escription 6% Cumulative (non-participating), Preferred stock $5 par Additional Paid-In Capital - Preferred stock Common stock, $1 par Additional Paid-In Capital - Common stock Paid-In Capital - Expired Warrants Retained Earnings Treasury stock (50 shares of common stock at cost) Amount $100 20 300 50 Common Stock book value per share at December 31, YR09 is (round to nearest penny): e. None of the above 17 b. $1.21 d. $2.30 G. $1.56 5 40 60 her information: In May of YR09 the company purchased, as treasury stock, 50 common shares for $60. Preferred dividends were last declared and paid in YR07. The market price of the common stock was $2 at December 31, YR09. At December 31, YR09 the preferred stock was selling for $6 per share and the stock indenture agreement indicates the preferred stock has a liquidation value of $7 per share. 50

escription 6% Cumulative (non-participating), Preferred stock $5 par Additional Paid-In Capital - Preferred stock Common stock, $1 par Additional Paid-In Capital - Common stock Paid-In Capital - Expired Warrants Retained Earnings Treasury stock (50 shares of common stock at cost) Amount $100 20 300 50 Common Stock book value per share at December 31, YR09 is (round to nearest penny): e. None of the above 17 b. $1.21 d. $2.30 G. $1.56 5 40 60 her information: In May of YR09 the company purchased, as treasury stock, 50 common shares for $60. Preferred dividends were last declared and paid in YR07. The market price of the common stock was $2 at December 31, YR09. At December 31, YR09 the preferred stock was selling for $6 per share and the stock indenture agreement indicates the preferred stock has a liquidation value of $7 per share. 50

Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Chapter16: Retained Earnings And Earnings Per Share

Section: Chapter Questions

Problem 19P: Anoka Company reported the following selected items in the shareholders equity section of its...

Related questions

Question

please help me

Transcribed Image Text:c.

d.

e.

on state law

Outstanding shares

Outstanding shares

None of the above

iding shares

Issued or outstanding shares

depending on state law

Outstanding shares

Issued or outstanding shares

depending on state law

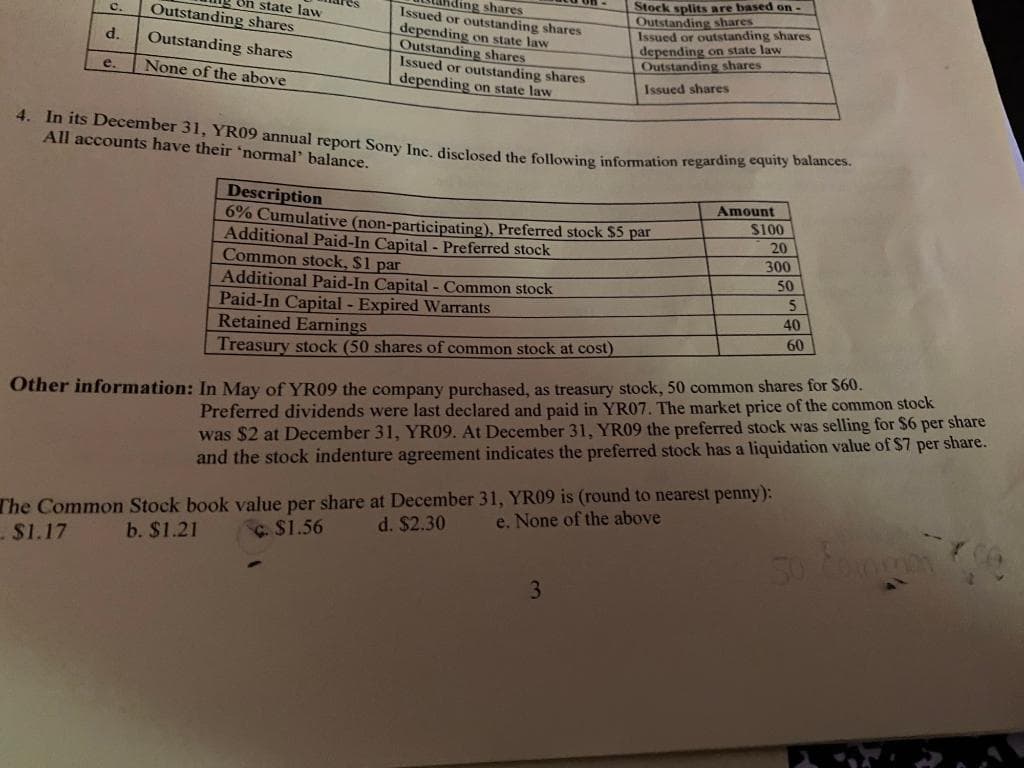

4. In its December 31, YR09 annual report Sony Inc. disclosed the following information regarding equity balances.

All accounts have their 'normal' balance.

Stock splits are based on-

Outstanding shares

Issued or outstanding shares

depending on state law

Outstanding shares

Issued shares

Description

6% Cumulative (non-participating), Preferred stock $5 par

Additional Paid-In Capital - Preferred stock

Common stock, $1 par

Additional Paid-In Capital - Common stock

Paid-In Capital - Expired Warrants

Retained Earnings

Treasury stock (50 shares of common stock at cost)

Amount

3

$100

20

300

The Common Stock book value per share at December 31, YR09 is (round to nearest penny):

e. None of the above

b. $1.21

d. $2.30

$1.17

C. $1.56

50

5

40

Other information: In May of YR09 the company purchased, as treasury stock, 50 common shares for $60.

Preferred dividends were last declared and paid in YR07. The market price of the common stock

was $2 at December 31, YR09. At December 31, YR09 the preferred stock was selling for $6 per share

and the stock indenture agreement indicates the preferred stock has a liquidation value of $7 per share.

60

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,

Financial Accounting

Accounting

ISBN:

9781337272124

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning