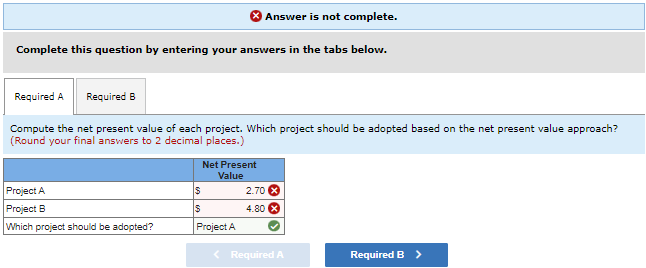

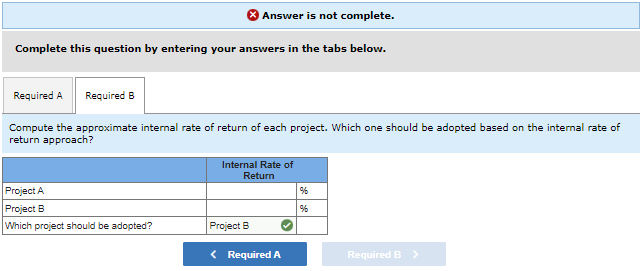

Compute the net present value of each project. Which project should be adopted based on the net present value approach? Compute the approximate internal rate of return of each project. Which one should be adopted based on the internal rate of return approach?

Dwight Donovan, the president of Stuart Enterprises, is considering two investment opportunities. Because of limited resources, he will be able to invest in only one of them. Project A is to purchase a machine that will enable factory automation; the machine is expected to have a useful life of five years and no salvage value. Project B supports a training program that will improve the skills of employees operating the current equipment. Initial cash expenditures for Project A are $104,000 and for Project B are $44,000. The annual expected

Required

-

Compute the

net present value of each project. Which project should be adopted based on the net present value approach? -

Compute the approximate

internal rate of return of each project. Which one should be adopted based on the internal rate of return approach?

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 2 images