Compute the break-even point for a single-product company.

Chapter3: Cost-volume-profit Analysis

Section: Chapter Questions

Problem 16MC: Break-even for a multiple product firm. can be calculated by dividing total fixed costs by the...

Related questions

Question

Learning Objective 05-P2: Compute the break-even point for a single-product company.

Skip to question

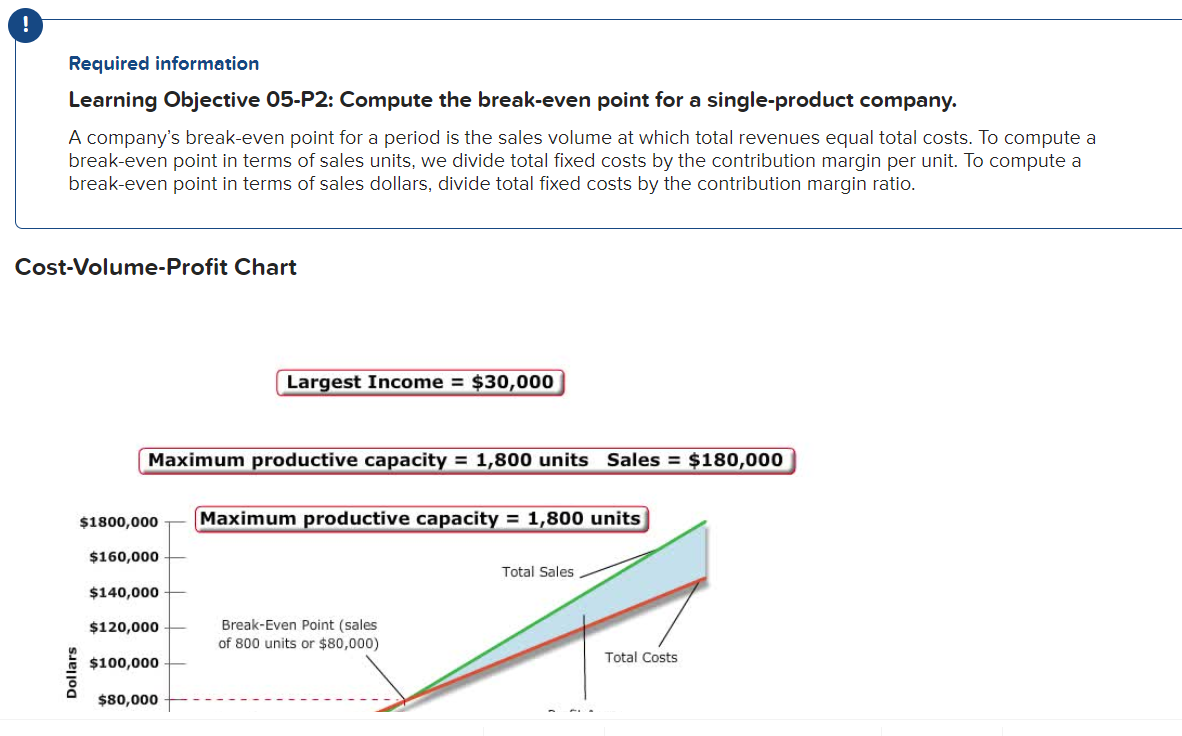

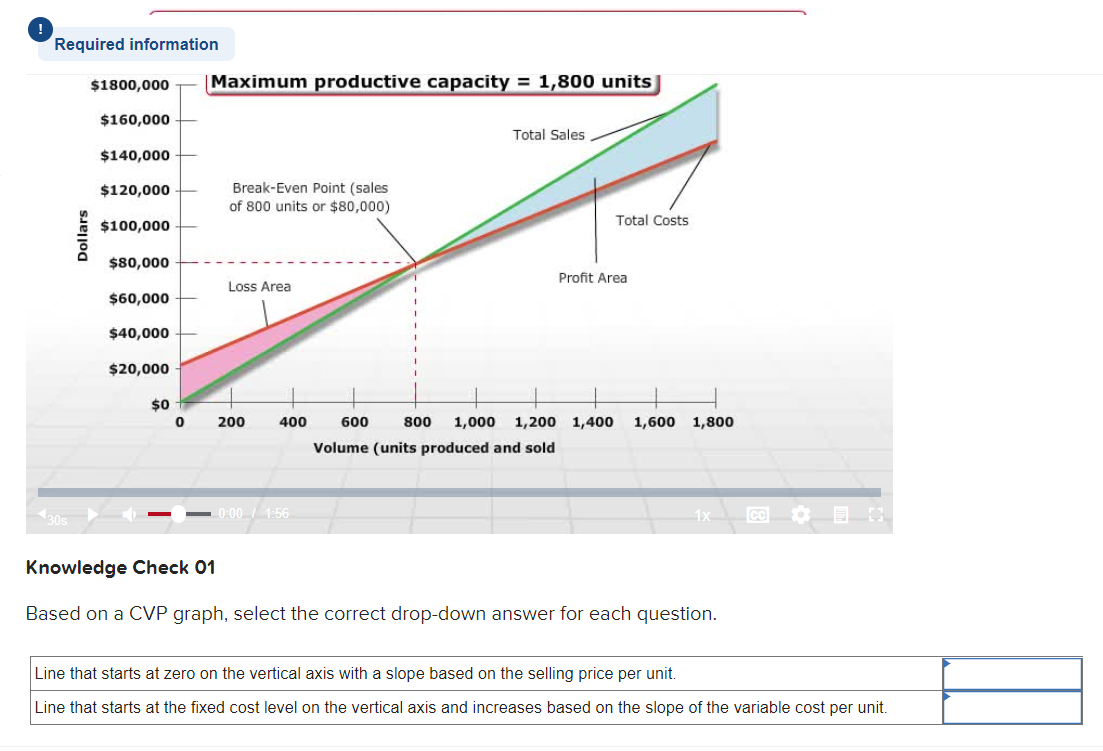

A company’s break-even point for a period is the sales volume at which total revenues equal total costs. To compute a break-even point in terms of sales units, we divide total fixed costs by the contribution margin per unit. To compute a break-even point in terms of sales dollars, divide total fixed costs by the contribution margin ratio.

Cost-Volume-Profit Chart

Current Time 0:00

/

Duration 1:56

1x

Knowledge Check 01

Based on a CVP graph, select the correct drop-down answer for each question.

Transcribed Image Text:Required information

Learning Objective 05-P2: Compute the break-even point for a single-product company.

A company's break-even point for a period is the sales volume at which total revenues equal total costs. To compute a

break-even point in terms of sales units, we divide total fixed costs by the contribution margin per unit. To compute a

break-even point in terms of sales dollars, divide total fixed costs by the contribution margin ratio.

Cost-Volume-Profit Chart

Dollars

Maximum productive capacity = 1,800 units Sales = $180,000

$1800,000

$160,000

$140,000

$120,000

$100,000

Largest Income = $30,000

$80,000

Maximum productive capacity = 1,800 units

Break-Even Point (sales

of 800 units or $80,000)

Total Sales

Total Costs

Transcribed Image Text:Required information

30s

Dollars

$1800,000

$160,000

$140,000

$120,000

$100,000

$80,000

$60,000

$40,000

$20,000

$0

0

Maximum productive capacity = 1,800 units

Break-Even Point (sales

of 800 units or $80,000)

Loss Area

200

400

0:00 / 1:56

Total Sales

Total Costs

Profit Area

600 800 1,000 1,200 1,400 1,600 1,800

Volume (units produced and sold

Knowledge Check 01

Based on a CVP graph, select the correct drop-down answer for each question.

CC

B

Line that starts at zero on the vertical axis with a slope based on the selling price per unit.

Line that starts at the fixed cost level on the vertical axis and increases based on the slope of the variable cost per unit.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Recommended textbooks for you

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

Principles of Cost Accounting

Accounting

ISBN:

9781305087408

Author:

Edward J. Vanderbeck, Maria R. Mitchell

Publisher:

Cengage Learning

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Excel Applications for Accounting Principles

Accounting

ISBN:

9781111581565

Author:

Gaylord N. Smith

Publisher:

Cengage Learning