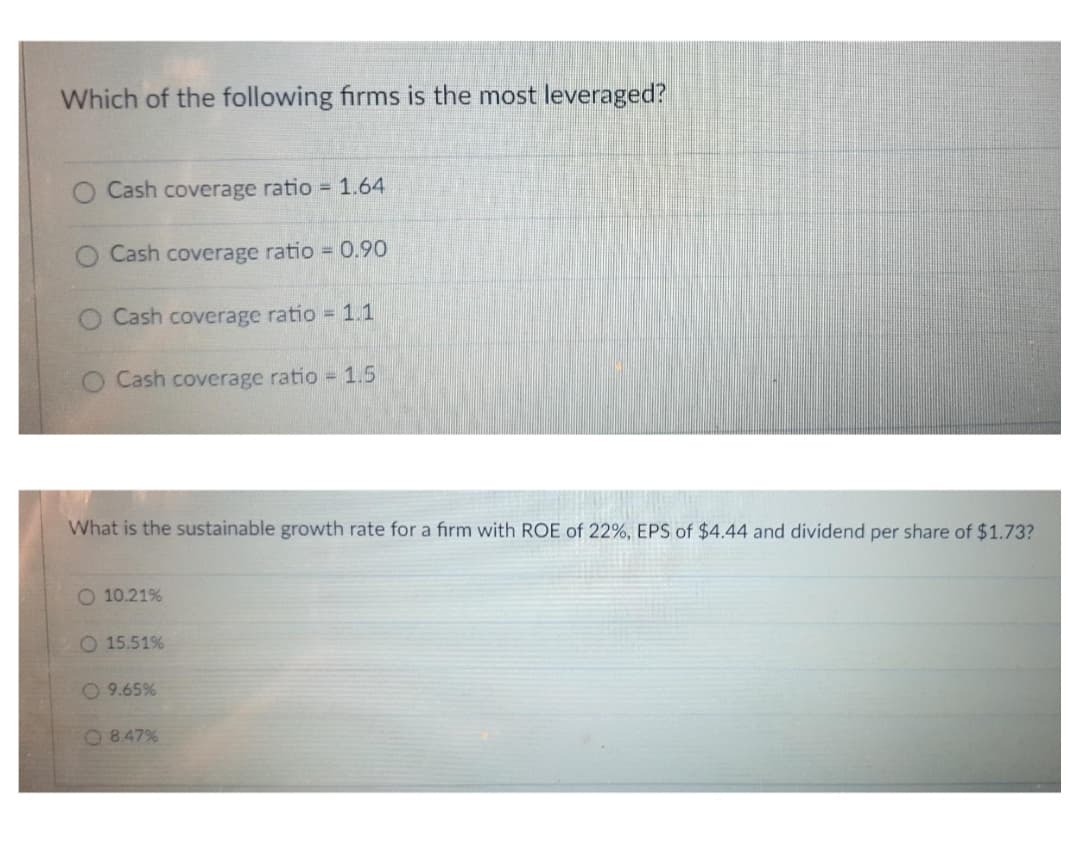

Which of the following firms is the most leveraged? O Cash coverage ratio 1.64 Cash coverage ratio 0.90 Cash coverage ratio 1.1 O Cash coverage ratio 1.5

Q: "Risk management is essentially about looking at your project goals and finding out what the dangers…

A: Project risk management is the process of identifying, analysing, and responding to any risk that…

Q: Torch Industries can issue perpetual preferred stock at a price of $61.00 a share. The stock would…

A: Cost of preferred stock = Annual dividend / Stock price where, Annual dividend = $4.50 Stock price =…

Q: Analyze below Cash Flow and compute for the unknown value. ... EOY (end of year) $5 $5 $5 $10 $15…

A: Here, Interest Rate (r) is 10% Compounding Period (m) is Semi Annual i.e 2 Payment Period (p) is…

Q: An investment banker would like to receive $1,200 at the beginning of every 3 months from her…

A: Quarterly payment = $1200 Interest rate = 3.3% Quarterly interest rate = 3.3%/4 = 0.825% Number of…

Q: A mortgage for a condominium had a principal balance of $41,400 that had to be amortized over the…

A: Compounding and discounting method of time value of money is used to calculate the equated monthly…

Q: 1.The first thing that the bank consider prior calling a bond issued a. lower interest in the…

A: As per Bartleby guidelines, since you have posted multiple questions, first 1 question will be…

Q: Title: Comparative Financial Analysis of Megawide Market Privatization vs. Alternative Market…

A: Given, Here, we have to compare the financial analysis of market privatization and market…

Q: Carson Electronics’ management has long viewed BGT Electronics as an industry leader and uses this…

A: a) Total Asset Turnover Ratio: i) Carson Inc = ( Net Sales / Total asset ) = 48,000 /24,000 = 2 ii)…

Q: Stock X has a 10% expected return, a beta coefficient of 0.9, and a 35% standard deviation of…

A: a) To find out which stock is riskier, should calculate Coefficient of Variation. Coefficient of…

Q: 29. A. $ You can earn a market rate of 6%. A. What is the monthly payment amount necessary to save…

A: Time value of money (TVM) is used to measure the value of money at different point of time in the…

Q: he Equator Principles set out a step-by-step process for 'green financial institutions.' Select…

A: There are many risk related to the finance of the projects and environmental and social have…

Q: Tan Company purchased a large server for $29,000. The company paid 30% of the value as a…

A: Loans are paid by monthly payment that carry the payment of interest and principal amount payment…

Q: Cross-Ocean Boats Ltd. is in the 30% tax bracket. It is interested in determining the minimum return…

A: “Since you have posted a question with multiple sub-parts, we will solve first three subparts for…

Q: QUESTION THREE You are considering purchasing a 20-year, $100, 12% coupon, bond, interest on which…

A: Face value (FV) = $100 Coupon rate = 12% Coupon amount (C) = 100*0.12 = $12 Years to maturity left…

Q: Out of the following options please tell me which are two dimensions or the main aspects of…

A: Budgeting is the process of making a plan for how person or organization will spend the money. A…

Q: Consider a XYZ stock index spot price is 69 and 7-months forward price is 70. The continuously…

A: The spot and forward rates: The spot rates are the rates prevailing at the current time. Forward…

Q: All else equal, an increase in the information asymmetry between informed traders and liquidity…

A: Asymmetric information causes illiquidity, which is then exacerbated by liquidity providers'…

Q: The following table shows the expected returns from six different stocks in three different states…

A: State of Economy Probability Return Stock A Return Stock B Growth 25.00% 31.00% 3.00% Status Quo…

Q: _____________ are used to measure the speed in which various accounts are converted into sales or…

A: Ratio analysis is a financial technique to measure the financial position of the company. It is the…

Q: An unavoidable cost may be met by outlays of $10,000 now and $1,000 at the end of every six months…

A: Given Outlay = $10,000 (now) & $1,000 at the end of every 6months for 4 years.

Q: albraith Co. is considering a four-year project that will require an initial investment of $9,000.…

A: NPV or the net present value is an important capital budgeting tool. It is the value of all future…

Q: Suppose that the R&B Beverage Company has a soft drink product that shows a constant annual demand…

A: Economic order quantity (EOQ) is a computation that businesses use to determine their ideal order…

Q: Maria's retirement fund has an accumulated amount of $50,000. If it has been earning interest at…

A: Given that: Monthly Interest rate =2.86%/12 =0.002383333%Quarterlyrate=(1+0.002383333)3-1=0.0071669…

Q: Deferred Annuity (please don’t use excel) 1. Find the present value of a deferred annuity of P1,250…

A: Since you have asked multiple questions, we will solve the first question for you. If you want any…

Q: Calculate the required rate of return for Mudd Enterprises assuming that investors expect a 3.2%…

A: Capital Asset Pricing Model (CAPM): CAPM is the method of calculating the expected return on…

Q: An investor holds a portfolio of stocks and is considering investing in the DBB Company. The firm’s…

A: Here,

Q: 4. A note having a face value of P9,300 was discounted at 11%. If the proceeds were 8,788.50. Find…

A: In order to calculate the term of the loan in months, where, other values viz. face value, discount…

Q: 1. Tim deposits P750 every end of 3 months in an account paying 5% interest compounded quarterly.…

A: “Hi There, Thanks for posting the questions. As per our Q&A guidelines, must be answered only…

Q: A $110,000 mortgage was amortized over 25 years by monthly repayments. The interest rate on the…

A: Given that: Effective annual Interest=(1+4.30%/2)2-1= 4.346225%Monthly…

Q: Over time, a portfolio manager’s cumulated trade implementation shortfall will equal

A: Trade implementation shortfall is Cumulated direct transaction costs and liquidity costs , Cumulated…

