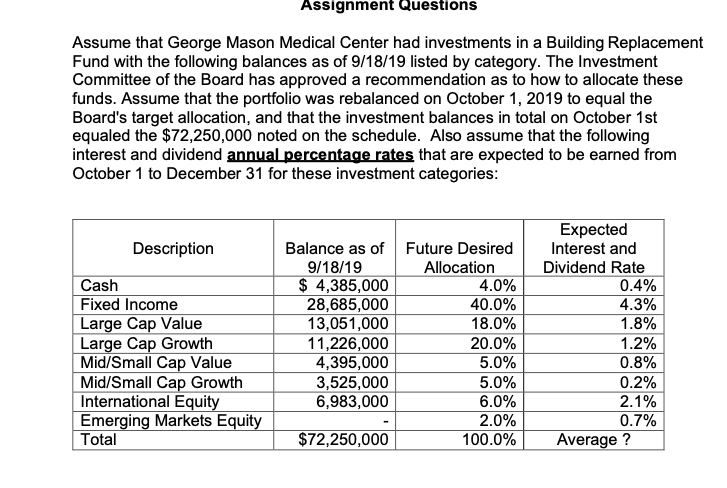

Assume that George Mason Medical Center had investments in a Building Replacement Fund with the following balances as of 9/18/19 listed by category. The Investment Committee of the Board has approved a recommendation as to how to allocate these funds. Assume that the portfolio was rebalanced on October 1, 2019 to equal the Board's target allocation, and that the investment balances in total on October 1st equaled the $72,250,000 noted on the schedule. Also assume that the following interest and dividend annual percentage rates that are expected to be earned from October 1 to December 31 for these investment categories: Expected Interest and Dividend Rate 0.4% 4.3% Description Balance as of Future Desired 9/18/19 $ 4,385,000 28,685,000 13,051,000 11,226,000 4,395,000 3,525,000 6,983,000 Allocation 4.0% 40.0% 18.0% Cash Fixed Income Large Cap Value Large Cap Growth Mid/Small Cap Value Mid/Small Cap Growth International Equity Emerging Markets Equity Total 1.8% 20.0% 5.0% 1.2% 0.8% 0.2% 5.0% 6.0% 2.0% 100.0% 2.1% 0.7% $72,250,000 Average ?

Master Budget

A master budget can be defined as an estimation of the revenue earned or expenses incurred over a specified period of time in the future and it is generally prepared on a periodic basis which can be either monthly, quarterly, half-yearly, or annually. It helps a business, an organization, or even an individual to manage the money effectively. A budget also helps in monitoring the performance of the people in the organization and helps in better decision-making.

Sales Budget and Selling

A budget is a financial plan designed by an undertaking for a definite period in future which acts as a major contributor towards enhancing the financial success of the business undertaking. The budget generally takes into account both current and future income and expenses.

Compute the budgeted “weighted average” annual investment return for dividends and interest for the fourth quarter of 2019. Prepare this spreadsheet so your calculations clearly show the reader your assumptions and how your calculations were made

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 2 images