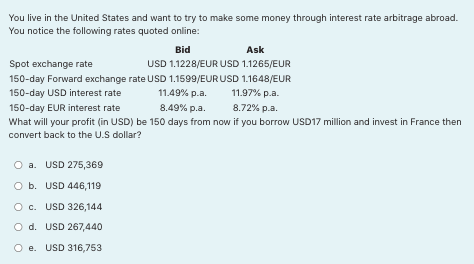

You live in the United States and want to try to make some money through interest rate arbitrage abroad. You notice the following rates quoted online: Bid Ask Spot exchange rate USD 1.1228/EUR USD 1.1265/EUR 150-day Forward exchange rate USD 1.1599/EUR USD 1.1648/EUR 150-day USD interest rate 11.49% p.a. 11.97% p.a. 150-day EUR interest rate 8.49% p.a. 8.72% p.a. What will your profit (in USD) be 150 days from now if you borrow USD17 million and invest in France then convert back to the U.S dollar? O a. USD 275,369 O b. USD 446,119 O c. USD 326,144 O d. USD 267,440 Oe. USD 316,753

You live in the United States and want to try to make some money through interest rate arbitrage abroad. You notice the following rates quoted online: Bid Ask Spot exchange rate USD 1.1228/EUR USD 1.1265/EUR 150-day Forward exchange rate USD 1.1599/EUR USD 1.1648/EUR 150-day USD interest rate 11.49% p.a. 11.97% p.a. 150-day EUR interest rate 8.49% p.a. 8.72% p.a. What will your profit (in USD) be 150 days from now if you borrow USD17 million and invest in France then convert back to the U.S dollar? O a. USD 275,369 O b. USD 446,119 O c. USD 326,144 O d. USD 267,440 Oe. USD 316,753

ChapterP2: Part 2: Exchange Rate Behavior

Section: Chapter Questions

Problem 1Q

Related questions

Question

A6)

Transcribed Image Text:You live in the United States and want to try to make some money through interest rate arbitrage abroad.

You notice the following rates quoted online:

Bid

Ask

Spot exchange rate

USD 1.1228/EUR USD 1.1265/EUR

150-day Forward exchange rate USD 1.1599/EUR USD 1.1648/EUR

150-day USD interest rate

11.49% p.a.

11.97% p.a.

150-day EUR interest rate

8.49% p.a.

8.72% p.a.

What will your profit (in USD) be 150 days from now if you borrow USD17 million and invest in France then

convert back to the U.S dollar?

O a. USD 275,369

O b. USD 446,119

O c. USD 326,144

O d. USD 267,440

O e. USD 316,753

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 3 steps with 7 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

Fundamentals Of Financial Management, Concise Edi…

Finance

ISBN:

9781337902571

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning