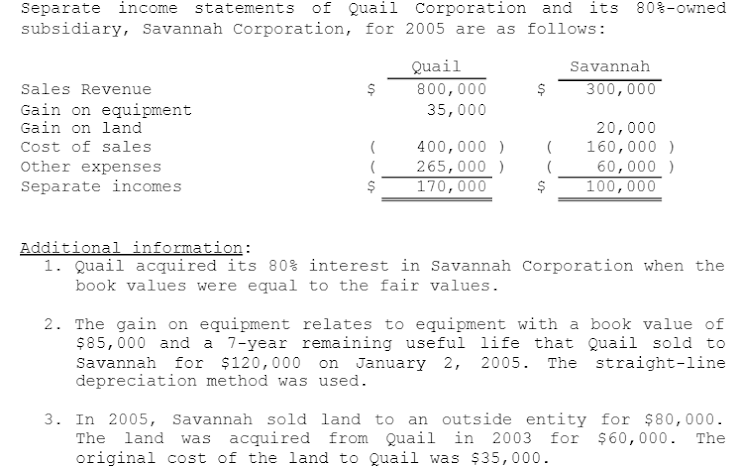

Compute for the consolidated net income.

Q: Elon Musk mentioned in a tweet that over the past few months Bitcoin's energy consumption was…

A: Answer:- Bitcoins meaning:- Bitcoin is a kind of digital currency or money that runs independently…

Q: E The statement of financial position of L, M, and N just before liquidat shows the following Cash P…

A: >In the event of dissolution of a partnership, the following steps are taken for payment:[1] Non…

Q: A printing machine initially costs ₱141,000. It can be sold for ₱15,000 at the end of its 14-year…

A: Straight line depreciation rate = 1/14 x 100 = 7.14% double declining balance method rate 7.14% x 2…

Q: H Company acquires 100% of the voting stock of R Company on January 1, 2021 for P400,000 cash. A…

A: Purchase Consideration: The term "Purchase Consideration" refers to the monetary payment made by the…

Q: How much is the average daily disbursement float? How much is the average daily collection float?…

A: The net float is calculated as difference in average daily disbursement float and average daily…

Q: ing:

A:

Q: Find the present value of the following stream of cash flows, assuming that the firm’s required…

A: >Present value is the value of future value that can be earned today. >This can get…

Q: Determine the Tax Credit Relief (if any) due to Professor Mohammed Ibrahim in the year 2019. The…

A: Tax credit relief is a form of tax relief that directly reduces the amount of tax owed(not taxable…

Q: Compute for the variances of the problem using the information given. Answer the numbers only up to…

A: Here, the standard cost has been used for the calculations. However, for labor rate variance…

Q: nds that it can draw on. o reduce collection time t wear to operate.

A: Lock box is a system where that can be utilized to reduce the time between customer sending a check…

Q: echnical & Ethical Issues with Tax Sky recently spoke to her father who is an experienced…

A: Here asked for multi question we will solve for first question for you as per Q/A guidelines. If you…

Q: 7. The following are the number of units produced and total cost of production of Company ZYX for…

A: High-low Method:- Under this method, difference between the total cost at highest and lowest volume…

Q: Calculate the Investment in S shown on P's ledger at December 31, 2014. Calculate the Investment…

A: For the year ending Dec 31, 2014 Acquisition cost i.e $25,00,000 X 90% = $22,50,000 Less: Excess…

Q: National Co.’s evaluation of its cash outlay required indicates that it needs 500,000 for the year.…

A: Since you have asked multiple questions, we will solve the first question for you. If you want any…

Q: DC Company purchased 100% of the outstanding common shares of FA Company on December 31, 20X3 for…

A: At the time of business combination, if the fair value of an asset exceeds its carrying amount, the…

Q: piece of equipment costs ₱399,000 including shipping, installation and taxes. The supplier assures a…

A: Solution concept sum of years digit method Under sum of years depreciation is charged on the basis…

Q: 1 A company purchased factory equipment on April 1, 2022 for $160,000. It is estimated that the…

A: Since you have posted a multiple questions, we will solve first question for you. if you want any…

Q: 8. Mr. Diamond expects to invest $1000 per year for each of the next 20 years in an investment plan…

A: Given: - Annual deposit= $1,000 Number of payment= 20 Interest rate= 10% Number of withdrawal= 60…

Q: er the following questions. Q.1 Identify and motivate the transaction processing taking place in…

A: The canteen at the college where I am enrolled is really crowded. Orders can be placed and paid for…

Q: 35 An intangible asset is considered impaired when its carrying value is greater than its…

A: An asset shall be considered impaired if its carrying value exceeds the recoverable value of such…

Q: A first-year ZU business students states: "There is no use in calculating financial ratios, because…

A: Before proving the validation of the given statement, it is essential to understand that what is the…

Q: Whispering Winds Company manufactures tablecloths. Sales have grown rapidly over the past 2 years.…

A: The flexible overhead budget is prepared on the basis of budgeted costs as decided by the company.

Q: Gillespie Gold Products, Inc., is considering the purchase of new smelting equipment. The new…

A: ATCF is after tax cash flow is the measurement o0f the performance of the company, that shows the…

Q: Hillary Company holds 10,000 shares of its P100 par value ordinary share capital as treasury shares…

A: Treasury stocks are repurchased shares of the company.The firm has the power to re issue these…

Q: 1. Initial amount of the investment 2. Carrying value of the investment at the end of 2026. 3.…

A:

Q: You are faced with making a decision on a large capital investment proposal. The capital investment…

A: As per our protocol we provide solution to one question only and you have asked multiple questions…

Q: (b) A design company seeks a return on investment of 6. The wafer costs $2500 and holds 450 gross…

A: Cost is to be bifurcated to all units and the selling price per unit is to be calculated. Then, the…

Q: On October 1, Ebony Ernst organized Ernst Consulting; on October 3, the owner contributed $83,540 in…

A: The income statement is an essential part of the financial statements of the company. It is prepared…

Q: P Company acquired 90% of S Corporation on January 1, 2014 for $2,250,000. S had net assets at that…

A: The net income increases the balance of retained earnings. Whereas, the dividend decreases the…

Q: National Co.’s evaluation of its cash outlay required indicates that it needs 500,000 for the year.…

A: when determining the optimal level of cash it is necessary to considered the opportunity as cost…

Q: How much would you have in your account at the end of 10 years if you deposit $2,000 into the…

A: Solution Continuous compounding is where the compounding is done continuously Mathematically Future…

Q: Balmforth Products, Inc. makes and sells a single product called a Bik. It takes three yards of…

A: Ending inventory of May = 14,500 units x 3 yards x 20% = 8,700 yards Production requirement = 12,600…

Q: How much is the loss on patent obsolescence?

A: Particulars Amount Balance of patents as of 1st January, 2018 P120,000 Less:- Accumulated…

Q: National Co.’s evaluation of its cash outlay required indicates that it needs 500,000 for the year.…

A: Since you have asked multiple questions, we will solve the first question for you. If you want any…

Q: The Central Division of Burlington Company reported the following operating data for the past year:…

A: Residual income: Residual income means the excess of income earned over the desired income. Desired…

Q: The cost of internally generated intangible asset comprises all expenditures that can be directly…

A: Lets understand the basics. Intangible asset is required to recognized when it is probable that the…

Q: Cookie Corporation reported the following amount in the shareholders’ equity section of its December…

A: Stockholder's Equity - Stockholder's Equity includes the amount contributed by shareholders issued…

Q: 6. Contracting company plans to update its equipment so that its trucks are replaced after five…

A: As per the concept of time value of money the worth of money changes with passage of time because…

Q: The future value of an ordinary annuity of $2,000 each year for 10 years, deposited at 12%, is:

A: The future value of ordinary annuity is calculated when the payments are made at end of the year. In…

Q: Yani Inc. is a wholly owned subsidiary of Pakito Corporation. The following are excerpts from the…

A: Calculation of Gross Profit % of Pakito Corp. = 750,000 / (2,500,000)*100 =30%

Q: Explain and Give recommendation and lesson learned

A: We are given the liquidity ratios of an organization over 5 years from 2016-2020. The liquidity…

Q: The entry to record the May 3 transaction is

A: The entry to record the May 3 transaction is: Particulars Dr. Cr. Cash $10000…

Q: g two mutuall

A: Given as,

Q: nts for next six years if beginning at end

A: Calculating the present value of four equal annual deposits of $1000.

Q: Under weighted average method, the equivalent units used to compute the unit costs of ending…

A: Answer to (1): Under weighted average method, the equivalent units used to compute the unit costs of…

Q: 12 A partner invests into a partnership a building with a $25,000 carrying value and $40,000 fair…

A: As posted multiple independent questions we are answering only first question kindly repost the…

Q: Given the following cost and activity observations for Wondrous Company's utilities, use the…

A: High low method: Variable cost per unit = (Highest activity cost - Lowest activity cost) / (Highest…

Q: Accumulate ₱42,650 for 3 years and 8 months at 13.75% simple discount.

A: calculation of simple interest is done by just multiplying the principal amount with the rate of…

Q: n Jan. 17, 2021, after all non-cash assets had been realized and all available cash had been…

A: Liquidation when all the partners or any one of them became insolvent then the business of the…

Q: Bamboo Consulting is a consulting firm owned and operated by Lisa Gooch. The following end-of-period…

A: Financial Statements: Financial statements are a set of reports that summarise an organization's…

Compute for the consolidated net income.

Step by step

Solved in 2 steps

- Macon Mills is a division of Bolin Products. Inc. During the most recent year, Macon had a net income of $40 million. Included in the income was interest expense of $2,800,000. The companys tax rate was 40%. Total assets were $470 million, current liabilities were $104,000,000, and $72,000,000 of the current liabilities are noninterest bearing. What are the invested capital and ROI for Macon?The following data are taken from the records of Dove Company, a division of Oasis Corporation for the year ended December 31, 2021 Sales 120,000,000.00Less: Variable Cost and Expenses 8,000,000.00Contribution Margin 4,000,000.00Less:: Direct Fixed Cost and Expenses 1,000,000.00Segment Income 3,000,000.00 The company used an average assets of P8,000,000.00 in 2021. The cost of capital is 12% Calculate the following:1. Return on Sales2. Asset Turnover3. ROI4. Residual IncomeComparative income statements of Sub Corporation for the calendar years 2019, 2020, and 2021 are as follows (in thousands): 2019 2020 2021Sales $22,000 $18,500 $19,250Cost of sales 10,600 9,900 10,100Gross profit 11400 8600 9150Operating expenses 5,700 5,500 6,000Net income $ 5700 $ 3100 $ 3150ADDITIONAL INFORMATION1. Sub was an 80 percent-owned subsidiary of Pub Corporation throughout the 2019–2021 period. Pub’s separate income (excludes income from Sub) was $7,200,000, $6,600,000, and $7,500,000 in 2019, 2020, and 2021, respectively. Pub acquired its interest in Sub at its underlying book value, which was equal to fair value on July 1, 2017.2. Pub sold inventory items to Sub during 2019 at a gross profit to Pub of $720,000. Half the merchandise remained in Sub’s inventory at December 31, 2019. Total sales by Pub to Sub in 2019 were $1,800,000. The remaining merchandise was sold by Sub in 2020.3. Pub’s inventory at December 31, 2020, included items acquired from Sub on…

- Comparative income statements of Sub Corporation for the calendar years 2019, 2020, and 2021 are as follows (in thousands): 2019 2020 2021Sales $22,000 $18,500 $19,250Cost of sales 10,600 9,900 10,100Gross profit 11400 8600 9150Operating expenses 5,700 5,500 6,000Net income $ 5700 $ 3100 $ 3150ADDITIONAL INFORMATION1. Sub was an 80 percent-owned subsidiary of Pub Corporation throughout the 2019–2021 period. Pub’s…Comparative income statements of Sub Corporation for the calendar years 2019, 2020, and 2021 are as follows (in thousands): 2019 2020 2021Sales $22,000 $18,500 $19,250Cost of sales 10,600 9,900 10,100Gross profit 11400 8600 9150Operating expenses 5,700 5,500 6,000Net income $ 5700 $ 3100 $ 3150ADDITIONAL INFORMATION1. Sub was an 80 percent-owned subsidiary of Pub Corporation throughout the 2019–2021 period. Pub’s separate income (excludes income from Sub) was $7,200,000, $6,600,000, and $7,500,000 in 2019, 2020, and 2021, respectively. Pub acquired its interest in Sub at its underlying book value, which was equal to fair value on July 1, 2017.2. Pub sold inventory items to Sub during 2019 at a gross profit to Pub of $720,000. Half the merchandise remained in Sub’s inventory at December 31, 2019. Total sales by Pub to Sub in 2019 were $1,800,000. The remaining merchandise was sold by Sub in 2020.3. Pub’s inventory at December 31, 2020, included items acquired from Sub on which Sub made…The following information relates to Hardin Limited’s year-ended 31 December 2020: The statement of comprehensive income shows profit for the year of R154 000. The calculation of this profit included the following income and expenses: Impairment of building: R64 000 (before tax: R74 000) Profit on sale of plant: R23 200 (before tax: R32 000) Inventory write-down: R10 000 (before tax: R15 000) The statement of changes in equity reflected preference dividends of R3 450. 12 000 shares in issue throughout the year. Required: Calculate the basic earnings and the headline earnings and disclose the headline earnings per share for the year-ended 31 December 2020

- Presented below is information related to Sohar Inc at December 31, 2020. Sales Revenue OMR 585,000 Cost of goods sold 265,000 Selling and Administrative Expenses 72,000 Gain on sale of plant 38,000 Unrealized gain on sale of Investments 16,000 Interest Expenses 9,000 Loss on discontinued operation 17,000 Allocation to non-controlling interest 49,000 Dividend declared and paid 8,000 Compute the following: (a) Income from operation, (b) net income, (c) net income attributed to controlling shareholders, (d) Comprehensive income, (e) retained earning balance.During the current year, The Jupiter Company, which is an S corporation, had the following items of income andexpenses: Income:Gross income from operations $150,000Interest income 5,000Qualified dividend income from investments 800Deductions:Compensation of Officers 67,000State taxes 5,000Short-Term Capital Loss 6,000Employee benefits 3,500Contribution to Pet Haven 1,000Interest 3,000Distributions to the shareholders 75,000a. Calculate the net ordinary income.b. List all the other items which must be separately reported.c. If the S corporation is on a calendar year, when is the corporation’s tax return due?Income information for 2019 taken from the separate company financial statements of Marinette corporation and its 75% old subsidiary Adrian corporation is presented as follows Marinette Adrian Sales 1,000,000 460,0000 Gain on sale of Building 20,000 Dividend Income 75,000 Cost of Goods Sold -500,000 -260,000 Depreciation Expense -100,000 -60,000 Other Expense -200,000 -40,000 Net Income 295,000 100,000 Marinette gain on sale of building relates to a building with a book value of 40,000 and a 10 year remaining useful life that was sold to Adrian for 60,000 of January 1,2019. The profit attributable to equity holders of parent or CNA contributable controlling interest for 2019 should be: a.295,000 b. 277,000 c. 275,000 d. 220,000

- Income information for 2019 taken from the separate company financial statements of Marinette corporation and its 75% old subsidiary Adrian corporation is presented as follows Marinette Adrian Sales 1,000,000 460,0000 Gain on sale of Building 20,000 Dividend Income 75,000 Cost of Goods Sold -500,000 -260,000 Depreciation Expense -100,000 -60,000 Other Expense -200,000 -40,000 Net Income 295,000 100,000 Marinette gain on sale of building relates to a building with a book value of 40,000 and a 10 year remaining useful life that was sold to Adrian for 60,000 of January 1,2019. At what amount will the gain on sale of building appear under consolidated/group income statement of Marinette and Adrian what the year 2019 should be a. 0 b. 5,000 c. 15,000 d. 20,000CARAT CORP. has completed its current year financial statements which reveal, in part, the following information: *Profit for the year - P110,000 *Total Comprehensive Income - P130,000 *Other comprehensive income relates to the revaluation of land and buildings to fair value *Dividends paid - P35,000 *Opening equity balances - share capital P300,000, retained earnings P220,000, asset revalution surplus P60,000 *No more share capital was issued during the reporting period The total equity at the end of the current year is: Choices a. 695,000 b. 675,000 c. 655,000 d. 580,000Macon Mills is a division of Bolin Products, Inc. During the most recent year, Macon had a net income of $43 million. Included in the income was interestexpense of $2,500,000. The company's tax rate was 40%. Total assets were $475 million, current liabilities were $108,000,000, and $69,000,000 of thecurrent liabilities are noninterest bearing.What are the invested capital and RO1 for Macon? Enter your answer in whole dollar. Round "ROI" answer to two decimal places. Invested Capital: ?ROI: ?