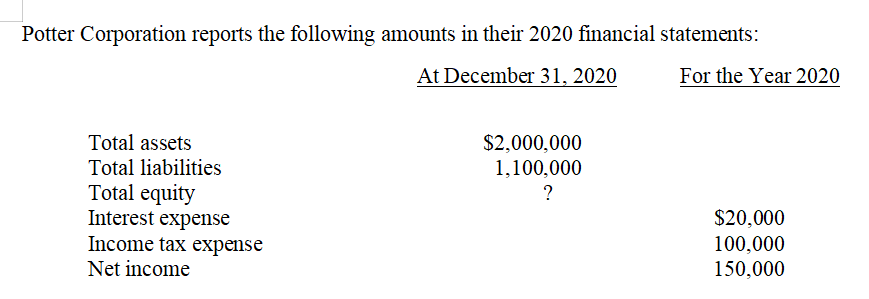

Compute the December 31, 2020, amount of equity. Compute the debt to assets ratio at December 31, 2020. Compute times interest earned for 2020.

Q: Using the pre-determined overhead rate calculated above, calculate the overhead that would be alloca...

A: >Predetermined Overhead rate is calculated at the beginning of the period to allocate the overhea...

Q: On July 1, KAW Inc. purchased 75 cows which, at that time were 2.5 years old for a total cost of P1,...

A: Computation of fair value of 3 years old cow 25000 * 75 = 1875000 Computation of fair value of 0.5 y...

Q: Under the new Tax Cut and Jobs Act of 2017 rules for the computation of taxable income did not chang...

A: ANSWER Tax Liability: Tax liability is the total amount of money that is liable to pay the tax b...

Q: purchase price. It costs the Book Shop $500 to place a single order. The maximum sale for the Book S...

A:

Q: Why do you think ethics is so important in accounting and business in general

A: Ethics in Accounting and business mean a set of specific guidelines or code of conduct which are bel...

Q: PFRS 3 requires that all business combination be accounted for using a. the pooling interest meth...

A: PFRS 3 is a business combination brief on accounting of acquiring business company obtains control o...

Q: MULTIPLE CHOICE 1. The entries in a purchases journal are posted to which of the following subsidiar...

A: Disclaimer: “Since you have asked multiple question, we will solve the first question for you. If yo...

Q: Required information [The following information applies to the questions displayed below.] Following...

A: Journal is the book of primary entry. All the transactions are recorded initially in the journal,acc...

Q: On January 1, 2021, ABC Co. acquired all of the identifiable assets and assumed all of the liabiliti...

A: Goodwill = Consideration paid - fair value assets + fair value of liabilities.

Q: You are provided with the following information for Blossom Company, effective as of its April 30, 2...

A: Income statement represents the net income or the net loss that includes the reporting of revenues a...

Q: ABC and XYZ Inc had the following balance sheets on December 31, 2021: (see image below) On January ...

A: Current Assets of Combined Entity = Current Assets of ABC + Current Assets of XYZ (Fair Value) Not...

Q: Which of the following is false regarding debt? Debt holders have no active voice in management of t...

A: “Since you have asked multiple questions, we will solve the first question for you. If you want any ...

Q: We have set up the new production facility in an old warehouse that we stopped using a year ago. Pri...

A: GIVEN we had considered selling the building and it had been valued at E$100,000 on 30 June 2021....

Q: CuPry started her own consulting firm, Sage Hill Inc., on May 1, 2022. The following transactions oc...

A: According to the accounting equation, a company's total assets equal the sum of its liabilities and ...

Q: n 30 June 2016, Cameron Clothing purchased $10000 of inventory on a one-year, 10% note yable.

A: Solution: Interest is accrued from the date of issuance of Note till the date of adjusting entries. ...

Q: Required information [The following information applies to the questions displayed below.] Lawson Co...

A: >Financial Statements are prepared at the end of accounting period, and these include: #1: In...

Q: Davao Company prepares quarterly interim financial reports. The entity sells electrical goods and no...

A: Given data: Sales in the first quarter = P10,000,000 Sales in the second quarter = P15,000,000 Provi...

Q: mpany uses ti proach. Wha- tio? Express y

A: The cost ratio is given as,

Q: Comparative financial statement data for Oriole Corporation and Pharoah Corporation, two competitors...

A: Net income refers to the earnings of the company after accounting for all the operating and non-oper...

Q: SOUND CORE WIRELESS sells a variety of mobile telephone accessories including several brands of Wire...

A: Perpetual and Periodic Inventory system Purchase and sales records are updated constantly in perpet...

Q: nelly as a partner in business. Just before the partnership's formation, Marie books showed the foll...

A:

Q: On January 1, 2021, ABC Co. acquired all of the identifiable assets and assumed all of the liabiliti...

A: Goodwill is an intangible asset which comes into existence when a company buys or acquire another ex...

Q: Where a partnership records a loss for an income year for tax purposes: (Choose the most correct opt...

A: Answer: As per Q/A guidelines, first question has been answered. Please repost remaining questions. ...

Q: General journal for coffee machine

A: Fixed asset is written off in the books of accounts, when there is obsolescence, or the asset is sol...

Q: Raytheon Company disclosed the following data related to segment sales and operating profits for fis...

A: GIVEN Raytheon Company disclosed the following data related to segment sales and operating profits...

Q: A. Explain the matching concept by incorporating the terms ‘recognized’, revenue recognition princip...

A: Hi student Since there are multiple questions, we will answer only first question.

Q: March 1 Brooks invested $195,000 cash along with $24,000 in office equipment in the company. March 2...

A: In the recording process Step 1 : Journal entries , These are prepared based on the transactions Ste...

Q: ABC and XYZ Inc had the following balance sheets on December 31, 2021: (see image below) On January ...

A: Consolidated financial statements are those statements which are prepared for the consolidation of t...

Q: At the beginning of November, Yoshi Inc.'s inventory consists of 63 units with a cost per unit of $9...

A: Inventory cost refers to the price paid for the inventory in addition to any other costs that are in...

Q: Juan, resident citizen, had the following income: Interest income from deposits in a foreign bank lo...

A: Answer: The income that is earned within Philippines are taxable within Philippines. Any income earn...

Q: On January 1, 2021, ABC Co. acquired all of the identifiable assets and assumed all of the liabiliti...

A: Answer: Fair value of consideration is the amount that is paid to the acquiring company by acquirer.

Q: Explain the relationship of Social and Economic Accounting to Financial What are the features of the...

A: Answer: Social and economic accounting and financial are all related with each other. The basic conc...

Q: ABC and XYZ Inc had the following balance sheets on December 31, 2021: (see image below) On January ...

A: solution given Purchase price 40000 Fair value of current assets of XYZ 26000 Fair v...

Q: Johnson’s Boat Yard, Inc., repairs, stores, and cleans boats for customers. It is completing the acc...

A: Adjusting entries are those journal entries which are recorded at the end of accounting period for t...

Q: Charade Company uses the direct method to prepare its statement of cash flows. Charade had the follo...

A: Cash Flow Statement - Under Cash Flow, there are three types of activities involved - Operating Acti...

Q: If equity is $420,000 and liabilities are $200,000, then assets equal: Multiple Choice $420,000.

A: The question is based on the concept of Financial Accounting.

Q: Bramble Company sells 8% bonds having a maturity value of $2,000,000 for $1,848,366. The bonds are d...

A:

Q: The Marin Company issued $240,000 of 13% bonds on January 1, 2020. The bonds are due January 1, 2025...

A: The price of a bond is the present value of its cash flows. For a coupon bond, the cash flows are th...

Q: XYZ Co had the following accounts at the time it was acquired by ABC Inc (see image below). ABC paid...

A: This question is related to the business combination. Cost of Acquisition: It is the consideration p...

Q: Exercise 4-21 (Algo) Statement of cash flows; direct method [LO4-8] Presented below is the 2021 inco...

A: Cash Flow Statement - Under Cash Flow, there are three types of activities involved - Operating Acti...

Q: Determine the ending balance of each of the following T- accounts. Cash Accounts Payable 250 200 3,5...

A: All assets normally have a debit balance. All liabilities normally have a credit balance. All equity...

Q: Mayfair Sdn. Bhd. which prepares account to 31.12 annually has the details of the following expendit...

A: Under Malaysian taxation, the capital allowance is allowed to business activities for deduction on a...

Q: a. To increase Store Supplies b. To decrease Equipment c. To increase Postage Expense d. To increase...

A: The General Rules of Debit and Credit are: All Debits increase Assets and Expenses. All Debits decr...

Q: If Stock A has a lower expected return than Stock B, which of the following statements is least like...

A: Beta is a measure of systematic risk for the company or security. It is the risk measure to show to ...

Q: A VAT registered trader had the following transactions: Sales of good to private entities, net of VA...

A: Value Added Tax: VAT is a consumption tax on products and services levied at each level of the suppl...

Q: Match the special journal you would use to record the following transactions. A. Cash Receipts Jour...

A: Journal Entries: When a commercial transaction is recorded in the accounting records of a company, i...

Q: 1. Issued stock to investors for $13,300 in cash. 2. Purchased used car for $10, 100 cash for use in...

A: The different transactions in the business affects two or more accounts of the business, with one ac...

Q: A for-profit hospital opened a new ER Clinic and the clinic completed the following transactions dur...

A: Cash is one of the current asset of the business, which is used for payment of various expenses and ...

Q: A credit is not the normal balance for which account listed below? Dividends account Liability accou...

A: All the assets, expenses, and losses have a debit balance and all the liability, revenue, and gains ...

Q: On November 1, 2012, management of Dianne Company committed to a plan to dispose of a major subsidia...

A: Concept Loss from discontinued operation shall be disclosed separately in the income statement The g...

On December 31, 2019, Potter Corporation issued €2,000,000, 6%, 5-year bonds for €1,837,750. The bonds were sold to yield an effective-interest rate of 8%. Interest is paid annually on December 31. The company uses the effective-interest method of amortization.

- Compute the December 31, 2020, amount of equity.

- Compute the debt to assets ratio at December 31, 2020.

- Compute times interest earned for 2020.

Step by step

Solved in 2 steps

- Leverage Cook Corporation issued financial statements at December 31, 2019, that include the following information: Balance sheet at December 31,2019 Assets $8,000,000 Liabilities $1,200,000 Stockholders' equity (300,000 shares) $6,800,000 Income statement for 2019: Income from operations $1,200,000 Less: Interest expense (100,000) Income before taxes $1,100,000 Less: Income taxes expense (0,30) (330,000) Net income $ 770,000 The levels of assets, liabilities, stockholders' equity, and operating income have been stable in recent years; however, Cook Corporation is planning a 51,800,000 expansion program that will increase income from operations by $350,000 to $1,550,000, Cook is planning to sell 8.5% notes at par to finance the expansion. Required: What earnings per share does Cook report before the expansion?Prince Corporations accounts provided the following information at December 31, 2019: What should be the current balance of retained earnings? a. 520,000 b. 580,000 c. 610,000 d. 670,000Rhodes Corporations financial statements are shown after part f. Suppose the federal-plus-state tax corporate tax is 25%. Answer the following questions. a. What is the net operating profit after taxes (NOPAT) for 2020? b. What are the amounts of net operating working capital for both years? c. What are the amounts of total net operating capital for both years? d. What is the free cash flow for 2020? e. What is the ROIC for 2020? f. How much of the FCF did Rhodes use for each of the following purposes: after-tax interest, net debt repayments, dividends, net stock repurchases, and net purchases of short-term investments? (Hint: Remember that a net use can be negative.) Rhodes Corporation: Income Statements for Year Ending December 31 (Millions of Dollars) Rhodes Corporation: Balance Sheets as of December 31 (Millions of Dollars)

- Fisafolia Corporation has gross income from operations of $210,000 and operating expenses of $160,000 for 2019. The corporation also has $30,000 in dividends from publicly traded domestic corporations in which the ownership percentage was 45 percent. Calculate the corporation's dividends received deduction for 2019. $_____________ Assume that instead of $210,000, Fisafolia Corporation has gross income from operations of $135,000. Calculate the corporation's dividends received deduction for 2019. $___________ Assume that instead of $210,000, Fisafolia Corporation has gross income from operations of $158,000. Calculate the corporation's dividends received deduction for 2019. $_____________Roseau Company is preparing its annual earnings per share amounts to be disclosed on its 2019 income statement. It has collected the following information at the end of 2019: 1. Net income: 120,400. Included in the net income is income from continuing operations of 130,400 and a loss from discontinued operations (net of income taxes) of 10,000. Corporate income tax rate: 30%. 2. Common stock outstanding on January 1, 2019: 20,000 shares. 3. Common stock issuances during 2019: July 6, 4,000 shares; August 24, 3,000 shares. 4. Stock dividend: On October 19, 2019, the company declared a 10% stock dividend that resulted in 2,700 additional outstanding shares of common stock. 5. Common stock prices: 2019 average market price, 30 per share; 2019 ending market price, 27 per share. 6. 7% preferred stock outstanding on January 1, 2019: 1,000 shares. Terms: 100 par, nonconvertible. Current dividends have been paid. No preferred stock issued during 2019. 7. 8% convertible preferred stock outstanding on January 1, 2019: 800 shares. The stock was issued in 2018 at 130 per share. Each 100 par preferred stock is currently convertible into 1.7 shares of common stock. Current dividends have been paid. To date, no preferred stock has been converted. 8. Bonds payable outstanding on January 1, 2019: 100,000 face value. These bonds were issued several years ago at 97 and pay annual interest of 9.6%. The discount is being amortized in the amount of 300 per year. Each 1,000 bond is currently convertible into 22 shares of common stock. To date, no bonds have been converted. 9. Compensatory share options outstanding: Key executives may currently acquire 3,000 shares of common stock at 20 per share. The options were granted in 2018. To date, none have been exercised. The unrecognized compensation cost (net of tax) related to the options is 4 per share. Required: 1. Compute the basic earnings per share. Show supporting calculations. 2. Compute the diluted earnings per share. Show supporting calculations. 3. Show how Roseau would report these earnings per share figures on its 2019 income statement. Include an explanatory note to the financial statements.Ratio Analysis Rising Stars Academy provided the following information on its 2019 balance sheet and state mcnt of cash flows: Long-term debt S 4,400 Interest expense S 398 Total liabilities 8,972 Net income 559 Total assets 38,775 Interest payments 432 Total equity 29,803 Cash flows from operations 1.015 Operating income 1.223 Income tax expenses 266 Income taxes paid 150 Required: Calculate the following ratios for Rising Stars: (a) debt to equity, (b) debt to total assets, (c) long-term debt to equity, (d) times interest earned (accrual basis), and (e) times interest earned (cash basis). (Note: Round answers to three decimal places.) CONCEPTUAL CONNECTION Interpret these results. 3.What does it mean if a bond is callable

- Comprehensive Colt Company reports pretax financial income of 143,000 in 2019. In addition to pretax income from continuing operations (of which revenues are 295,000), the following items are included in this pretax income: Colts taxable income totals 93,000 in 2019. The difference between the pretax financial income and the taxable income is due to the excess of tax depreciation over financial depreciation on assets used in continuing operations. At the beginning of 2019, Colt had a retained earnings balance of 310.000 and a deferred tax liability of 8,100. During 2019, Colt declared and paid dividends of 48,000. It is subject to tax rates of 15% on the first 50,000 of income and 30% on income in excess of 50,000. Based on proper interperiod tax allocation procedures, Colt has determined that its 2019 ending deferred tax liability is 14,100. Required: 1. Prepare a schedule for Colt to allocate the total 2019 income tax expense to the various components of pretax income. 2. Prepare Colts income tax journal entry at the end of 2019. 3. Prepare Colts 2019 income statement. 4. Prepare Colts 2019 statement of retained earnings. 5. Show the related income tax disclosures on Colts December 31, 2019, balance sheet.Athenian Venues Inc. just reported the following selected portion of its financial statements for the end of 2020. Your assistant has already calculated the 2020 end-of-year net operating working capital (NOWC) from the full set of financial statements (not shown here), which is 13 million. The total net operating capital for 2019 was 50 million. What was the 2020 net investment in operating capital? Athenian Venues Inc.: Selected Balance Sheet Information as of December 31 (Millions of Dollars)During 2021, Anthony Company purchased debt securities as a long-term investment and classified them as trading. All securities were purchased at par value. Pertinent data are as follows: The net holding gain or loss included in Anthonys income statement for the year should be: a. 0 b. 3,000 gain c. 9,000 loss d. 12,000 loss

- Hyde Corporations capital structure at December 31, 2018, was as follows: On July 2, 2019, Hyde issued a 10% stock dividend on its common stock and paid a cash dividend of 2.00 per share on its preferred stock. Net income for the year ended December 31, 2019, was 780,000. What should be Hydes 2019 basic earnings per share? a. 7.80 b. 7.09 c. 7.68 d. 6.73Frost Company has accumulated the following information relevant to its 2019 earningsper share. 1. Net income for 2019: 150,500. 2. Bonds payable: On January 1, 2019, the company had issued 10%, 200,000 bonds at 110. The premium is being amortized in the amount of 1,000 per year. Each 1,000 bond is currently convertible into 22 shares of common stock. To date, no bonds have been converted. 3. Bonds payable: On December 31, 2017, the company had issued 540,000 of 5.8% bonds at par. Each 1,000 bond is currently convertible into 11.6 shares of common stock. To date, no bonds have been converted. 4. Preferred stock: On July 3, 2018, the company had issued 3,800 shares of 7.5%, 100 par, preferred stock at 108 per share. Each share of preferred stock is currently convertible into 2.45 shares of common stock. To date, no preferred stock has been converted and no additional shares of preferred stock have been issued. The current dividends have been paid. 5. Common stock: At the beginning of 2019, 25,000 shares were outstanding. On August 3, 7,000 additional shares were issued. During September, a 20% stock dividend was declared and issued. On November 30, 2,000 shares were reacquired as treasury stock. 6. Compensatory share options: Options to acquire common stock at a price of 33 per share were outstanding during all of 2019. Currently, 4,000 shares may be acquired. To date, no options have been exercised. The unrecognized compens Frost Company has accumulated the following information relevant to its 2019 earnings ns is 5 per share. 7. Miscellaneous: Stock market prices on common stock averaged 41 per share during 2019, and the 2019 ending stock market price was 40 per share. The corporate income tax rate is 30%. Required: 1. Compute the basic earnings per share. Show supporting calculations. 2. Compute the diluted earnings per share. Show supporting calculations. 3. Indicate which earnings per share figure(s) Frost would report on its 2019 income statement.