Q: Use the ordinary annuity formula shown to the right to determine the accumulated amount in the…

A: Future Value of Ordinary Annuity refers to the concept which determines the sum total of all the…

Q: are used to measure the speed in which various accounts are converted into sales or cash. Select…

A: Correct Option is 'C' =Activity Ratios

Q: Mary set up a fund that would pay her family $3,000 at the beginning of every month, in perpetuity.…

A: PV perpetuity will be the will be the size of investment in the fund. PV of perpetuity =Periodic…

Q: Find the semi-annual payment at the end of every six months, the first payment is due at the end of…

A: Compound Interest: It is the interest on a loan or deposit that is calculated based on both the…

Q: Three investments cost $7,000 each and have the following cash flows. Rank them on the basis of…

A: The payback period is the time to recover the cost of investment.

Q: Karsted Air Services is now in the final year of a project. The equipment originally cost $23…

A: Since equipment has been 100% depreciated;Book value as on date of sale = 0 Hence gain on sale =…

Q: An investment banker would like to receive $1,200 at the beginning of every 3 months from her…

A: Quarterly payment (Q) = $1200 Quarterly interest rate (r) = 3.3%/4 = 0.825% Number of quarterly…

Q: A firm reported the following financials for 2021: Sales revenue = $3,060 Accounts receivables =…

A: Earnings per share: Earnings per share is the earnings available for the equity shareholders of the…

Q: (16. A 28.5-acre parcel of land in Orange County sells for $4,100 per acre. What is the documen- 16.…

A: The documentary stamp tax rate =0.7003% Deed amount = 28.5*4100=116850

Q: A firm reported the following financials for 2021: Sales revenue = $3,060 Accounts receivables =…

A: The fraction of a company's profit assigned to each outstanding share of common stock is called…

Q: A 180-day simple interest note was signed on March 15, 20xx with a face value of 65,000 at 8.25% per…

A: We need to use simple interest formula to calculate discount amount. Discount amount =Face…

Q: Two young couples (all about to turn 25 years old) are discussing how to enjoy life. Couple X…

A: Given, Couple X and Y invests $2500 every month Term is 15 years Current age is 25 and investment is…

Q: QUESTION 1 What is the amount of the periodic payment made at the beginning of every month into a…

A: A periodic payment is an equal series of payments made by the investor or borrower. It includes…

Q: Unilever (UK firm) would like to borrow USD, and Coca-Cola (US firm) wants to borrow GBP. Coca-Cola…

A: Interest rates of Unilever (UK firm) and Coca-cola (US firm) Borrowing needed in USD rate GBP…

Q: Quantitative Problem: Today, interest rates on 1-year T-bonds yield 1.7%, interest rates on 2-year…

A: a) Annualized Forward rate of 1 year T-bond: 1years from now=((1+2Year…

Q: The security market line depicts: a. Expected return as a function of systematic risk (indicated…

A: The security market line (SML) is a graphical representation of the capital asset pricing model…

Q: ABC Bank has a AAA-rated, 15-year zero-coupon bond with a face value of $400 million. The yield to…

A: Modified Duration of Zero coupon Bond = (Macaulay duration of bond) /( 1+ Yield) Macaulay duration…

Q: Suppose that General Motors Acceptance Corporation issued a bond with 10 years until maturity, a…

A: Face value of bond = $1000 Years to maturity = 10 Years Number of coupon payments = 10 Coupon rate…

Q: A firm reported the following financials for 2021: Sales revenue = $3,060 %3D Accounts receivables =…

A: Sales = $3060 COGS = $1800 Total operating expenses = $600 Interest expenses = $126 Tax rate = 40%…

Q: When purchasing a $100,000 house, a borrower is comparing two loan alternatives. The first loan is…

A:

Trending now

This is a popular solution!

Step by step

Solved in 3 steps

- Assume the company has weight of debt WD = 70%, cost of debt RD = 13%, for un-leveraged firm: Bu =1; the company has Tax Rate = 30%, risk-free rate Rf = 3%, Market Return = 10%, free cash flow FCF0 = 200 million, growth rate g = 4%. Use the following formula for beta of leveraged company: B = Bu [1+ (1-T) × (WD /WS)], What is the WACC and what is the value of the firm?A firm is firanced with market values of $295 million in nsk-free debt and $575 million in equity. The firm's asset beta is 0.93. Assume a risk-free rate of 2.5%, a market risk-premium of 6.2% and a tax rate of 25%. Assume the firm's debt beta is 0. What is the firms after- tax weighted average cost of capital? (answer to the fourth decimal place)Trendsetters has a cost of equity of 14.6 percent. The market risk premium is 8.4 percent and the risk-free rate is 3.9 percent. The company is acquiring a competitor, which will increase the company's beta to 1.4. What effect, if any, will the acquisition have on the firm's cost of equity capital? a. Decrease of .84 percent b. No effect c. Increase of .13 percent d. Decrease of .62 percent e. Increase of 1.06 percent

- Consider the following security: Brous Metalworks Earnings Per Share, Time = 0 $2.00 Dividend Payout Rate 0.250 Return on Equity 0.150 Market Capitalization Rate 0.125 Required: Using the information in the tables above, please calculate the sustainable growth rate, dividends per share, and intrinsic value per share. Then solve for the present value of growth opportunities. (Use cells A5 to B8 from the given information to complete this question.) Brous Metalworks Sustainable Growth Rate Dividends per share (Next Year) Intrinsic Value No-Growth Value Per Share Present Value of Growth Opportunities (PVGO)A firm has decided that its optimal capital structure is 100% equity-financed. It perceives its optimal dividend policy to be a 60% payout ratio. Asset turnover is sales/assets = 0.6, the profit margin is 10%, and the firm has a target growth rate of 3%. a-1. Calculate the sustainable growth rate. (Do not round intermediate calculations. Enter your answer as a percent rounded to 1 decimal place.) a-2. Is the firm’s target growth rate consistent with its other goals? b. If the firm’s target growth rate is not consistent with its other goals, what would asset turnover need to be to achieve its goals? (Do not round intermediate calculations. Round your answer to 3 decimal places.) c. If the firm’s target growth rate is not consistent with its other goals, how high would the profit margin need to be to achieve its goals? (Do not round intermediate calculations. Enter your answer as a percent rounded to 1 decimal place.)A company is estimating its optimal capital structure. Now the company has a capital structure that consists of 20% debt and 80% equity, based on market values (debt to equity D/S ratio is 0.25). The risk-free rate (rRF) is 5% and the market risk premium (rM – rRF) is 6%. Currently the company’s cost of equity, which is based on the CAPM, is 14% and its tax rate is 20%. Find the firm’s current leveraged beta using the CAPM 1.0 1.5 1.6 1.7

- a) You are given the following information Jamuna Ltd Market price per share Tk. 400 Earnings per share Tk. 25 Dividend per share Tk. 10 P/E ratio 8 times Required (Using Walter’s model) i) Cost of equity, ii) D/P ratio, iii) Retention ratio, iv) Internal rate of return,v)Growth rate b) Explain the reasons why do investors prefer high or low pay out ratio? c) Why do you think Dividend Irrelevance theory is unrealistic?Coca-Cola Inc. (KO) has FCFF of $9.205 billion and FCFE of $7.554 billion. Coca-Cola’s WACC is 7.0 percent, and its required rate of return for equity is 8.5 percent. FCFF is expected to grow forever at 2.07 percent, and FCFE is expected to grow forever at 4.81 percent. Pfizer has debt outstanding of $52.867 billion. What is the total value of Coca-Cola’s equity using the FCFF valuation approach? B. What is the total value of Coca-Cola’s equity using the FCFE valuation approachRemember that the value of a firm with cost of equity R and dividend growth g is given by D(1)/(R-g), where D(1) is the dividend one year from now. Consider a firm that had a net income NI(0)=100M last year. What would be the value of the firm under the retention rates of 20%, 40%, 60% and 80%? Assume R=20% and ROE=10%

- Firm B has a capital intensity ratio of 2,optimal debt equity ratio of 1.5, and dividend payout ratio of 0.5. What profit margin must the firm achieve in orderto grow at a rate of 15% without new equity issue?A firm wants a sustainable growth rate of 2.73 percent while maintaining a dividend payout ratio of 39 percent and a profit margin of 6 percent. The firm has a capital intensity ratio of 2. What is the debt–equity ratio that is required to achieve the firm's desired rate of growth?To help them estimate the company's cost of capital, Smithco has hired you as a consultant. You have been provided with the following data: D1 = $1.45; P0 = $22.50; and gL = 6.50% (constant). Based on the dividend growth approach, what is the cost of common from reinvested earnings? Group of answer choices 12.94% 11.68% 12.30% 13.59% 11.10%