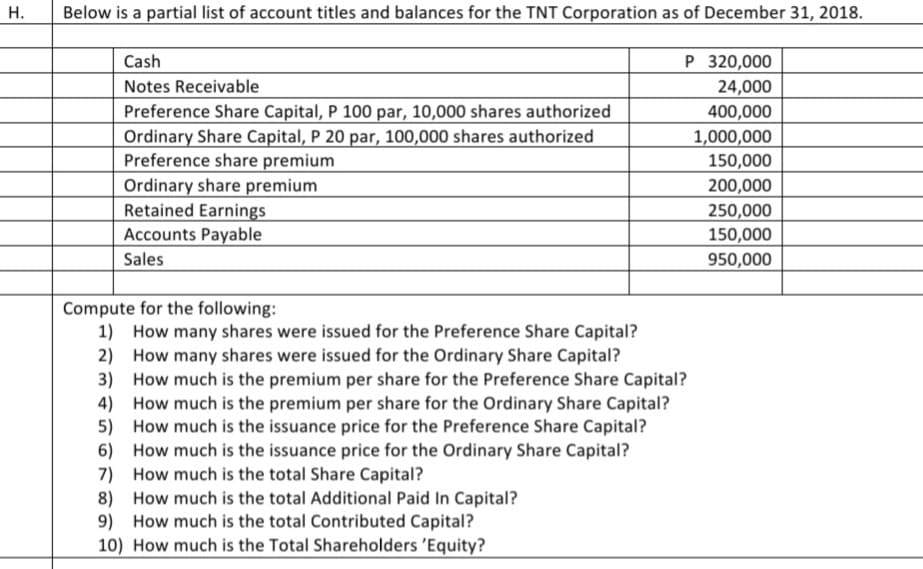

Compute for the following: 1) How many shares were issued for the Preference Share Capital? 2) How many shares were issued for the Ordinary Share Capital? 3) How much is the premium per share for the Preference Share Capital?

Q: What is meant by the term notes payable?

A: Notes payable is an account that details the specifics of a borrowed amount in note form. Its a…

Q: Prepare a closing entries, post-closing trial balance and reversing entries, use your columnar paper…

A: Adjusting Entries: Date Account Title Debit(P) Credit(P) a) Dec 31,2018 Rent Expenses A/c Dr…

Q: Prepare the statement of retained earnings for the month of July 31.

A: Retained Earning = Retained earning at the beginning+ Net Income-Dividends

Q: The company DELTA provides the following information for the year 20X9: Sales 100,000 euros Variable…

A: Operating leverage indicates the ability of the business to manage the fixed and variable costs to…

Q: White Corporation’s budget calls for the following sales for next year: Quarter 1…

A: Given that: Units to be produced=Expected sales in units + Desired units of ending inventory - Units…

Q: repare journal entries to record the following transactions in the capital projects fund and the…

A: Local Government Accounting: It is based on the concept of Fund Based Accounting or on the basis of…

Q: Mr. Ang is a member of the board of directors. He will be given a bonus if he can increase the share…

A: Board of Directors A board of directors is a group of people who serve as the company's…

Q: O One of construction company purchased a construction machine 195,000$ having useful life of 12…

A: Hi student Since there are multiple questions, we will answer only first question. Depreciation is…

Q: Chan Company received a bill totaling $3,700 for machine parts used in maintaining factory…

A: Lets understand the basics. Journal entry is required to make to record event and transaction that…

Q: Questions Question 1 Aero3D Ltd produces a range of filament cartridges for 3D printers. The…

A: Activity-based costing is a costing approach in which a company's activities are identified and the…

Q: 4. Roberts and Smith drafted a partnership agreement that lists the following assets contributed at…

A: Lets understanf the basics. Partnership is an agreement between two or more person who works…

Q: Net present value method The following data are accumulated by Geddes Company in evaluating the…

A: Net Present Value Shall be calculated = Present Value of Cash Flow - Initial Investment

Q: Design a salary slip for the month of December 2021 with information given below.

