Compute for the following (show solution): a. How much total profit should Technocraft recognize for the year ended December 31, 2020? b. How much interest expense shall Marina Sands recognize for the year ended December 31, 2020? c. What amount shall Marina Sands report for the equipment at December 31, 2021? d. What amount of interest revenue should Technocraft report for the year ended December 31, 2020? e. What amount of financial asset shall Technocraft report at December 31, 2020?

Compute for the following (show solution): a. How much total profit should Technocraft recognize for the year ended December 31, 2020? b. How much interest expense shall Marina Sands recognize for the year ended December 31, 2020? c. What amount shall Marina Sands report for the equipment at December 31, 2021? d. What amount of interest revenue should Technocraft report for the year ended December 31, 2020? e. What amount of financial asset shall Technocraft report at December 31, 2020?

Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Chapter20: Accounting For Leases

Section: Chapter Questions

Problem 6E: Lessor Accounting Issues Ramsey Company leases heavy equipment to Terrell Inc. on March 1, 2019, on...

Related questions

Question

TOPIC: LEASES

Compute for the following (show solution):

a. How much total profit should Technocraft recognize for the year ended December 31, 2020?

b. How much interest expense shall Marina Sands recognize for the year ended December 31, 2020?

c. What amount shall Marina Sands report for the equipment at December 31, 2021?

d. What amount of interest revenue should Technocraft report for the year ended December 31, 2020?

e. What amount of financial asset shall Technocraft report at December 31, 2020?

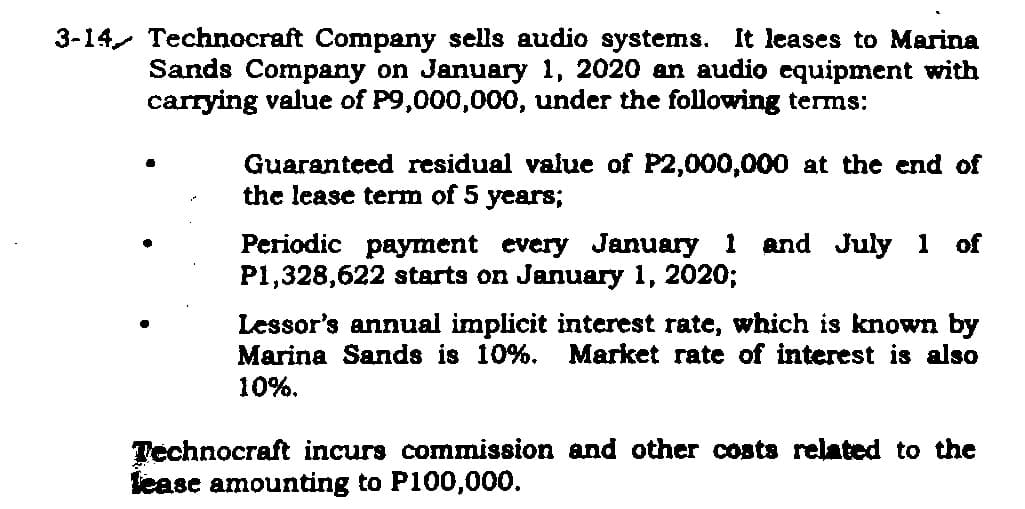

Transcribed Image Text:3-14 Technocraft Company sells audio systems. It leases to Marina

Sands Company on January 1, 2020 an audio equipment with

carrying value of P9,000,000, under the following terms:

Guaranteed residual value of P2,000,000 at the end of

the lease term of 5 years;

Periodic payment every January 1 and July 1 of

P1,328,622 starts on January 1, 2020;

Lessor's annual implicit interest rate, which is known by

Marina Sands is 10%. Market rate of interest is also

10%.

Technocraft incurs commission and other costs related to the

lease amounting to P100,000.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Financial Reporting, Financial Statement Analysis…

Finance

ISBN:

9781285190907

Author:

James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

Publisher:

Cengage Learning