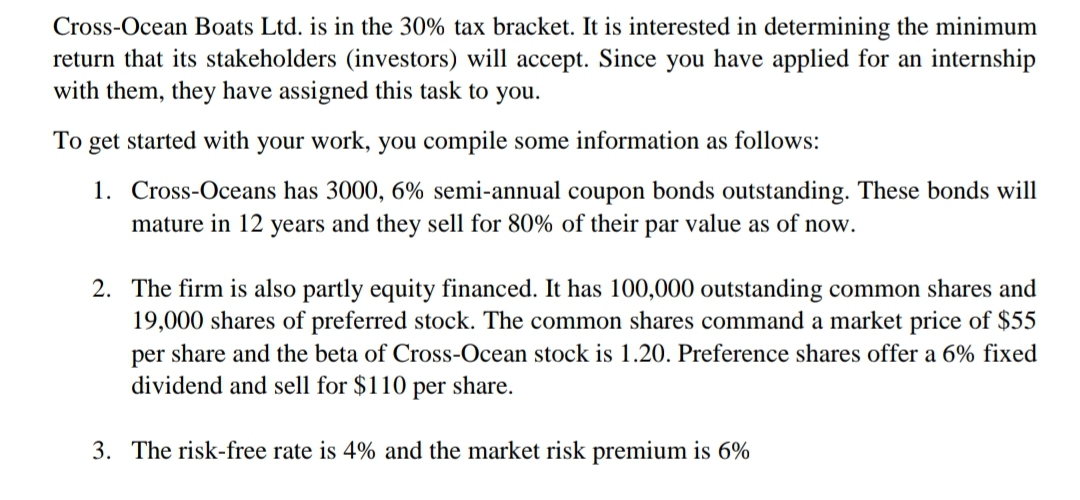

- Cross-Ocean Boats Ltd. is in the 30% tax bracket. It is interested in determining the minimumreturn that its stakeholders (investors) will accept. Since you have applied for an internshipwith them, they have assigned this task to you.To get started with your work, you compile some information as follows: a. Cross-Oceans has 3000, 6% semi-annual coupon bonds outstanding. These bonds willmature in 12 years and they sell for 80% of their par value as of now. b. The firm is also partly equity financed. It has 100,000 outstanding common shares and19,000 shares of preferred stock. The common shares command a market price of $55per share and the beta of Cross-Ocean stock is 1.20. Preference shares offer a 6% fixeddividend and sell for $110 per share. c. The risk-free rate is 4% and the market risk premium is 6%Armed with this information, compute: 1. The minimum required return by Cross-Ocean's debtholdesrs 2. The minimum required return by Cross-Ocean's common shareholders 3. The minimum…Cross-Ocean Boats Ltd. is in the 30% tax bracket. It is interested in determining the minimumreturn that its stakeholders (investors) will accept. Since you have applied for an internshipwith them, they have assigned this task to you. To get started with your work, you compile some information as follows: a. Cross-Oceans has 3000, 6% semi-annual coupon bonds outstanding. These bonds willmature in 12 years and they sell for 80% of their par value as of now. b. The firm is also partly equity financed. It has 100,000 outstanding common shares and19,000 shares of preferred stock. The common shares command a market price of $55per share and the beta of Cross-Ocean stock is 1.20. Preference shares offer a 6% fixeddividend and sell for $110 per share. c. The risk-free rate is 4% and the market risk premium is 6%Armed with this information, compute: 4. The overall minimum required return for Cross-Ocean’s stakeholders. N.B. Show all workingsCross-Ocean Boats Ltd. is in the 30% tax bracket. It is interested in determining the minimumreturn that its stakeholders (investors) will accept. Since you have applied for an internshipwith them, they have assigned this task to you. To get started with your work, you compile some information as follows: 1. Cross-Oceans has 3000, 6% semi-annual coupon bonds outstanding. These bonds willmature in 12 years and they sell for 80% of their par value as of now. 2. The firm is also partly equity financed. It has 100,000 outstanding common shares and19,000 shares of preferred stock. The common shares command a market price of $55per share and the beta of Cross-Ocean stock is 1.20. Preference shares offer a 6% fixeddividend and sell for $110 per share. 3. The risk-free rate is 4% and the market risk premium is 6% Armed with this information, compute: 1. The minimum required return by Cross-Ocean’s debtholders 2. The minimum required return by Cross-Ocean’s common shareholders 3. The minimum…

- Cross-Ocean Boats Ltd. is in the 30% tax bracket. It is interested in determining the minimumreturn that its stakeholders (investors) will accept. Since you have applied for an internshipwith them, they have assigned this task to you.To get started with your work, you compile some information as follows:1. Cross-Oceans has 3000, 6% semi-annual coupon bonds outstanding. These bonds willmature in 12 years and they sell for 80% of their par value as of now.2. The firm is also partly equity financed. It has 100,000 outstanding common shares and19,000 shares of preferred stock. The common shares command a market price of $55per share and the beta of Cross-Ocean stock is 1.20. Preference shares offer a 6% fixeddividend and sell for $110 per share.3. The risk-free rate is 4% and the market risk premium is 6%Armed with this information, compute: 4. The overall minimum required return for Cross-Ocean’s stakeholders.Cross-Ocean Boats