A: Introduction: Fixed ratio: The amount of replies required to receive reinforcement is referred to as…

Q: bank dealing in foreign currency tells you that the foreign currency will buy you $.80 US dollars.…

A: The correct option is (a) a direct quote

Q: Comprehensive Problem Set On July 1, Lula Plume created a new self-storage business, Safe…

A: A balance sheet is a representation of an individual's personal or corporation's financial balances…

Q: If a person is claimed as a dependant by another taxpayer, eligible tuition and expenses paid by…

A: A tax dependent is a child or relative whose traits and relationship to you qualify you for tax…

Q: Computing Depreciation under Alternative Methods Strong Metals Inc. purchased a new stamping machine…

A: Depreciation is an accounting technique for distributing a tangible or fixed asset's cost over its…

Q: Journalize the following transactions for the buyer, Martin Company, using the net method to account…

A: Purchase discount is the discount which is allowed on purchases made during the period. Credit terms…

Q: Q4: These are amounts and prices of Ahmed company store: Account name Quantity Cost per unit 10 30…

A: FIFO is first in first out inventory valuation method under which inventories which are purchased…

Q: Determine the proceeds of the sale on a six-year interest-bearing promissory note for $5,750 at 6.9%…

A: The periodic interest rate on the note = 6.9%12=0.575% The term is six years with monthly…

Q: Goods in process inventory, 1/1 25,000 Goods in process inventory, 12/31 21,920 Indirect labor 4,600…

A: Answer:- Income statement meaning:- An income statement is a financial statement of the company…

Q: hould be reported on a company's balance sheet. The following information was given to the student…

A: Cash and Cash Equivalent : It includes cash in hand and demand deposits with bank and cash…

Q: U-LEE Company granted 180,000 restricted share awards of its no-par ordinary shares to executives,…

A: ESOP expenses is known as compensation cost. ESOP contibution expenses charge over the period of…

Q: Deferred tax expense or benefit is the net change in DTL and DTA for the period. If the increase in…

A: Note: As per the policy, we’ll answer the first question since the exact one wasn’t specified.…

Q: Cost of merchandise sold reported on the income statement was $159,380. The accounts payable balance…

A: The cash flow statement is prepared to record the cash flow from various activities during the…

Q: Q3: These are amounts and prices of Ali company store Account name Quantity Cost per unit 9 40…

A: Lets understand the basics. In LIFO method entity assumes that, goods come last in the inventory are…

Q: This investment On July 1, 2021, Bird Inc., a private enterprise, acquired 1,250 shares of Duck Ltd.…

A: Journal entries are recorded in the books to make a complete and daily report of transactions of a…

Q: According to Anna, the value of an ABC share is P50.00 while according to Bob, it should be P50.10.…

A: Valuation of Share: The process of determining the worth of a company's shares is referred to as the…

Q: (prepare and process Required: After the closing process has been completed, answer the following…

A: Closing entries are those entries which are passed at the end of the period. It will close all…

Q: On January 1, Pulse Recording Studio (PRS) had the following account balances. Accounts Payable $…

A: "Since you have posted a question with multiple subparts, we will solve the first three subparts for…

Q: Muscat company purchased office supplies costing OMR2,000 and debited Office Supplies for the full…

A: Introduction: Journals: All the business transactions are to be recorded in Journals. Journals are…

Q: net share in the profit of the associate would b

A: The Carrying value of the Investment account on Dec 31,20X1 is : The acquisition Amount : P70,00,000…

Q: Tiago makes three models of camera lens. Its product mix and contribution margin per unit follow:…

A: Breakeven sales is that level of sales revenue at which business is only recovering it's fixed costs…

Q: Use the information provided for Harding Company to answer the question that follow. Harding Company…

A: Working capital is the amount that should be available for e normal working operation. It can be…

Q: Tiffancy and Co. has projected sales to be 70,000 in February, 85,000 in March and 90,000 in April.…

A: Projected sales refer to the units or items that a business anticipates to sell in the near future.…

Q: Explain the impact of the collection of these receivables on the Financial Statements.

A: Introduction:- Financial statement gives clear picture of financial position of the company.…

Q: Chapter 22 At the beginning of the 2019 school year, Bob Logan decided to prepare a cash budget for…

A: The cash budget represents the flow of cash that takes place during a specific period of time. It is…

Q: Exercise 1-10A (Algo) Interpreting information in an accounting equation LO 1-5 The financial…

A: Introduction:- A balance sheet is a statement of assets, liability, and equity. It is prepared after…

Q: The BRS Corporation makes collections on sales according to the following schedule: 25% in month…

A: Introduction: Cash collection, also recognized as payment, is a reserve bank function that describes…

Q: Give a financial description of the Balance S

A: Balance Sheet : It is the sheet which shows the Assets, Liabilities and Equity and shows Assets =…

Q: Tiago makes three models of camera lens. Its product mix and contribution margin per unit follow:…

A: Introduction: The weighted average contribution margin is the standard amount by which a group of…

Q: Nonordinary items resulting in income or loss a. include unusual but not infrequent gains. b.…

A: a. include unusual but not infrequent gains.

Q: Use the following information to prepare adjusting entries: a.Prepaid insurance of $400 expired…

A: Adjusting entries are those which are recorded at the end of the period to adjust the prepayments…

Q: Chapter 23 Mesa Bottle Company (MBC) manufactures plastic two-liter bottles for the beverage…

A: Budgets are the estimates or forecasts made for future period of time. Standard cost budget is based…

Q: A manufacturer can sell a certain health supplement for P1,100 per unit. Its total cost consists of…

A: a) Break-even units: = Fixed cost/contribution per unit = Php75,000/ (Php1100 - Php440 per unit) =…

Q: A young engineer borrowed P 10,000 at 12% interest and paid P 2,000 per annum for the first four…

A: Given that: Principal amount = P 10,000 Amount to be paid at the end of 4 each year = P 2000…

Q: On June 1, 20x10, HEAD and ACHE decided to form a partnership contributing their existing…

A: A partnership is a kind of business structure in which two or more people agree to carry out…

Q: Joint ventures involve the merging of two or more companies. ( ) a) True () b) False A country…

A:

Q: WOODBRICKS CORP. decided on September 1, 2021 to dispose of a component of business. The component…

A: As per IFRS 5, Non-current assets held for sale and discontinued operations, Discontinued operation…

Q: Jam produces siomai (10,000 units is needed per month) and incurred the following: DM is 5 per…

A: There are several types of costs being incurred in business. Variable costs changes with change in…

Step by step

Solved in 3 steps

- Silva Company is authorized to issue 5,000,000 shares of $2 par value common stock. In its IPO, the company has the following transaction: Mar. 1, issued 500,000 shares of stock at $15.75 per share for cash to investors. Journalize this transaction.Contributed Capital Adams Companys records provide the following information on December 31, 2019: Additional information: 1. Common stock has a 5 par value, 50,000 shares are authorized, 15,000 shares have been issued and are outstanding. 2. Preferred stock has a 100 par value, 3,000 shares are authorized, 800 shares have been issued and are outstanding. Two hundred shares have been subscribed at 120 per share. The stock pays an 8% dividend, is cumulative, and is callable at 130 per share. 3. Bonds payable mature on January 1, 2023. They carry a 12% annual interest rate, payable semiannually. Required: Prepare the Contributed Capital section of the December 31, 2019, balance sheet for Adams. Include appropriate parenthetical notes.Selected transactions completed by Equinox Products Inc. during the fiscal year ended December 31, 2016, were as follows: a. Issued 15,000 shares of 20 par common stock at 30, receiving cash. b. Issued 4, 000 shares of 80 par preferred 5% stock at 100, receiving cash. c. Issued 500,000 of 10-year, 5% bonds at 104, with interest payable semiannually. d. Declared a quarterly dividend of 0.50 per share on common stock and 1.00 per share on preferred stock. On the date of record, 100,000 shares of common stock were outstanding, no treasury shares were held, and 20,000 shares of preferred stock were outstanding. e. Paid the cash dividends declared in (d). f. Purchased 7,500 shares of Solstice Corp. at 40 per share, plus a 150 brokerage commission. The investment is classified as an available-for-sale investment. g. Purchased 8,000 shares of treasury common stock at 33 per share. h. Purchased 40,000 shares of Pinkberry Co. stock directly from the founders for 24 per share. Pinkberry has 125,000 shares issued and outstanding. Equinox Products Inc. treated the investment as an equity method investment. i. Declared a 1.00 quarterly cash dividend per share on preferred stock. On the date of record, 20,000 shares of preferred stock had been issued. j. Paid the cash dividends to the preferred stockholders. k. Received 27,500 dividend from Pinkberry Co. investment in (h). l. Purchased 90,000 of Dream Inc. 10-year, 5% bonds, directly from the issuing company, at their face amount plus accrued interest of 37 5. The bonds are classified as a held-to-maturity long -term investment. m. Sold, at 38 per share, 2,600 shares of treasury common stock purchased in (g). n. Received a dividend of 0 .60 per share from the Solstice Corp. investment in (f). o. Sold 1,000 shares of Solstice Corp. at 45, including commission. p. Recorded the payment of semiannual interest on the bonds issue d in (c) and the amortization of the premium for six months. The amortization is determined using the straight-line method . q. Accrued interest for three months on the Dream Inc. bonds purchased in (I). r. Pinkberry Co. recorded total earnings of 240 ,000. Equinox Products recorded equity earnings for its share of Pinkberry Co. net income. s. The fair value for Solstice Corp. stock was 39. 02 per share on December 31, 2016. The investment is adjusted to fair value , using a valuation allowance account. Assume Valuation Allowance for Available-for-Sale Investments h ad a beginning balance of zero. Instructions 1. Journalize the selected transactions. 2. After all of the transaction s for the year ended December 31, 201 6, had been poste d [including the transactions recorded in part (1) and all adjusting entries), the data that follows were taken from the records of Equinox Products Inc. a. Prepare a multiple-step in come statement for the year ended December 31, 201 6, concluding with earnings per share . In computing earnings per share, assume that the average number of common shares outstanding was 100,000 and preferred dividends were 100,000. ( Round earnings per share to the nearest cent.) b. Prepare a retained earnings statement for the year ended December 31, 20 6. c. Prepare a balance sheet in report form as of December 31, 2016.

- Hyde Corporations capital structure at December 31, 2018, was as follows: On July 2, 2019, Hyde issued a 10% stock dividend on its common stock and paid a cash dividend of 2.00 per share on its preferred stock. Net income for the year ended December 31, 2019, was 780,000. What should be Hydes 2019 basic earnings per share? a. 7.80 b. 7.09 c. 7.68 d. 6.73Kent Corporation was organized on January 1, 2014. On that date, it issued 200,000 shares of 10 par value common stock at 15 per share (400,000 shares were authorized). During the period January 1, 2014, through December 31, 2019, Kent reported net income of 750,000 and paid cash dividends of 380,000. On January 5, 2019, Kent purchased 12,000 shares of its common stock at 12 per share. On December 28, 2019, 8,000 treasury shares were sold at 8 per share. Kent used the cost method of accounting for treasury shares. What is Kents total shareholders equity as of December 31, 2019? a. 3,290,000 b. 3,306,000 c. 3,338,000 d. 3,370,000Cary Corporation has 50,000 shares of 10 par common stock authorized. The following transactions took place during 2019, the first year of the corporations existence: Sold 5,000 shares of common stock for 18 per share. Issued 5,000 shares of common stock in exchange for a patent valued at 100,000. At the end of Carys first year, total contributed capital amounted to: a. 40,000 b. 90,000 c. 100,000 d. 190,000

- Raun Company had the following equity items as of December 31, 2019: Preferred stock, 9% cumulative, 100 par, convertible Paid-in capital in excess of par value on preferred stock Common stock, 1 stated value Paid-in capital in excess of stated value on common stock| Retained earnings The following additional information about Raun was available for the year ended December 31, 2019: 1. There were 2 million shares of preferred stock authorized, of which 1 million were outstanding. All 1 million shares outstanding were issued on January 2, 2016, for 120 a share. The preferred stock is convertible into common stock on a 1-for-1 basis until December 31, 2025; thereafter, the preferred stock ceases to be convertible and is callable at par value by the company. No preferred stock has been converted into common stock, and there were no dividends in arrears at December 31, 2019. 2. The common stock has been issued at amounts above stated value per share since incorporation in 2002. Of the 5 million shares authorized, 3,580,000 were outstanding at January 1, 2019. The market price of the outstanding common stock has increased slowly but consistently for the last 5 years. 3. Raun has an employee share option plan where certain key employees and officers may purchase shares of common stock at 100% of the marker price at the date of the option grant. All options are exercisable in installments of one-third each year, commencing 1 year after the date of the grant, and expire if not exercised within 4 years of the grant date. On January 1, 2019, options for 70,000 shares were outstanding at prices ranging from 47 to 83 a share. Options for 20,000 shares were exercised at 47 to 79 a share during 2019. During 2019, no options expired and additional options for 15,000 shares were granted at 86 a share. The 65,000 options outstanding at December 31, 2019, were exercisable at 54 to 86 a share; of these, 30,000 were exercisable at that date at prices ranging from 54 to 79 a share. 4. Raun also has an employee share purchase plan whereby the company pays one-half and the employee pays one-half of the market price of the stock at the date of the subscription. During 2019, employees subscribed to 60,000 shares at an average price of 87 a share. All 60,000 shares were paid for and issued late in September 2019. 5. On December 31, 2019, there was a total of 355,000 shares of common stock set aside for the granting of future share options and for future purchases under the employee share purchase plan. The only changes in the shareholders equity for 2019 were those described previously, the 2019 net income, and the cash dividends paid. Required: Prepare the shareholders equity section of Rauns balance sheet at December 31, 2019. Substitute, where appropriate, Xs for unknown dollar amounts. Use good form and provide full disclosure. Write appropriate notes as they should appear in the publisher financial statements.The following selected accounts appear in the ledger of EJ Construction Inc. at the beginning of the current fiscal year: During the year, the corporation completed a number of transactions affecting the stockholders equity. They are summarized as follows: a. Issued 500,000 shares of common stock at 8, receiving cash. b. Issued 10,000 shares of preferred 1% stock at 60. c. Purchased 50,000 shares of treasury common for 7 per share. d. Sold 20,000 shares of treasury common for 9 per share. e. Sold 5,000 shares of treasury common for 6 per share. f. Declared cash dividends of 0.50 per share on preferred stock and 0.08 per share on common stock. g. Paid the cash dividends. Instructions Journalize the entries to record the transactions. Identify each entry by letter.Prepare general journal entries for the following transactions of GOTE Company: (a) Received subscriptions for 10,000 shares of 2 par common stock for 80,000. (b) Received payment of 30,000 on the stock subscription in transaction (a). (c) Received the balance in full for the stock subscription in transaction (a) and issued the stock. (d) Purchased 1,000 shares of its own 2 par common stock for 7.50 a share. (e) Sold 500 shares of the stock on transaction (d) for 8.50 a share.

