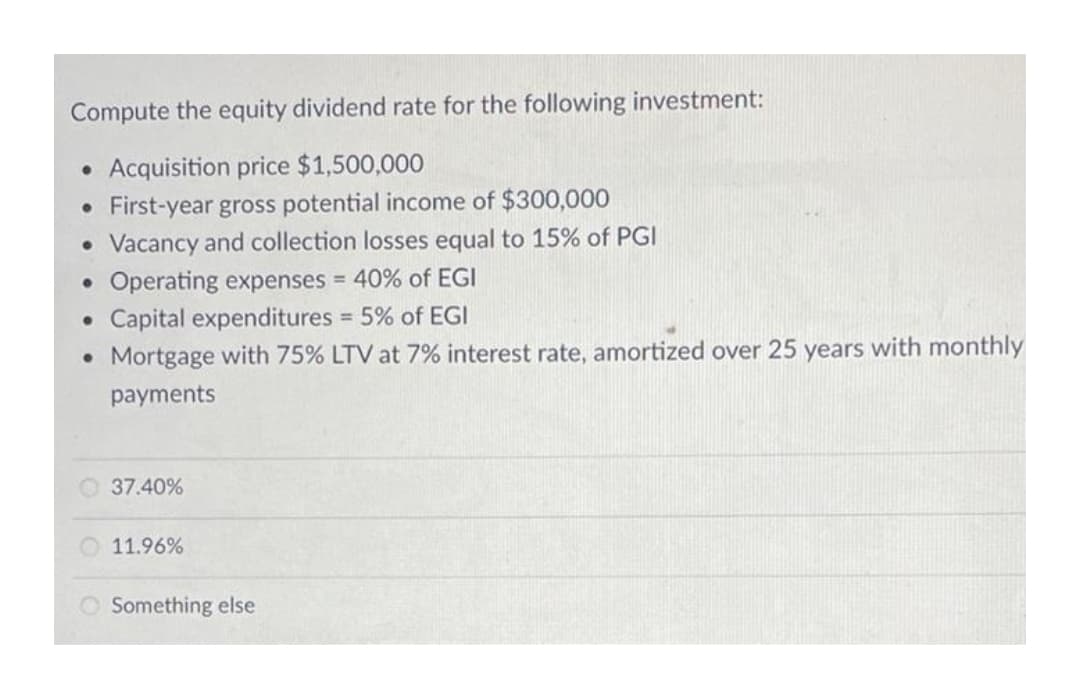

Compute the equity dividend rate for the following investment: • Acquisition price $1,500,000 • First-year gross potential income of $300,000 Vacancy and collection losses equal to 15% of PGI • Operating expenses 40% of EGI • Capital expenditures 5% of EGI • Mortgage with 75% LTV at 7% interest rate, amortized over 25 years with monthly %3D payments 37.40% 11.96% Something else

Q: You want to purchase a new car in 4 years and expect the car to cost $55,000. Your bank offers a pla...

A: Time value of money (TVM) refers to the concept which proves that the value of money today is higher...

Q: Liam dreams of starting her own business to import consumer electronics products to the country. she...

A: Starting a business requires many assets and the most important asset is the investment requirement....

Q: QUESTION 8 The market risk measure in the CAPM is: O Alpha O Beta O The standard deviation of HPRS O...

A: Note: This post has two distinct questions. The first, Q8 has been answered below.

Q: Consider a $100 par value bond that has an 8% coupon rate, pays a semi-annual coupon, matures 2 year...

A: Par value = $100 Coupon rate = 8% Semi-annual = 2 times in a year maturity = 2 years Yield = 6%

Q: Dufner Co. issued 13-year bonds one year ago at a coupon rate of 6.5 percent. The bonds make semiann...

A: We know, price of a bond = Present value of coupon payments receivable from bond discounted at YTM +...

Q: Solve using Rate of Return Method

A: The rate of return method or ROR method is the return which can either be in the form of gain or los...

Q: How much must be deposited today into the following account in order to have a $135,000 college fund...

A: Present value = Future value/(1 + r)n Future value = 135,000 Quarterly interest rate (r) = 3.16%/4...

Q: Discuss the functions of financial intermediaries.

A: Financial intermediary is an institution which act as a link between the two parties in a financial ...

Q: Rayhan Company has an average collection period of 55 days. The annual sales is 8,500,000. What is t...

A: The average collection period indicates the period between the sale and collection/ receipt of money...

Q: Caren Rodriguez borrows P1,500 with simple interest at 3% per month. What payment at the end of 10 m...

A: Borrowed amount (P) = P 1,500 Monthly interest rate (r) = 3% Monthly period (t) = 10 Months

Q: The WSSU parking garage project: Last we checked, a parking garage costs $7,000 per spot. Suppose ca...

A: Hi There, thanks for posting the question. But as per Q&A guidelines, we must answer the first t...

Q: You are the CEO of a mediocre gaming company. Your company has just announced earnings of $500,000. ...

A: Let us first determine the earnings in each of the year going ahead using the provided growth rates....

Q: LEIS company is planning to borrow P10.5M for a company expansion and is not sure what the interest ...

A: Annual worth is the equivalent uniform annual payment of the calculated present worth which can be c...

Q: what are the meaning of Revenue Enhancement and Cost Saving ? and I need examples for each.

A: Revenue enhancement is the enhancement or increase in the revenues which also leads to an increase i...

Q: An investment of 500 will increase to 4000 at the end of 20 years. Find the resent values of three p...

A: We will use the concept of time value of money here.

Q: JPJ Corp has sales of $1.33 million, accounts receivable of $52,000, total assets of $5.05 million (...

A: Inventory Inventory can be described as a good or material that a company holds for the purpose of r...

Q: Handley Bank advertises that its standard lending rate is 12% per annum compounding monthly. Which o...

A: The effective rate is the actual rate that we get if we take the frequency of compounding into consi...

Q: As the top employer at your firm you are given the following choices as your end of year bonus: (ass...

A: Present value Present value of a future amount is calculated by discounting the future amount to the...

Q: Identify the types and formats of financial forecasts and provide an example of each.

A: Financial forecasts are the forecasts which helps in the analysis of the financial information. Thes...

Q: What mean finance

A: Finance is a broad term that can mean management of large amounts of money in a general sense.

Q: DEFG Company has an inventory conversion period of 66 days, a receivable conversion period of 35 day...

A: The operating cycle is the time that a firm takes to purchase goods and convert the same into cash b...

Q: A man borrowed Php 120,000 and promised to pay annually for 5 years The payment starts at "X pesos a...

A: Loan amount (LV) = Php 120,000 Number of annual payments (N) = 5 Interest rate (I) = 8% Annual growt...

Q: lending of things/money to individuals or organizations that is expected to be paid back on acertain...

A: The term loan can be defined as the monetary assistance given to the borrower by a lender in conside...

Q: WHAT ARE THE TYPES OF FINANCIAL STATEMENTS?

A: Financial statements Financial statements are referred to as written records that are used in convey...

Q: he firm purchases a ship to rent out. Only equity capital is used, no debt. The terms of the renta...

A: Foreign exchange risk: All projects undertaken in foreign countries have a component of forex risks....

Q: Why aren't more resources committed to proper financial system prudential oversight to curb excessiv...

A: Deception with the goal of securing an unlawful profit for the perpetrator or depriving a victim of ...

Q: What is the expected return for the following portfolio? (State your answer in percent with two deci...

A: Solution:- Expected return for the portfolio (in percentage) = Summation of (Weight of Asset x Retur...

Q: If you are calculating the present value of this cash flow under semiannual (twice per year) compoun...

A: Future Value: It represents the value of annual cash flows or the sum of money at a later/future da...

Q: You are given a loan on which interest is charged over a 4-year period, as follows: i. an effective ...

A: Let the annual effective interest rate = r 1st year discount rate = 6% 2nd year discount rate = 4% q...

Q: Improved methods of oil and gas recovery, including fracking, have renewed interest in mineral royal...

A: Present Value The present value is the value of cash flow stream or the fixed lump sum amount at tim...

Q: The aggregate expenditure for a simple economy in 2016 was $9 million. The table below shows spendin...

A: First, we will calculate the aggregate expenditure of the government which includes Consumption, Inv...

Q: What is the required return for each security? Round your answers to two decimal places. Stock A:...

A: Required Return: It refers to the minimum return acceptable to the investor for financing the busin...

Q: You invest $1,500 into a "hot stock" through the Robin Hood app. The stock does well in the first qu...

A: We can find the money-weighted return by taking the investment made in the stock $1500 and $1000 and...

Q: Decide which option to choose using a 12% BCR and cost-benefit analysis A B Initial cost 500 800 dec...

A: The Benefit to Cost ratio or Benefit - Cost ratio is a financial metric which takes into account the...

Q: A company has issued $75 million (face value) of bonds with three-years to maturity. They offer an a...

A: (Note: We’ll answer the first question since the exact one wasn’t specified. Please submit a new que...

Q: Techiefy Co. wants to launch a new product. it is observed that the fixed cost of the new product is...

A: Cost function = 35,000 + 500D Revenue function = 5000D-100 D2 Profit function at breakeven = Reven...

Q: Ann found an apartment that costs $800,000 to buy. She will make a $100,000 down payment and get a m...

A: Since we only answer up to 3 sub-parts, we’ll answer the first 3. Please resubmit the question and s...

Q: Find out debtors turnover ratio from the following information for one year ended 31st March 2014. A...

A: Debtors turnover ratio is the measure of finding out the efficiency of the company in collecting the...

Q: Both Bond Bill and Bond Ted have 10.6 percent coupons, make semiannual payments, and are priced at p...

A: We can calculate the current price of the Bond bill and Bond ted then will find the change in the pr...

Q: What is the Inventory turnover, Age of inventory, asset turnover (2 years), and Fixed asset turnove...

A: Given: Particulars 2017 2016 Total assets 1,970,000.00 1,930,000.00 Plant & Equipment ...

Q: Given that nominal rate of interest i(m) = 0.1488144 and nominal rate of discount d(m) = 0.1417814, ...

A: imm-dmm=im×dmm2

Q: Joe paid a full price of $1,059.04 each for 77 bonds. If the flat price of each bond is $1,044.07, i...

A: Here, Full Price is $1,059.04 Flat Price is $1,044.07 No. of Bonds are 77

Q: Given the following spot rates, calculate the value of a 3-year, 4% annual-coupon bond. Spot rates:...

A:

Q: Tacomas population in 2000 was about 200 thousand, and has been growing by about 8% each year. If th...

A: FV = PV * (1 + r)^nWhere FV = Future ValuePV = Present Value = 200,000r = rate of grow = 8%n = numbe...

Q: Bond X is a premium bond making semiannual payments. The bond has a coupon rate of 9.3 percent, a YT...

A: Since we only answer up to 3 sub-parts, we’ll answer the first 3. Please resubmit the question and s...

Q: Suppose that Engie has sent their energy engineers like Bryce across campus and they have developed ...

A: The predetermined budget will be used for the projects that provide the highest NPV (Net Present Val...

Q: A new bridge across the Allegheny River in Pittsburgh is expected to be permanent and will have an i...

A: Data given: Initial cost =$ 30,000,000 Resurfaced cost = $1000,000 ( every 5 year) Annual inspection...

Q: Which of the following statements are true about unsecured bonds? I. Income bonds require interest ...

A: Unsecured bonds are backed by the issuer's "full faith and credit," rather than a specific asset. In...

Q: You have already $5,000 in your savings account today. You want to have $50,000 in your savings acco...

A: Data given: FV= $50,000 n= 10 years i= 5% p.a. Amount in savings account = $ 5000 Required: Amount...

Q: Explain the best way for a finance manager to establish good relationship with the managers from oth...

A: Financial managers oversee the finances of large enterprises, government organizations, and everythi...

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 2 images

- Firm Valuation Through Excess Returns ApproachThe incorporation of XYZ Inc. was completed through the raising of funds. These funds include net proceeds from debt and from equity at P5,000,000 and P20,000,000 respectively. The after-tax costs of debt and of equity are 9% and 15% in order. If the actual return of XYZ is forecasted to be 17% annually over the firm’s 10-year life, compute the firm value.E12-2 Chancellor lndustries has available retained earnings of $ 1.2 million. The company plans to make two investments that require financing of $ 950,000 and $ 1.75 million respectively. Chancellor uses a target capital structure with 60 percent debt and 40 percent equity. Apply the residual theory to determine the dividends that can be paid and calculate the resulting dividend payment ratio.Atlas Corp is contemplating acquiring Miya Inc. Relevant information follows:● Miya's average annual earnings in the past 5 years were P540,000● Miya's net assets as the current year-end have a fair value of P5,000,000● The industry average rate of return on equity is 10%● The probable duration of Miya's “excess earnings" is 5 years.If goodwill is measured by capitalizing the average excess earnings at 20%. Howmuch is the goodwill?

- Please answer it in next 45mins,it would be a great help. ParCorp spent $720K to acquire all of ChiCorp's stock on January 1, 20X2, when ChiCorp's retained earnings was $300K. Difference between the acquisition price and ChiCorp's underlying book value was attributed to buildings with a remaining economic life of 10 years from the date of acquisition. On December 31, 20X3, ParCorp reported Investment in sub of $756K, while ChiCorp reported common stock of $300K, retained earnings of $360K. Prepare the elimination entry in entry format for consolidation on Dec 31, 20X3.Craft Co. is opening its doors to investors and shared the following prospective financial information Isee table). Craft Co. owns a property originally acquired at P2,000,000 with a useful life of 10 years. Assuming tax rate is 30% and cost of capital is 12%, compute for the net cash flow to the firm (round the growth rate to four decimal point). And assuming 50% of Craft Co. is being sold for P8,000,000, which of the following will you recommend?National Co. make these assumptions for valuation purposes:a. The firm consists of a single asset that will generate pretax net cash flows of P3,000,000 per year forever.b. The income tax rate is 25%.c. After making debt service payments and paying taxes, the firm pays dividends to distribute any remaining cash flows to the equity shareholders each year.d. The equity shareholders finance a portion of the investment in the asset with P60,000,000 of equity capital. (Equity ratio = 6/10 = 60%)e. The firm finances the remainder of the asset using P40,000,000 of debt capital. (Debt ratio = 40% = 4/10)f. This amount of debt in the firm’s capital structure does not alter substantially the risk of the firm to the equity investors, so they continue to require a 12% rate of return.g. The debt is issued at par, and it is less risky than equity; so the debt-holders demand interest of only 7% each year, payable at the end of each year.h. Interest expense is deductible for income tax…

- National Co. make these assumptions for valuation purposes:a. The firm consists of a single asset that will generate pretax net cash flows of P3,000,000 per year forever.b. The income tax rate is 25%.c. After making debt service payments and paying taxes, the firm pays dividends to distribute any remaining cash flows to the equity shareholders each year.d. The equity shareholders finance a portion of the investment in the asset with P60,000,000 of equity capital. (Equity ratio = 6/10 = 60%)e. The firm finances the remainder of the asset using P40,000,000 of debt capital. (Debt ratio = 40% = 4/10)f. This amount of debt in the firm’s capital structure does not alter substantially the risk of the firm to the equity investors, so they continue to require a 12% rate of return.g. The debt is issued at par, and it is less risky than equity; so the debt-holders demand interest of only 7% each year, payable at the end of each year.h. Interest expense is deductible for income tax purposes 1.…Nelson Company's current liabilities are P50,000, its long-term liabilities are P150,000, and its working capital is P80,000. If Nelson Company's debt-to-equity ratio is 0.32, its total long-term assets must equal O P625,000 O P825,000 O P745,000 O P695.000 Hydro Cable wishes to calculate their return on assets (ROA). You know that the return on equity (ROE) is 12% and that the debt ratio is 40%. What is the ROA? 0 4.8% O 20% 0 7.2% O 12% Tech Manufacturing Company realized P15,000,000 in sales, with a cost of goods sold of P6,000,000, gross profit margin of 45% of net sales, operating expenses of P4,500,000, tax rate of 35%, and average total assets of P6,500,000. What is Tech's Return on Assets (ROA)? O 42.5% O 50% O 45% O 47.75%Prokter and Gramble (PG) currently has $25 billion outstanding debt. PG has a cost of equity capital of 7 percent and a cost of debt capital of 4%. PG’s tax rate is 30 percent. PG is expected to have EBIT of $9 billion at the end of this year. If PG’s cash flows to equity holders grow at 3% in perpetuity, what is the market value for PG’s equity? Group of answer choices $105 billion $100 billion $165 billion $140 billion

- balance sheet 20201231 (mkr): fixed assets 9540 current assets 2630 s: a assets. 1280 equity 2070 long loans 5650 short-term. liabilities. 4360 s: a EQ and liabilities 12080 Let us assume that a new share issue is carried out where the owners invest SEK 1,400 million. The money is then used to repay long-term loans of SEK 900 million and short-term liabilities of SEK 400 million. Your task is to fill in the amounts for the following items in the balance sheet after the new share issue and associated transactions described above have been completed: S assets:mkr Equity:mkr Short loans:mkrBased on the current capitalization, KHM Sdn Bhd has made the following forecast for the coming year: Interest expense RM2,000,000 Operating income (EBIT) RM40,000,000 Earnings per share RM4.00 The company has RM20,000,000 worth of debt outstanding and all of its debt yields 10 %. The company’s tax rate is 30%. The company’s price earnings (P/E) ratio has traditionally been 10. The company’s investment bankers have suggested that the company recapitalize. Their suggestion is to issue enough new bonds at a yield of 10% to repurchase 1,400,000 shares of common stock. Assume that the repurchase will have no effect on the company’s operating income; however, the repurchase will increase the company’s dollar interest expense. Also, assume that as a result of the increased financial risk, the company’s price earnings (P/E) ratio will be 10.5x after the repurchase. What would be the expected year-end stock price if the company proceeded with the recapitalization? Should KHM proceed with the…Madison Corporation purchases an investment in Lake Geneva, Inc. at a purchase price of $20 million cash, representing 40% of the book value of Lake Geneva, Inc. During the year, Lake Geneva reports net income of $3,400,000 and pays $838,000 of cash dividends. At the end of the year, the market value of Madison’s investment is $24 million. What is the year-end balance of the equity investment in Lake Geneva? Select one: a. $21,024,800 b. $24,000,000 c. $20,000,000 d. $22,562,000 e. $21,360,000