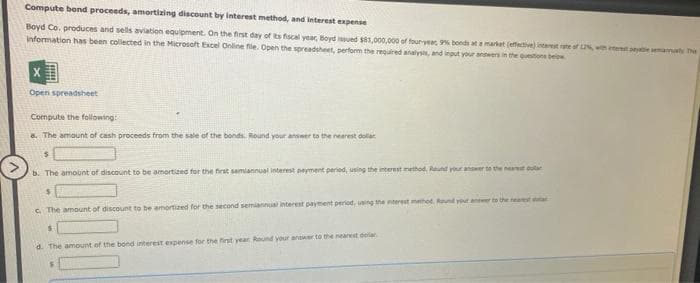

Compute bond proceeds, amortizing discount by interest method, and interest expense Boyd Co. produces and sells aviation equipment. On the first day of its fiscal year, Boyd issued $81,000,000 of four-year 9% bonds at a market (effective) interest rate of 2%, with extent selesema information has been collected in the Microsoft Excel Online file. Open the spreadsheet, perform the required analysis, and input your answers in the questions below. Open spreadsheet Compute the following: a. The amount of cash proceeds from the sale of the bonds. Round your answer to the nearest dollar S b. The amount of discount to be amortized for the first semiannual interest payment period, using the interest method, Round your answer to the ne $ c. The amount of discount to be amortized for the second semiannual interest payment period, using the interest method found your S d. The amount of the bond interest expense for the first year Round your answer to the nearest de

Compute bond proceeds, amortizing discount by interest method, and interest expense Boyd Co. produces and sells aviation equipment. On the first day of its fiscal year, Boyd issued $81,000,000 of four-year 9% bonds at a market (effective) interest rate of 2%, with extent selesema information has been collected in the Microsoft Excel Online file. Open the spreadsheet, perform the required analysis, and input your answers in the questions below. Open spreadsheet Compute the following: a. The amount of cash proceeds from the sale of the bonds. Round your answer to the nearest dollar S b. The amount of discount to be amortized for the first semiannual interest payment period, using the interest method, Round your answer to the ne $ c. The amount of discount to be amortized for the second semiannual interest payment period, using the interest method found your S d. The amount of the bond interest expense for the first year Round your answer to the nearest de

Cornerstones of Financial Accounting

4th Edition

ISBN:9781337690881

Author:Jay Rich, Jeff Jones

Publisher:Jay Rich, Jeff Jones

Chapter9: Long-term Liabilities

Section: Chapter Questions

Problem 75E

Related questions

Question

100%

Transcribed Image Text:Compute bond proceeds, amortizing discount by interest method, and interest expense

Boyd Co. produces and sells aviation equipment. On the first day of its fiscal year, Boyd issued $81,000,000 of four-year 9% bonds at a market (effective) interest rate of 2%, with test peale semanualy The

information has been collected in the Microsoft Excel Online file. Open the spreadsheet, perform the required analysis, and input your answers in the questions below

X

Open spreadsheet

Compute the following:

a. The amount of cash proceeds from the sale of the bonds. Round your answer to the nearest dollar

$

b. The amount of discount to be amortized for the first semiannual interest peyment period, using the interest method. Round your answer

$

c. The amount of discount to be amortized for the second semiannual interest payment period, using the interest method f

S

d. The amount of the bond interest expense for the first year Round your answer to the nearest der

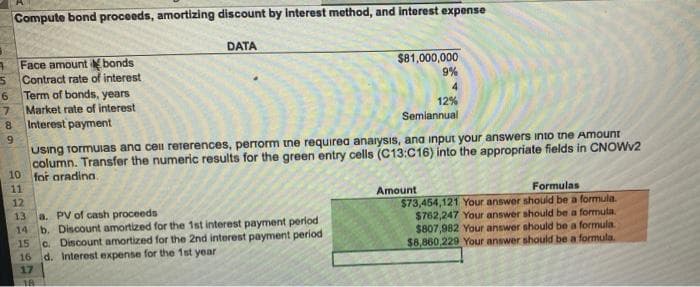

Transcribed Image Text:$81,000,000

9%

4

12%

Semiannual

Using Tormulas and cell references, perform the required analysis, and input your answers into the Amount

column. Transfer the numeric results for the green entry cells (C13:C16) into the appropriate fields in CNOWv2

10 for aradina.

Compute bond proceeds, amortizing discount by interest method, and interest expense

DATA

A Face amount bonds

5

Contract rate of interest

6

7

8

9

11

HARMSSA

Term of bonds, years

Market rate of interest

Interest payment

12

13 a. PV of cash proceeds

14 b. Discount amortized for the 1st interest payment period

c. Discount amortized for the 2nd interest payment period

16 d. Interest expense for the 1st year

15

17

18

Formulas

$73,454,121 Your answer should be a formula.

$762,247 Your answer should be a formula.

$807,982 Your answer should be a formula.

$8,860,229 Your answer should be a formula.

Amount

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 5 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Financial Reporting, Financial Statement Analysis…

Finance

ISBN:

9781285190907

Author:

James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Financial Reporting, Financial Statement Analysis…

Finance

ISBN:

9781285190907

Author:

James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

Publisher:

Cengage Learning