Compute for the following: 1. Current Ratio 2. Quick Ratio 3. Debt Ratio 4. Equity Ratio

Compute for the following: 1. Current Ratio 2. Quick Ratio 3. Debt Ratio 4. Equity Ratio

Survey of Accounting (Accounting I)

8th Edition

ISBN:9781305961883

Author:Carl Warren

Publisher:Carl Warren

Chapter9: Metric-analysis Of Financial Statements

Section: Chapter Questions

Problem 9.4.13P: Twenty metrics of liquidity, solvency, and profitability The comparative financial statements of...

Related questions

Question

Compute for the following:

1.

2. Quick Ratio

3. Debt Ratio

4. Equity Ratio

Transcribed Image Text:ull Globe LTE

17:34

O O 26%

Done

03_Handout_1(12).pdf

ESTI

SH1663

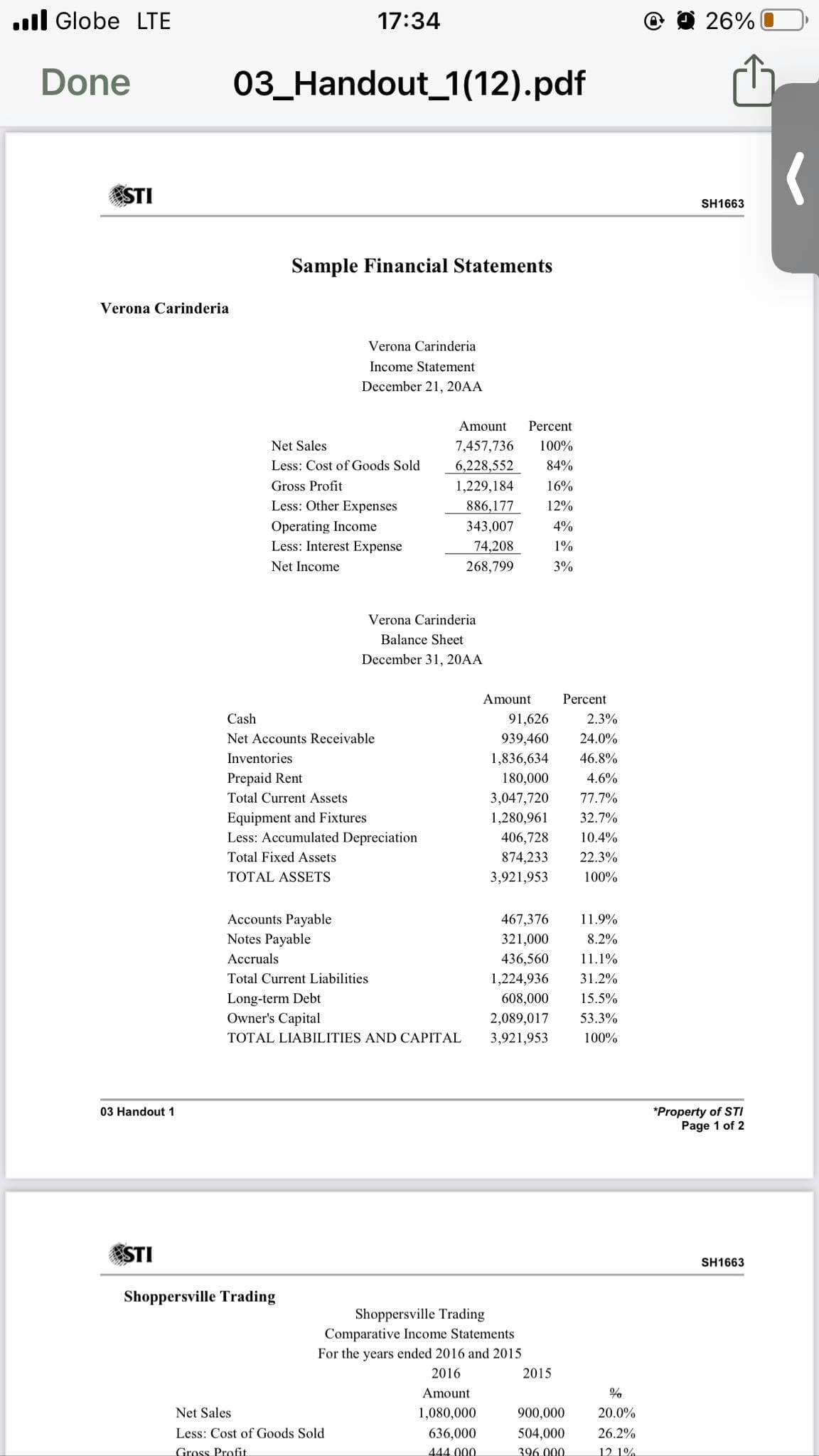

Sample Financial Statements

Verona Carinderia

Verona Carinderia

Income Statement

December 21, 20AA

Amount

Percent

Net Sales

7,457,736

100%

Less: Cost of Goods Sold

6,228,552

84%

Gross Profit

1,229,184

16%

Less: Other Expenses

886,177

12%

Operating Income

Less: Interest Expense

343,007

4%

74,208

1%

Net Income

268,799

3%

Verona Carinderia

Balance Sheet

December 31, 20AA

Amount

Percent

Cash

91,626

2.3%

Net Accounts Receivable

939,460

24.0%

Inventories

1,836,634

46.8%

Prepaid Rent

180,000

4.6%

Total Current Assets

3,047,720

77.7%

Equipment and Fixtures

Less: Accumulated Depreciation

1,280,961

32.7%

406,728

10.4%

Total Fixed Assets

874,233

22.3%

TOTAL ASSETS

3,921,953

100%

Accounts Payable

467,376

11.9%

Notes Payable

321,000

8.2%

Accruals

436,560

11.1%

Total Current Liabilities

1,224,936

31.2%

Long-term Debt

Owner's Capital

608,000

15.5%

2,089,017

53.3%

TOTAL LIABILITIES AND CAPITAL

3,921,953

100%

*Property of STI

Page 1 of 2

03 Handout 1

STI

SH1663

Shoppersville Trading

Shoppersville Trading

Comparative Income Statements

For the years ended 2016 and 2015

2016

2015

Amount

Net Sales

1,080,000

900,000

20.0%

Less: Cost of Goods Sold

636,000

504,000

26.2%

Gross Profit

444.000

396.000

12 1%

Transcribed Image Text:Total Current Assets

3,047,720

77.7%

ull Globe LTE

17:34

© O 26%

Equipment and Fixtures

Less: Accumulated Depreciation

1,280,961

32.7%

406.728

10.4%

Done

03_Handout_1(12).pdf

100%

Accounts Payable

467,376

11.9%

Notes Payable

321,000

8.2%

Accruals

436,560

11.1%

Total Current Liabilities

1,224,936

31.2%

Long-term Debt

Owner's Capital

608,000

15.5%

2,089,017

53.3%

TOTAL LIABILITIES AND CAPITAL

3,921,953

100%

03 Handout 1

*Property of STI

Page 1 of 2

STI

SH1663

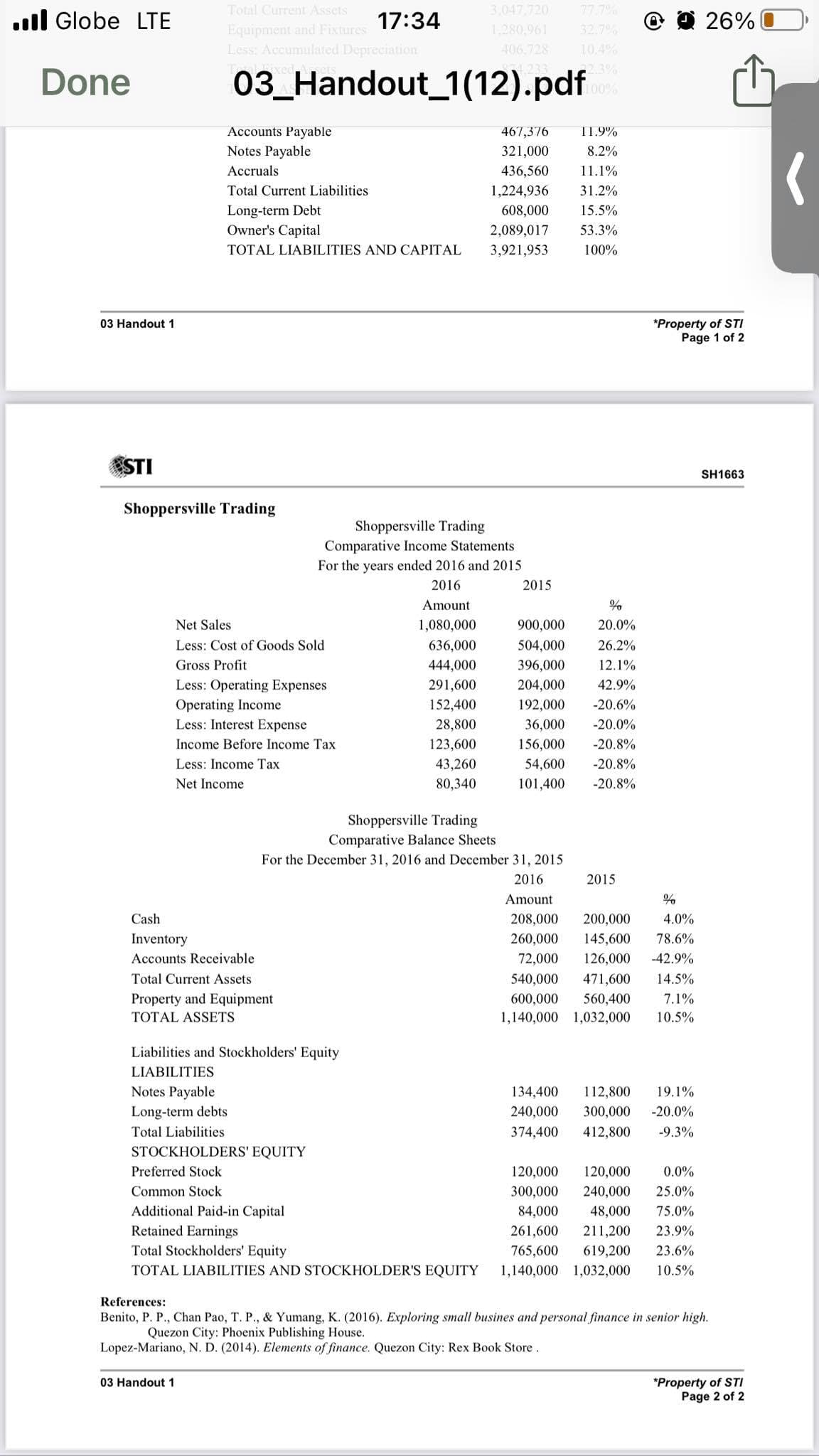

Shoppersville Trading

Shoppersville Trading

Comparative Income Statements

For the years ended 2016 and 2015

2016

2015

Amount

Net Sales

1,080,000

900,000

20.0%

Less: Cost of Goods Sold

636,000

504,000

26.2%

Gross Profit

444,000

396,000

12.1%

Less: Operating Expenses

291,600

204,000

42.9%

Operating Income

Less: Interest Expense

152,400

192,000

-20.6%

28,800

36,000

-20.0%

Income Before Income Tax

123,600

156,000

-20.8%

Less: Income Tax

43,260

54,600

-20.8%

Net Income

80,340

101,400

-20.8%

Shoppersville Trading

Comparative Balance Sheets

For the December 31, 2016 and December 31, 2015

2016

2015

Amount

Cash

208,000

200,000

4.0%

Inventory

260,000

145,600

78.6%

Accounts Receivable

72,000

126,000

-42.9%

Total Current Assets

540,000

471,600

14.5%

Property and Equipment

600,000

560,400

7.1%

TOTAL ASSETS

1,140,000 1,032,000

10.5%

Liabilities and Stockholders' Equity

LIABILITIES

Notes Payable

134,400

112,800

19.1%

Long-term debts

240,000

300,000

-20.0%

Total Liabilities

374,400

412,800

-9.3%

STOCKHOLDERS' EQUITY

Preferred Stock

120,000

120,000

0.0%

Common Stock

300,000

240,000

25.0%

Additional Paid-in Capital

84,000

48,000

75.0%

Retained Earnings

Total Stockholders' Equity

261,600

211,200

23.9%

765,600

619,200

23.6%

TOTAL LIABILITIES AND STOCKHOLDER'S EQUITY

1,140,000 1,032,000

10.5%

References:

Benito, P. P., Chan Pao, T. P., & Yumang, K. (2016). Exploring small busines and personal finance in senior high.

Quezon City: Phoenix Publishing House.

Lopez-Mariano, N. D. (2014). Elements of finance. Quezon City: Rex Book Store.

03 Handout 1

*Property of STI

Page 2 of 2

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 3 steps with 3 images

Recommended textbooks for you

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning