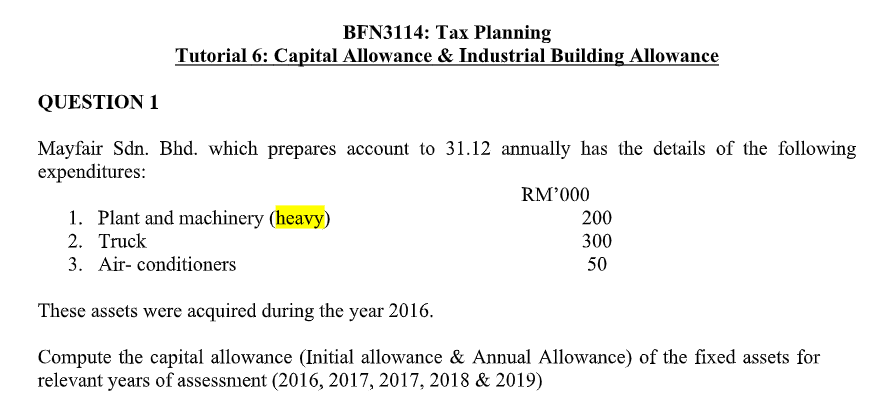

Mayfair Sdn. Bhd. which prepares account to 31.12 annually has the details of the following expenditures: RM'000 1. Plant and machinery (heavy) 200 2. Truck 300 50 3. Air- conditioners These assets were acquired during the year 2016.

Q: Carter, Inc. uses a traditional volume-based costing system in which direct labor hours are the allo...

A: This question is regarding computation of costs under Traditional Costing System and Activity Based ...

Q: 1. D. Belle created a new business and invested $6,400 cash, $6,000 of equipment, and $12,400 in web...

A: See , you have posted debit items into credit and credit items into debit , Otherwise the whole answ...

Q: Northwest Company produces two types of glass shelving: rounded edge and squared edge. The company r...

A: Activity based costing is one of the costing system under which all indirect costs and overhead cost...

Q: Calculate current ratio, quick ratio and receivable turnover ratio

A: Current assets = 38,761 Current liabilities = 6,850 Inventory = 6,300 Prepaid expense = 800 Average ...

Q: expense, and advertising expense. It categorizes the remaining expenses a Adjusted Account Balances ...

A: Working Notes :- Cost of Goods Sold Particulars Amoun...

Q: rs are the allocation base. Carter is considering switching to an ABC system by splitting its manufa...

A: A.The indirect manufacturing costs assigned to Product A under the traditional costing system =1,00,...

Q: $ 11,500 I. Lawson, Withdrawals 5,800 Services revenue 7,800 Rent expense 4,170 Wages expense 19,130...

A: Solution: Balance is a financial statement which summarizes all the assets, liabilities and equity o...

Q: On January 1, 20x1, PRISTINE UNCORRUPTED Co. acquired an equipment for ₱4,000,000. The equipment wil...

A: solution working note annual depreciation under SLM = cost – residual value / life ...

Q: On March 1, 2016, ASG Co. assigned its P1,900,000 accounts receivable to DXB Bank in exchange for a ...

A: solution given Date of assignment March 1 2016 Amount of account receivable assigned 190...

Q: Expected Life Cost Allocation Warehouse $100 20 years Straight-l...

A: Long terms assets refers to those assets or investments made by a company that are for a longer time...

Q: An assumption inherent in a company’s IFRS statement of financial position is that companies recover...

A: Solution Concept IFRS stands for the International financial reporting standards IFRS are approved a...

Q: Hearts Company has various cash generating units. One cash generating unit has the following carryin...

A: Lets understand the basics. As per IAS 36 "Impairment loss", when carrying value of the asset cash g...

Q: Instructions The McDonald's Corporation Cash Flow Statement for Cash Flow received from customers $8...

A: Cash Flow Statement - Under Cash Flow, there are three types of activities involved - Operating Acti...

Q: Exercise 3-4 (Division of Profit under Various Assumptions) Blessing and Linda formed a partnership ...

A: The partnership comes into existence when two or more persons agree to do the business and share pro...

Q: Indicate the financial statement on which each of the following items appears: income statement, sta...

A: Introduction:- Financial statements are official records of a company's, person's, or other entity's...

Q: Based on the data in Table 11.10, you have been asked to determine:a) The company's percentage of as...

A: Common size analysis is one of the analysis which shows each item of balance asset as a percentage o...

Q: 1

A: Loan is one of the liability of the business, which needs to be paid or settled on timely basis. Int...

Q: ____1. Initial amount recognized as right of use asset ____________2. Initial amount recognized as ...

A: A Lease agreement is a contract between the lessor and the lessee whereby the lessor who is the owne...

Q: Paymore Products places orders for goods equal to 75% of its sales forecast in the next quarter whic...

A: Budgeting - Budgeting is the process of estimating future operations based on past performance. % ar...

Q: In addition to keeping an eye on her inventory Rita is also a little bit worried amount of cash she ...

A: Bank Reconciliation statement is prepared when there is a difference between cash balance as per cas...

Q: Perfect Cover Insurance Brokers is doing well with Assets - 262,000 Liabilities - 119,000 Equity – (...

A: Partnership is one of the agreement between two or more than two partners, in which they invest thei...

Q: а. Record the appropriate journal entry on December 31, 20X1. b. Where on the financial statements a...

A: Mark to market accounting is made to ensure that the financial statement consists of true amounts. T...

Q: The Gilster Company, a machine tooling firm, has several plants. One plant, located in St. Cloud, Mi...

A: Plantwide and Departmental are the two overhead rates used in applying the overhead costs where plan...

Q: Use the following to answer questions 16 – 20 Following are the transaction of TR Inc., which provid...

A: The statement of cash flow (CFS), also known as the statement of cash flows, is a financial statemen...

Q: 13. Merchandise is sold on account for P90, and the sale is subject to sales tax of P5.40. The sales...

A: Since you have asked multiple questions, we will solve one question for you. If you want any specifi...

Q: On January 1, 2020, Diluc acquired land for a cost of P3,000,000 and a building costing P6,000,000. ...

A: Land is not a depreciable asset , therefore no depreciation will be charged on Land . As per provisi...

Q: Required: Prepare the CLOSING ENTRIES on Februry 28, 2015

A: Adjustment Journal Entry The purpose of recording adjustment journal entries which provides more acc...

Q: Laval produces lighting fixtures. Budgeted information for its two production departments follows. T...

A: 1. Estimated Overhead CostEstimated Direct Labour Hours=$1,810,000*452,500=$4 per direct labour hour...

Q: Hardcover Insurers Guide a deluxe booklet advertising the premier insurers and their products. Each ...

A: In FIFO, First sales should be adjusted with first purchase. In weighted average, weighted rate need...

Q: A review of the ledger of Flint Co. at December 31, 2022, produces the following data pertaining to ...

A: The adjustment entries are prepared at year end to adjust the revenue and expenses of the current pe...

Q: If an IT auditor discover irregular & illegal acts during the course of his audit, what should the a...

A: Answer: It is the responsibility of the auditor to report independence opinion on any audit completi...

Q: Prepare a schedule starting with pretax financial income and compute taxable income.

A: Pretax financial income is the income which the company has earned during the year before the income...

Q: Differentiate using an example company’s primary revenue and secondary revenue, company’s primary ex...

A: Revenue refers to the funds generated by an entity through its direct or indirect business operation...

Q: Determine the components of pension expense that the company would recognize in 2020. (With only one...

A: Pension expense (PE) refers to those expenses which are charged by the company in relation to pay it...

Q: Mr. Keyur received dividend @Rs34 per share, on account of 5000 shares held of a publicly traded co...

A: Introduction:- A dividend is a payment made by a corporation to its stockholders. When a firm makes ...

Q: (2) Bank Reconciliation of Company ABCDEFU Balances as of December 31, 2022 Bank balance : Php 1,020...

A: Ideally cash balance as per cashbook and bank balance as per bank statement must reconcile with each...

Q: Assume that in addition to the original facts, Jeremy has a long-term capital gain of $4,000. What i...

A: Taxable income refers to the amount to which tax is imposed. It is arrived at after allowing certain...

Q: mile JungkookCompany reported the following balances at the end of each year: 2020 2019 InventoryP2...

A: Solution Given 2020 2019 Inventory 2600000 2900000 Accounts payable 750000 ...

Q: Ash Traynor opened a Pokèmon dress shop called PokèShoppe. During the first month of operations, the...

A: Worksheet - Worksheet includes unadjusted Trial Balance, Adjustments and Adjusted Trial Balance. All...

Q: Using the following information, prepare the adjusting entries in general journal form for the Tia C...

A: Adjusting entries are those journal entries which are passed at the end of accounting period in orde...

Q: can you help me fill out my balance sheets based on my journal.

A: Balance sheet is one of the the financial statement of business which shows all assets, liabilities ...

Q: Cost 500,000.00 1,285,000.00

A: The average cost method is given as,

Q: The following amortization and interest schedule reflects the issuance of 10-year bonds by Cullumber...

A: >Bonds Payable are the source of finance for the companies. >The bondholders are entit...

Q: Required information Exercise 5-19 (Algo) Prepaid expenses—insurance LO 10 Skip to question [The ...

A: Prepaid insurance: It implies to the insurance payment made in advance before incurring the expenses...

Q: Question 4 Explain the measurement of accounts receivable. (Write a complete answer)

A: Financial Accounting: Financial accounting is the efficient strategy of recording, ordering, summing...

Q: rospere General Merchandise. earning Task 4: Below are a nu "ospere General Merchandise. rinciple, i...

A: Assets refer to a form of resources that provides value in terms of money or other economic value to...

Q: Husserl Company included a coupon in each box of its cereal. For every 10 coupons returned by a cust...

A:

Q: Sara Computer Sales (SAS) has supplied the following list of transactions for his business. The acco...

A: solution cash flow statement comprises of -cash flow from operating activities ...

Q: Colors Company purchased a piece of machinery for $4,000. The company paid $1,500 at the time of the...

A: Journal entries recording is one of the initial step of accounting process, under which atleast one ...

Q: Problem 4-7 (Algo) Income statement presentation; statement of comprehensive income; unusual items (...

A: Comprehensive Income: Comprehensive Income remembers all changes for value during a period with the ...

Step by step

Solved in 3 steps with 3 images

- From the following information for R Ltd. for the year ended 31 March, 2016, calculate the deferred tax asset/ liability as per AS-22 Accounting Profit. ₹10,00,000 Book Profit as per MAT(|Minimum Alternate Tax. ₹9,00,000Profit as per income Tax Act. ₹1,00,000Tax Rate 30%MAT Rate 10%Refer to the following financial information of Scholz Company: NOPAT 8.250.000.00 EBITDA 17,725.000.00 Net Income 5,050,000.00 Capital Expenditures 6,820,000.00 After tax capital costs 6,280.000.00 Tax rate 40% 1. Calculate the Company's depreciation and amortization expense 2. calculate its interest expense. Use 2 decimal places for your final answer. 3. calculate its EVA. Use 2 decimal places for your final answer.1.Whatare the conditions under Income Tax Act, ACT 896 forexpenditure to be allowed as a deduction when computingbusiness, employment or investment income?2.List5 allowable deductions from the assessable income3.Assumethat the written down value of assets in the pool 2 isGH 100 000 and the repairs and improvements is GH 20 000What will be the tax allowable expenses?4.Giventhat the assessable income for the company isGH 140 000 the finance cost is GH 90 000 and there is nocorresponding finance gain, what is the allowable expense?

- You are given the following transactions relating to the capital expenditure of Marang Logistics Solutions (Pty) Ltd for the year ended 31 December 2022: The tax written down value of capital items on 1 January 2022 was: Cost Capital Allowance WDV Office Buildings 800,000 50,000 750,000 Furniture and Fittings 89,000 44,000 45,000 Other plant and machinery 350,000 125,000 225,000 Commercial Vehicles 1,600,000 750,000 850,000 The following purchases were…Please calculate capital allowance using declining balance method with the following information: Details of the Fixed Assets: Details Cost NBV Tax Written Down As at 31 Dec 2021 As at 31 Dec 2021 Value as at 1 Jan 2021Motor Vehicles 10,00,000 7,200,000 7,000,000Equipment 15,000,00 12,00,000 6,713,335Office buildings 45,000,000 36,000,000 36,450,000 Included in the cost of motor vehicle is a lorry purchased on 1 April 2021 for $2,000,000…BACKGROUND The company, North S.L., has the following information in the Balance Sheet and Profit and Loss Account for 2016, before calculating its Corporate Tax: BALANCE SHEET ASSETS LIABILITIES 69.360,00 A) NON CURRENT ASSET A) NET EQUITY 105.130,00 4.860,00 1. Intangible asset A-1) Equity 60.000,00 4.860,00 1. R+D 1. Capital 60.000,00 4.860,00 201 DEVELOPMENT 1. Issued capital 60.000,00 64.500,00 II. Tangible Fixed Assets 100 SOCIAL CAPITAL 19.500,00 64.500,00 2. Technical facilities and others. III. Funds 12.000,00 52.000,00 213 MACHINERY 1. Legal y statuary 12.000,00 8.000,00 216 FURNITURE 112 LEGAL FUNDS 7.500,00 3.500,00 217 INFORMATION PROCESSING EQUIP. 2. Other funds 7.500,00 25.000,00 218 TRANSPORT 113 VOLUNTEER FUND 25.630,00 -24.000,00 281 CUMULATIVE DEPRECIATION VII. Result of the fiscal year 32.000,00 104.050,00…

- BACKGROUND The company, North S.L., has the following information in the Balance Sheet and Profit and Loss Account for 2016, before calculating its Corporate Tax: BALANCE SHEET ASSETS LIABILITIES 69.360,00 A) NON CURRENT ASSET A) NET EQUITY 105.130,00 4.860,00 1. Intangible asset A-1) Equity 60.000,00 4.860,00 1. R+D 1. Capital 60.000,00 4.860,00 201 DEVELOPMENT 1. Issued capital 60.000,00 64.500,00 II. Tangible Fixed Assets 100 SOCIAL CAPITAL 19.500,00 64.500,00 2. Technical facilities and others. III. Funds 12.000,00 52.000,00 213 MACHINERY 1. Legal y statuary 12.000,00 8.000,00 216 FURNITURE 112 LEGAL FUNDS 7.500,00 3.500,00 217 INFORMATION PROCESSING EQUIP. 2. Other funds 7.500,00 25.000,00 218 TRANSPORT 113 VOLUNTEER FUND 25.630,00 -24.000,00 281 CUMULATIVE DEPRECIATION VII. Result of the fiscal year 32.000,00 104.050,00…Q1) At 30 June 2019, Beta Ltd had the following deferred tax balances: Deferred tax liability $18,000 Deferred tax asset $15,000 Beta ltd recorded a profit before tax of $80,00 for the year to 30 June 2020, which included the following terms: Depreciation expense-plant $7,000 Doubtful debts expense $3,000 Long-service leave expense $4,000 Depreciation rates for taxation purposes are higher than for accounting purposes. A corporate tax rate of 30% applies. Required: (a) Prepare the necessary journal entries to account for income tax assuming recognition criteria are satisfied. (b) What are the balance of deferred tax liability and deferred tax asset at 30 June 2020?BDO Company reported the following on December 31, 2015: Income before tax for accounting purposes P12,000,000; Rent expense for financial accounting purposes is P2,000,000 Rent expense for tax purposes is P1,000,000; Tax depreciation is P3,200,000 Accounting depreciation is P1,700,000; Loss on a case incurred but not yet paid so tax-deductible in the future is P700,000. The tax rate is 30%. Question: What is the amount of deferred tax asset? What is the net income after tax?

- BDO Company reported the following on December 31, 2015: Income before tax for accounting purposes P12,000,000; Rent expense for financial accounting purposes is P2,000,000 Rent expense for tax purposes is P1,000,000; Tax depreciation is P3,200,000 Accounting depreciation is P1,700,000; Loss on a case incurred but not yet paid so tax-deductible in the future is P700,000. The tax rate is 30%. Question: What is the amount of taxable temporary difference? What is the current tax expense?BDO Company reported the following on December 31, 2015: Income before tax for accounting purposes P12,000,000; Rent expense for financial accounting purposes is P2,000,000 Rent expense for tax purposes is P1,000,000; Tax depreciation is P3,200,000 Accounting depreciation is P1,700,000; Loss on a case incurred but not yet paid so tax-deductible in the future is P700,000. The tax rate is 30%. Question: What is the amount of the deferred tax expense? What is the amount of deferred tax asset?BDO Company reported the following on December 31, 2015: Income before tax for accounting purposes P12,000,000; Rent expense for financial accounting purposes is P2,000,000 Rent expense for tax purposes is P1,000,000; Tax depreciation is P3,200,000 Accounting depreciation is P1,700,000; Loss on a case incurred but not yet paid so tax-deductible in the future is P700,000. The tax rate is 30%. What is the net income after tax?