- Outstanding Stock Lars Corporation shows the following information in the stockholders equity section of its balance sheet: The par value of common stock is S5, and the total balance in the Common Stock account is $225,000. There are 13,000 shares of treasury stock. Required: What is the number of shares outstanding? Use the following information for Exercises 10-58 and 10-59: Stahl Company was incorporated as a new business on January 1, 2019. The company is authorized to issue 600,000 shares of $2 par value common stock and 80,000 shares of 6%, S20 par value, cumulative preferred stock. On January 1, 2019, the company issued 75,000 shares of common stock for $15 per share and 5,000 shares of preferred stock for $25 per share. Net income for the year ended December 31, 2019, was $500,000.Selected transactions completed by Equinox Products Inc. during the fiscal year ended December 31, 2016, were as follows: a. Issued 15,000 shares of 0 par common stock at 0, receiving cash. b. Issued 4,000 shares of 80 par preferred 5% stock at 100, receiving cash. c. Issued 500,000 of 10-year, 5% bonds at 104, with interest payable semiannually. d. Declared a quarterly dividend of 0.50 per share on common stock and 1.00 per share on preferred stock. On the date of record, 100,000 shares of common stock were outstanding, no treasury shares were held, and 20,000 shares of preferred stock were outstanding. e. Paid the cash dividends declared in (d). f. Purchased 7,500 shares of Solstice Corp. at 40 per share, plus a 150 brokerage commission. The investment is classified as an available-for-sale investment. g. Purchased 8,000 shares of treasury common stock at 33 per share. h. Purchased 40,000 shares of Pinkberry Co. stock directly from the founders for 24 per share. Pinkberry has 125,000 shares issued and outstanding. Equinox Products Inc. treated the investment as an equity method investment. i. Declared a 1.00 quarterly cash dividend per share on preferred stock. On the date of record, 20,000 shares of preferred stock had been issued. j. Paid the cash dividends to the preferred stockholders. k. Received 27,500 dividend from Pinkberry Co. investment in (h). l. Purchased 90,000 of Dream Inc. 10-year, 5% bonds, directly from the issuing company, at their face amount plus accrued interest of 375. The bonds are classified as a held- to-maturitv long-term investment. m. Sold, at 38 per share, 2,600 shares of treasury common stock purchased in (g). n. Received a dividend of 0.60 per share from the Solstice Corp. investment in (f). o. Sold 1,000 shares of Solstice Corp. at 545, including commission. p. Recorded the payment of semiannual interest on the bonds issued in (c) and the amortization of the premium for six months. The amortization is determined using the straight-line method, q. Accrued interest for three months on the Dream Inc. bonds purchased in (1). r. Pinkberry Co. recorded total earnings of 240,000. Equinox Products recorded equity earnings for its share of Pinkberry Co. net income. s. The fair value for Solstice Corp. stock was 39.02 per share on December 31, 2016. The investment is adjusted to fair value, using a valuation allowance account. Assume Valuation Allowance for Available-for-Sale Investments had a beginning balance of zero. Instructions Journalize the selected transactions. After all of the transactions for the year ended December 31, 2016, had been posted [including the transactions recorded in part (1) and all adjusting entries], the data that follows were taken from the records of Equinox Products Inc. a. Prepare a multiple-step income statement for the year ended December 31, 2016, concluding with earnings per share. In computing earnings per share, assume that the average number of common shares outstanding was 100,000 and preferred dividends were 100,000. (Round earnings per share to the nearest cent.) b. Prepare a retained earnings statement for the year ended December 31, 2016. c. Prepare a balance sheet in report form as of December 31, 2016. Income statement data: Advertising expense 150,000 Cost of merchandise sold 3,700,000 Delivery expense 30,000 Depreciation expense -office buildings and equipment 30,000 Depreciation expensestore buildings and equipment 100,000 Dividend revenue 4,500 Gain on sale of investment 4,980 Income from Pinkberry Co. investment 76,800 Income tax expense 140,500 Interest expense 21,000 Interest revenue 2,720 Miscellaneous administrative expense 7.500 Miscellaneous selling expense 14,000 Office rent expense 50,000 Office salaries expense 170,000 Office supplies expense 10,000 Sales 5,254,000 Sales commissions 185,000 Sales salaries expense 385,000 Store supplies expense 21,000 Retained earnings and balance sheet data: Accounts payable 194,300 Accounts receivable 545,000 Accumulated depreciationoffice buildings and equipment 1,580,000 Accumulated depreciationstore buildings and equipment 4,126,000 Allowance for doubtful accounts 8,450 Available for sale investments (at cost) 260,130 Bonds payable. 5%. due 2024 500,000 Cash 246,000 Common stock, 20 par (400,000 shares authorized; 100,000 shares issued. 94,600 outstanding) 2,000,000 Dividends: Cash dividends for common stock 155,120 Cash dividends for preferred stock 100,000 Goodwill 500,000 Income tax payable 44,000 Interest receivable 1,125 Investment in Pinkberry Co. stock (equity method) 1,009,300 Investment in Dream Inc. bonds (long term) 90,000 Merchandise inventory [December 31, 2016). at lower of cost (FIFO) or market 778,000 Office buildings and equipment 4.320,000 Paid-in capital from sale of treasury stock 13,000 Excess of issue price over parcommon stock 886,800 Excess of issue price over parpreferred stock 150,000 Preferred 5% stock. 80 par (30,000 shares authorized; 20,000 shares issued] 1,600,000 Premium on bonds payable 19,000 Prepaid expenses 27,400 Retained earnings, January 1, 2016 9,319,725 Store buildings and equipment 12,560,000 Treasury stock (5,400 shares of common stock at cost of 33 per share) 178,200 Unrealized gain (loss) on available for sale investments (6,500) Valuation allowance for available for sale investments (6,500)Calculating the Number of Shares Issued Castalia Inc. issued shares of its $0.80 par value common stock on September 4, 2019, for $8 per share. The Additional Paid-In Capital-Common Stock account was credited for 5612,000 in the journal entry to record this transaction. Required: How many shares were issued on September 4, 2019?