Ltd. is in the 30% tax bracket. It is interested in determining the minimumreturn that its stakeholders (investors) will accept. Since you have applied for an internshipwith them, they have assigned this task to you.To get started with your work, you compile some information as follows:1. Cross-Oceans has 3000, 6% semi-annual coupon bonds outstanding. These bonds willmature in 12 years and they sell for 80% of their par value as of now.2. The firm is also partly equity financed. It has 100,000 outstanding common shares and19,000 shares of preferred stock. The common shares command a market price of $55per share and the beta of Cross-Ocean stock is 1.20. Preference shares offer a 6% fixeddividend and sell for $110 per share.3. The risk-free rate is 4% and the market risk premium is 6% Armed with this information, compute:4. The overall minimum required return for Cross-Ocean’s stakeholders. Please show full workings (without the use of microsoft excel)Cross-Ocean Boats Ltd. is in the 30% tax bracket. It is interested in determining the minimumreturn that its stakeholders (investors) will accept. Since you have applied for an internshipwith them, they have assigned this task to you.To get started with your work, you compile some information as follows:1. Cross-Oceans has 3000, 6% semi-annual coupon bonds outstanding. These bonds willmature in 12 years and they sell for 80% of their par value as of now.2. The firm is also partly equity financed. It has 100,000 outstanding common shares and19,000 shares of preferred stock. The common shares command a market price of $55per share and the beta of Cross-Ocean stock is 1.20. Preference shares offer a 6% fixeddividend and sell for $110 per share.3. The risk-free rate is 4% and the market risk premium is 6%Armed with this information, compute:1. The minimum required return by Cross-Ocean’s debtholders 2. The minimum required return by Cross-Ocean’s common shareholders 3. The minimum required…

- Cross-Ocean Boats Ltd. is in the 30% tax bracket. It is interested in determining the minimum return that its stakeholders (investors) will accept. Since you have applied for an internship with them, they have assigned this task to you. To get started with your work, you compile some information as follows: Cross-Oceans has 3000, 6% semi-annual coupon bonds outstanding. These bonds will mature in 12 years and they sell for 80% of their par value as of now. The firm is also partly equity financed. It has 100,000 outstanding common shares and 19,000 shares of preferred stock. The common shares command a market price of $55 per share and the beta of Cross-Ocean stock is 1.20. Preference shares offer a 6% fixed dividend and sell for $110 per share. The risk-free rate is 4% and the market risk premium is 6% Armed with this information, compute: The minimum required return by Cross-Ocean’s preferred shareholders The overall minimum required return for Cross-Ocean’s…Cross-Ocean Boats Ltd. is in the 30% tax bracket. It is interested in determining the minimum return that its stakeholders (investors) will accept. Since you have applied for an internship with them, they have assigned this task to you. To get started with your work, you compile some information as follows: Cross-Oceans has 3000, 6% semi-annual coupon bonds outstanding. These bonds will mature in 12 years and they sell for 80% of their par value as of now. The firm is also partly equity financed. It has 100,000 outstanding common shares and 19,000 shares of preferred stock. The common shares command a market price of $55 per share and the beta of Cross-Ocean stock is 1.20. Preference shares offer a 6% fixed dividend and sell for $110 per share. The risk-free rate is 4% and the market risk premium is 6%. Question 1 - What is the minimum required return by Cross-Ocean’s debtholders?Question 2 - What is the minimum required return by Cross-Ocean’s common shareholders?Question 3 - What…Cross-Ocean Boats Ltd. is in the 30% tax bracket. It is interested in determining the minimum return that its stakeholders (investors) will accept. Since you have applied for an internship with them, they have assigned this task to you. To get started with your work, you compile some information as follows: Cross-Oceans has 3000, 6% semi-annual coupon bonds outstanding. These bonds will mature in 12 years and they sell for 80% of their par value as of now. The firm is also partly equity financed. It has 100,000 outstanding common shares and 19,000 shares of preferred stock. The common shares command a market price of $55 per share and the beta of Cross-Ocean stock is 1.20. Preference shares offer a 6% fixed dividend and sell for $110 per share. The risk-free rate is 4% and the market risk premium is 6% Armed with this information, compute: The minimum required return by Cross-Ocean’s debtholders The minimum required return by Cross-Ocean’s common shareholders The minimum required…

- Cross-Ocean Boats Ltd. is in the 30% tax bracket. It is interested in determining the minimum return that its stakeholders (investors) will accept. Since you have applied for an internship with them, they have assigned this task to you. To get started with your work, you compile some information as follows: Cross-Oceans has 3000, 6% semi-annual coupon bonds outstanding. These bonds will mature in 12 years and they sell for 80% of their par value as of now. The firm is also partly equity financed. It has 100,000 outstanding common shares and 19,000 shares of preferred stock. The common shares command a market price of $55 per share and the beta of Cross-Ocean stock is 1.20. Preference shares offer a 6% fixed dividend and sell for $110 per share. The risk-free rate is 4% and the market risk premium is 6% Armed with this information, compute: a. The minimum required return by Cross-Ocean’s debtholders b. The minimum required return by Cross-Ocean’s common shareholders c. The…Cross-Ocean Boats Ltd. is in the 30% tax bracket. It is interested in determining the minimum return that its stakeholders (investors) will accept. Since you have applied for an internship with them, they have assigned this task to you. To get started with your work, you compile some information as follows: Cross-Oceans has 3000, 6% semi-annual coupon bonds outstanding. These bonds will mature in 12 years and they sell for 80% of their par value as of now. The firm is also partly equity financed. It has 100,000 outstanding common shares and 19,000 shares of preferred stock. The common shares command a market price of $55 per share and the beta of Cross-Ocean stock is 1.20. Preference shares offer a 6% fixed dividend and sell for $110 per share. The risk-free rate is 4% and the market risk premium is 6% Armed with this information, compute: The minimum required return by Cross-Ocean’s debtholders The minimum required return by Cross-Ocean’s common shareholdersCross-Ocean Boats Ltd. is in the 30% tax bracket. It is interested in determining the minimum return that its stakeholders (investors) will accept. Since you have applied for an internship with them, they have assigned this task to you. To get started with your work, you compile some information as follows: a. Cross-Oceans has 3000, 6% semi-annual coupon bonds outstanding. These bonds will mature in 12 years and they sell for 80% of their par value as of now. b. The firm is also partly equity financed. It has 100,000 outstanding common shares and 19,000 shares of preferred stock. The common shares command a market price of $55 per share and the beta of Cross-Ocean stock is 1.20. Preference shares offer a 6% fixed dividend and sell for $110 per share. c. The risk-free rate is 4% and the market risk premium is 6% Compute: a.The minimum required return by Cross-Ocean’s debtholders b. The minimum required return by Cross-Ocean’s common shareholders