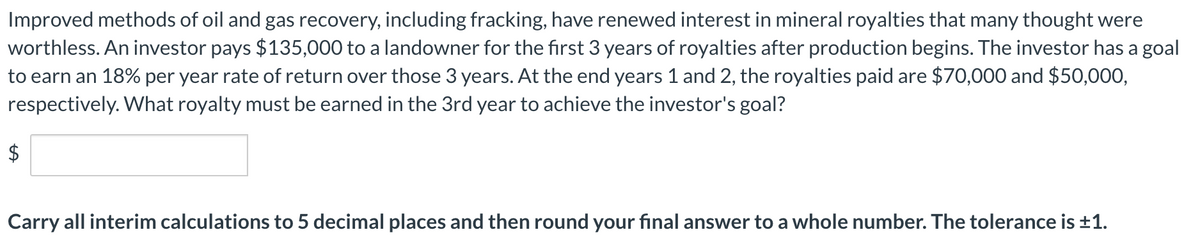

Improved methods of oil and gas recovery, including fracking, have renewed interest in mineral royalties that many thought were worthless. An investor pays $135,000 to a landowner for the first 3 years of royalties after production begins. The investor has a goal to earn an 18% per year rate of return over those 3 years. At the end years 1 and 2, the royalties paid are $70,000 and $50,000, respectively. What royalty must be earned in the 3rd year to achieve the investor's goal? 2$ Carry all interim calculations to 5 decimal places and then round your final answer to a whole number. The tolerance is ±1.

Improved methods of oil and gas recovery, including fracking, have renewed interest in mineral royalties that many thought were worthless. An investor pays $135,000 to a landowner for the first 3 years of royalties after production begins. The investor has a goal to earn an 18% per year rate of return over those 3 years. At the end years 1 and 2, the royalties paid are $70,000 and $50,000, respectively. What royalty must be earned in the 3rd year to achieve the investor's goal? 2$ Carry all interim calculations to 5 decimal places and then round your final answer to a whole number. The tolerance is ±1.

Chapter11: Long-term Assets

Section: Chapter Questions

Problem 6PA: Gimli Miners recently purchased the rights to a diamond mine. It is estimated that there are one...

Related questions

Question

Transcribed Image Text:Improved methods of oil and gas recovery, including fracking, have renewed interest in mineral royalties that many thought were

worthless. An investor pays $135,000 to a landowner for the first 3 years of royalties after production begins. The investor has a goal

to earn an 18% per year rate of return over those 3 years. At the end years 1 and 2, the royalties paid are $70,000 and $50,000,

respectively. What royalty must be earned in the 3rd year to achieve the investor's goal?

$

Carry all interim calculations to 5 decimal places and then round your final answer to a whole number. The tolerance is +1.

%24

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

Fundamentals Of Financial Management, Concise Edi…

Finance

ISBN:

9781337902571

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning